Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : October 29, 2017

Market Action

The US economy grew at a faster-than-forecast pace of 3% in the third quarter, handily beating 2.5% forecasts. Economists had expected a moderate Q3 slowdown because of the impacts of hurricanes Harvey and Irma. Real consumer spending showed continued strength last quarter, rising 2.4%, which exceeded forecasts for a 2.2% advance. Core inflation remained well below the US Federal Reserve’s 2% target, coming in steady at 1.3%.

Investors dumped Spanish stocks and bonds after the region of Catalonia declared independence on Friday, in a move that promises further turmoil for the country’s markets.

The US dollar advanced strongly late in the week, particularly against the euro, lifted in part by the ECB’s new policy trajectory, the Catalonia tremors, and the rising hopes for an overhaul of the US tax code.

At the conclusion of a weeklong congress of China’s Communist Party, Xi Jinping was elected to a second term as president and a new seven-member Politburo Standing Committee was introduced with no clear successor to Xi—a development that has been interpreted as cementing the current president’s power for the foreseeable future.

Japanese prime minister Shinzo Abe won a landslide victory in last weekend’s general election. Abe campaigned on the platform that the threat from North Korea requires leaders to remove any doubt over the legitimacy of Japan’s military. In the wake of Abe’s reelection, the Nikkei 225 Index ended the week above 22,000 for the first time in 21 years.

Please click here for this week’s update on market returns.

This Week from BlackSummit

Electric Vehicles and Market Penetration: Investment Implications

John Charalambakis

Recommended Reads

Our Pick to Head the Fed

Randall W. Forsyth

Get Ready for an Imperial China

Nathaniel Taplin

Xi’s Key Milestone Positions Him to Rule China for Decades

Bloomberg News with assistance by Ting Shi, Keith Zhai, and Peter Martin

Central banks alone cannot deliver stable finance

Martin Wolf

Walter Bagehot would have loathed government by referendum

The Economist editorial team

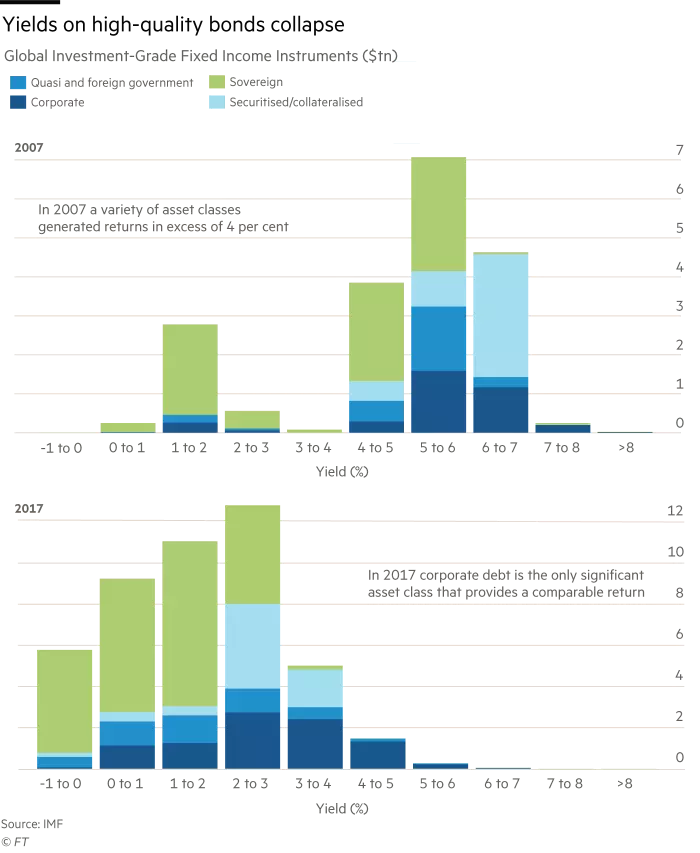

Image of the Week

In 2007 a variety of debt asset classes generated returns in excess of 4%. In 2017 corporate debt is the only significant asset class that provides a comparable return. Source: Financial Times