Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : September 24, 2017

Market Action

- Major stock indexes rose to records earlier this week, then decreased—closing mostly flat or slightly down for the week—while treasury yields increased, as global tension came back into the forefront with North Korea’s announcement that the country may test a hydrogen bomb in the Pacific Ocean.

- Oil prices reached a three-month high this week, helped by increasing demand from refineries in the Gulf of Mexico coming back online.

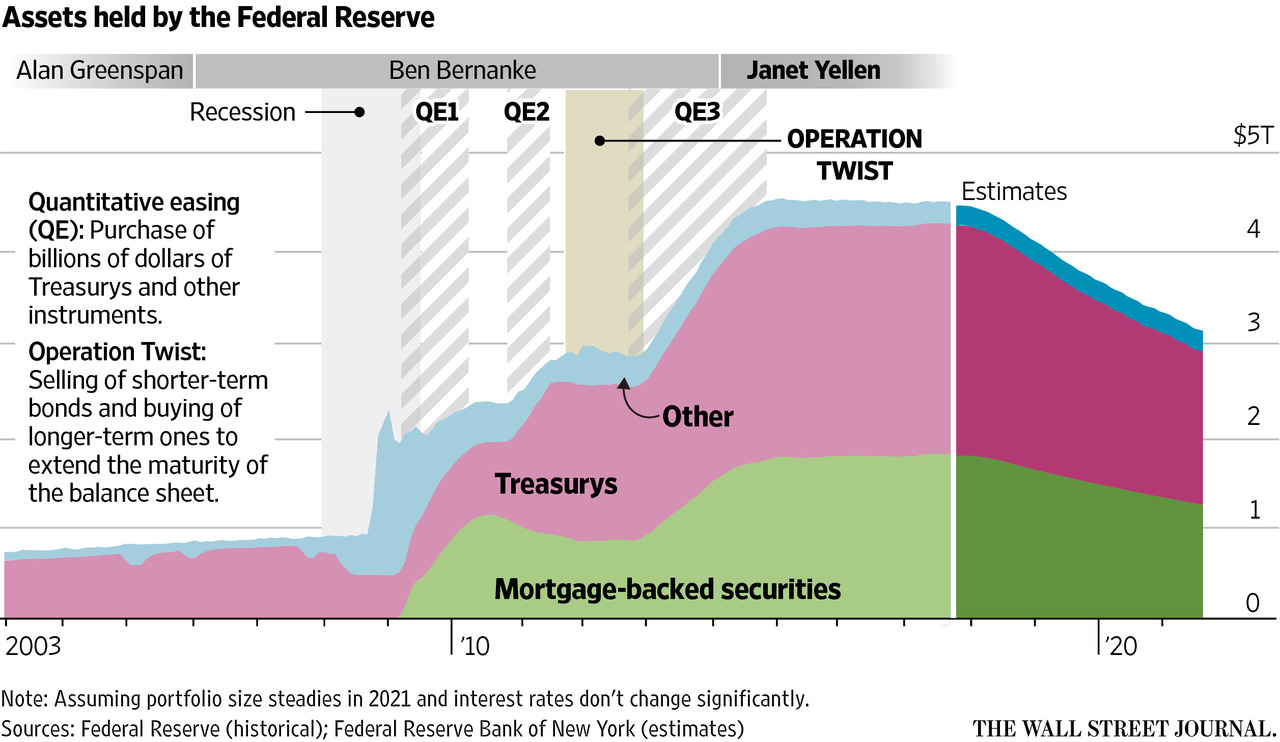

- The Federal Reserve indicated Wednesday it remained on track to raise short-term rates later this year and said it would begin shrinking its portfolio of bonds next month.

- Eurozone PMI came in very solid for September as growth of business activity accelerated. Across both manufacturing and services, job creation was the second highest seen over the past decade. Eurozone flash composite PMI was 56.7, rising to its highest level since May.

- The Bank for International Settlements, in its latest quarterly report, warned that policymakers face a delicate balancing act in attempting to wean markets and businesses off extraordinarily cheap money, and called the mix of low inflation and increasing global growth the “trillion dollar question.”

- In a speech on Friday, British Prime Minister Theresa May said the U.K. would honor its financial commitments to the European Union’s current budget and seek to retain current trade terms for two years after its planned exit in 2019.

Please click here for this week’s update on market returns.

This Week from BlackSummit

Why Have We Been Switching the Headlines? War Games and the US Dollar

John Charalambakis

Recommended Reads

The Fed’s Long March to Normal

The Editorial Board of the Wall Street Journal

The Risk of Nuclear War with North Korea

Evan Osnos

Toward Kurdish Independence?

James M. Dorsey

Image of the Week: The Federal Reserve announced Wednesday it will begin in October to shrink its portfolio of bonds.