Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : December 9, 2017

Market Action

The U.K. and the E.U. reached an agreement Friday on Brexit terms after six months of tense talks. The deal clears the path for discussions to start next year on the new terms of trade between the U.K. and its biggest commercial partner.

A report by the IMF warned of three internal threats to China’s financial system: an excessively expansionary monetary and fiscal policy, the “shadow banking” sector, and “excessive risk-taking.” The IMF previously warned in October that China’s dependence on debt was growing at a “dangerous pace”. The PBOC expressed disagreement with some points in the Thursday report but also said the IMF recommendations are “highly relevant in the context of deepening financial reforms” in the country.

U.S. President Donald Trump on Wednesday recognized Jerusalem as Israel’s capital and said he would begin moving the U.S. embassy there. Arab and Muslim leaders warned this move could trigger new violence in the region, and on Thursday and Friday, Palestinian protesters and Israeli security forces clashed in Jerusalem and the West Bank.

Saudi Arabian warplanes bombed the presidential palace in Yemen’s capital late Monday, stepping up attacks on Houthi rebels after they killed ex-President Ali Abdullah Saleh just as he appeared set to switch sides in the conflict. His death may alter the course of the war in the country, and comes as the U.S. Supreme Court upheld President Trump’s travel ban on six Muslim-majority nations, including Yemen.

The Bank for International Settlements (BIS) added its voice to institutions questioning whether stocks have become too expensive, saying they look “frothy,” particularly in the U.S. According to the BIS quarterly report released last Sunday, “the vulnerabilities that have built around the globe during the long period of unusually low interest rates have not gone away… and high debt levels are still there.”

Please click here for this week’s update on market returns.

This Week from BlackSummit

Sector Focus: Semiconductors

Ken Rietz and David Coulliette

Recommended Reads

Ten Years Out

Gideon Rachman et al.

What’s At Stake With the U.S. Recognition of Jerusalem

Zachary Laub

Maybe China Shouldn’t Open Up

Michael Pettis

The End of the Social Era Can’t Come Soon Enough

Nick Bilton

Bitcoin Mania: Even Grandma Wants In on the Action

Peter Rudegeair and Akane Otani

The Global Economy in 2018

Michael Spence

Video of the Week

Nigerian migrants return from Libya with stories of abuse

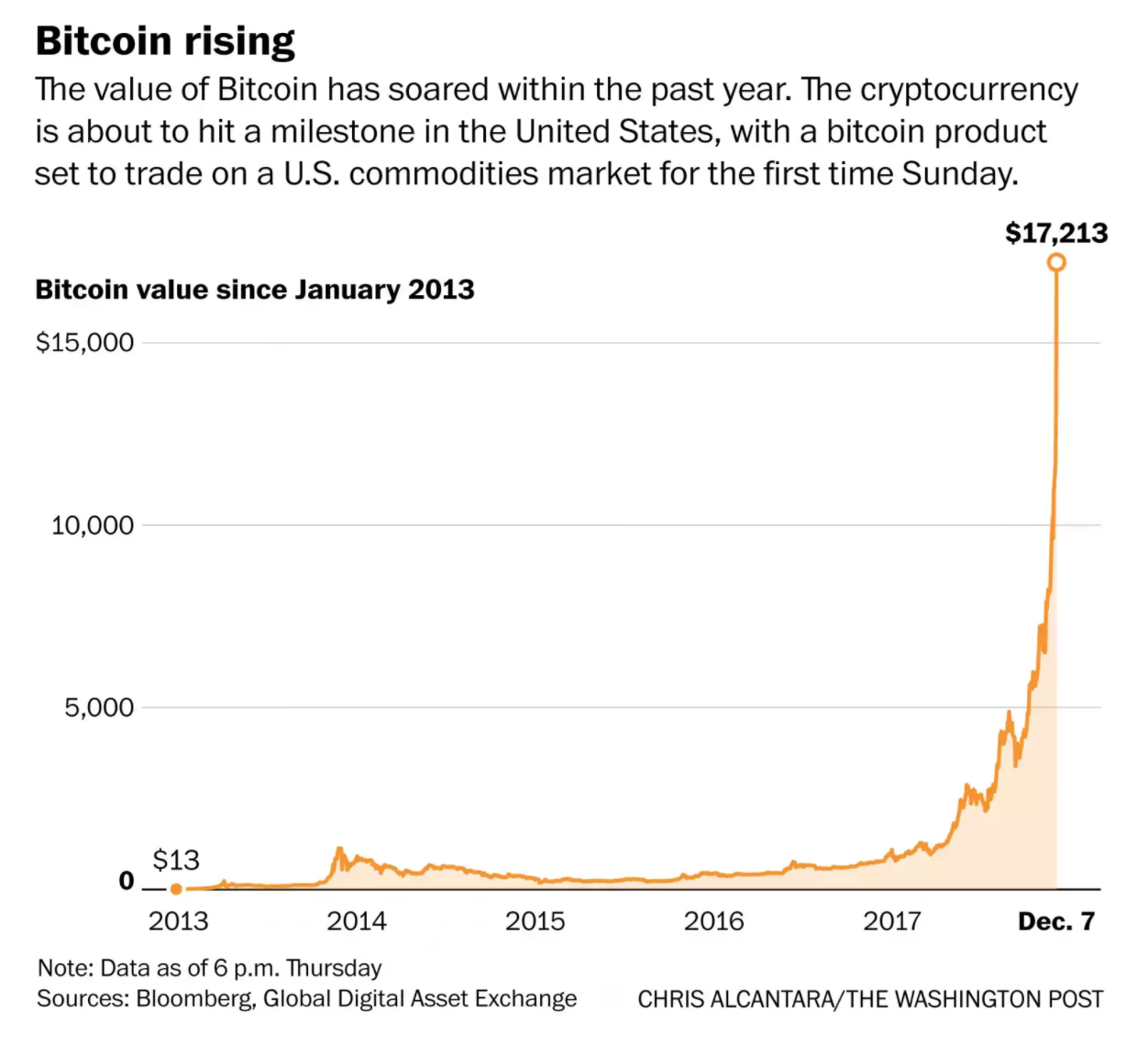

Image of the Week

Bitcoin shot past $15k, $16k, $17k in less than 24 hours then plunged more than $3,000, swinging wildly on Friday between a high of $17,154 and a low of $13,964 according to tracking site CoinDesk.