Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : November 12, 2017

Market Action

Global equities reached all-time highs at midweek before backing down amid anxiety about delays in US corporate tax cuts.

Saudi Arabia’s crackdown on corruption, growing tensions between Iran and Saudi Arabia, and the potential for a Venezuelan debt default all helped push oil prices to two-and-a-half-year highs this week.

The U.K. has two weeks to show the European Union that sufficient progress has been made on a trio of issues, the EU’s chief Brexit negotiator Michel Barnier said Friday. The three issues under discussion are citizens’ rights after Britain’s exit from the EU, preventing the re-emergence of a border between Ireland and Northern Ireland, and the U.K.’s financial settlement for withdrawal.

The U.S. White House revealed a list of 37 major deals signed during U.S. President Donald Trump’s trip through Asia. Following the visit, China announced further steps toward liberalizing its financial system, saying it will remove foreign ownership limits on banks and asset management companies while allowing overseas firms to take majority stakes in local securities ventures and insurers.

China’s financial system is becoming significantly more vulnerable due to high leverage, warned central bank governor Zhou Xiaochuan, who has made a series of blunt statements about the debt level in recent weeks. Risks are accumulating, Zhou warned, that are “hidden, complex, sudden, contagious and hazardous.” Zhou said China should open up markets, relax capital controls and reduce restrictions on non-Chinese financial institutions to counter the rise in leverage.

Please click here for this week’s update on market returns.

This Week from BlackSummit

The Strategic Importance of Brazil

Evan Ellis

Recommended Reads

Sky-High Stock Market has Investors Looking to Commodities

Devika Krishna Kumar, Chris Prentice

Artificial Intelligence’s Winners and Losers

Bill Alpert

Saudi Prince Discards Royal Balancing Act for One-Man Rule

Glen Carey

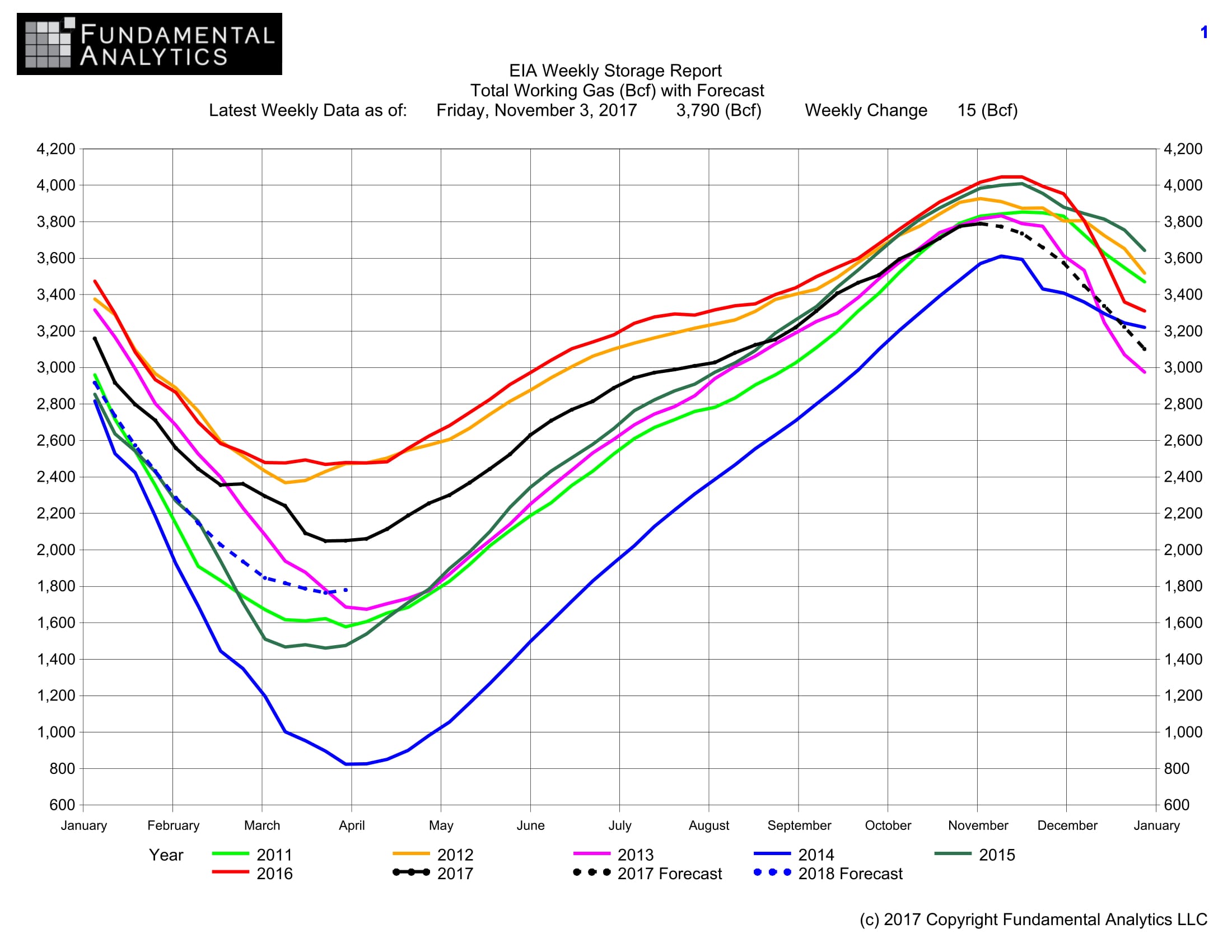

Image of the Week

The EIA released data Thursday for the week ending Friday, November 3, that the total Natural Gas in storage increased by 15 billion cubic feet (Bcf) to 3,790 Bcf. As shown on the chart, this is the usual end of the summer injection season for natural gas storage builds. The 3,790 Bcf currently in storage (black line) is less than the 4,000 Bcf in storage at the end of the 2016 summer injection season a year ago (red line). A computer time series forecasting model puts total storage at the end of the winter withdrawal season at about 1,800 Bcf (dotted line). This too is less than the previous year winter withdrawal in which storage decreased to about 2,000 Bcf at the end of March 2017. These data support the fact that traders are currently bullish Natural Gas prices, which have risen within the past two weeks from $2.90 to $3.20 – a more than 10% increase.