Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : November 19, 2017

Market Action

Global equities edged slightly lower this week amid an uptick in volatility. Yields on benchmark US 10-year Treasury notes slipped a few basis points to 2.35%, and the price of a barrel of West Texas Intermediate crude oil fell about 3% mid-week before rallying on Friday.

Indian markets rallied Thursday and Friday after Moody’s upgraded its ratings on the country’s sovereign bonds for the first time since 2004, citing continued progress on economic and institutional reforms. The move comes just weeks after the World Bank moved India up 30 places in its annual ease of doing business rankings.

Japan’s economy expanded at an annualized pace of 1.4% in Q3, marking the 7th straight period of quarterly growth and longest of uninterrupted growth in more than 15 years.

Europe is experiencing the fastest growth rate in a decade, rising 2.5% year over year, which is a faster pace than the 2.3% US rate. Growth in the United Kingdom was more subdued than on the continent, coming in at 1.5% annually.

The US House of Representatives passed its version of the Republican tax bill by a vote of 227–205. The Senate Finance Committee passed its version of the bill late Thursday, with the full Senate expected to vote later this month. Party leaders hope to reconcile both versions of the tax bill and have it passed by Christmas.

Zimbabweans celebrated in the streets what they considered the end of Robert Mugabe’s 37-year rule in the capital Saturday, and demanded a formal transfer of power. The widespread celebration took place despite resistance from Mugabe to resign after days of talks with military generals, who seized control on Tuesday and placed Mugabe and his wife under house arrest. The governing party will be hoping to retain its grip on power in Zimbabwe, but the mass celebration and protests have unlocked forces that may be hard to control.

The theater of politicizing faith which crowns situational ethics and proves the bankruptcy of modern evangelicalism and its moral relativism is reigning supreme in the US state of Alabama.

Please click here for this week’s update on market returns.

This Week from BlackSummit

At the Corridors of Power: Markets and Geopolitical Developments

John Charalambakis

Recommended Reads

Europe’s Next Separatist Time Bomb Is Ticking

Misha Savic and Gordana Filipovic

The Real Risk to the Global Economy

Christopher Smart

The Risk of Estimating Risk

James Picerno

Drawbridge economics: the Brexit reality check is coming

Adam Posen

Video of the Week

Iran 'earthquake' children video debunked

A cute video of a boy helping a little girl has been widely shared since Iran was hit by a powerful earthquake (bbc.in/2zabPxT). But it's not what it seems.

Posted by BBC News on Friday, November 17, 2017

Image of the Week

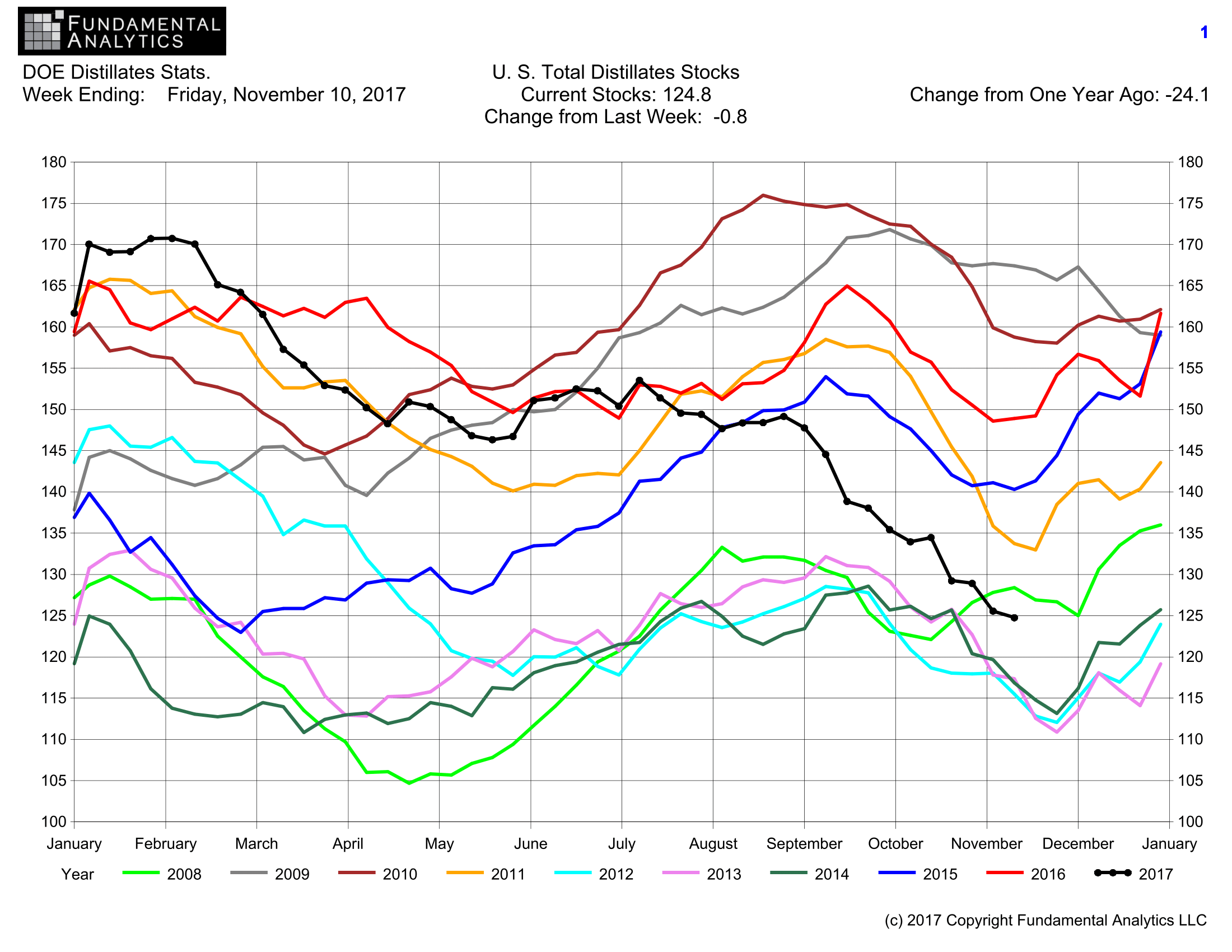

Heating Oil/Distillates prices have rallied in part because of the low Distillates Stocks as illustrated by the above chart showing Stocks at 125 million barrels for the week ending November 10, 2017. Stocks are about 25 million barrels less than last year at this time, well below other previous years. With the winter heating season now in progress and holiday truck traffic increasing, these low stocks will contribute to higher Heating Oil/Distillates Prices in the coming weeks.

Heating Oil/Distillates prices have rallied in part because of the low Distillates Stocks as illustrated by the above chart showing Stocks at 125 million barrels for the week ending November 10, 2017. Stocks are about 25 million barrels less than last year at this time, well below other previous years. With the winter heating season now in progress and holiday truck traffic increasing, these low stocks will contribute to higher Heating Oil/Distillates Prices in the coming weeks.