Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : June 10, 2017

Market Actions

- The British pound plunged to a seven-week low on Friday after Thursday’s snap election that cost Prime Minister Theresa May’s Conservative Party its majority in Parliament. Global equity markets rallied at first on Friday then dropped as technology stocks tumbled sharply, wounding the Nasdaq and holding down other major Wall Street indexes which had touched record highs earlier in the session.

- Euro zone bond yields hit multi-month lows and the euro dipped below $1.12 on Thursday after the European Central Bank cut its forecasts for inflation and said policymakers had not discussed scaling back its bond-buying program.

- The European Central Bank stepped in to avert a collapse of Spain’s Banco Popular triggered by a run on the bank, orchestrating a last-minute purchase on Wednesday by bigger local rival Santander for the symbolic sum of €1. The terms of the Santander deal are likely to be challenged in court.

- Household debt levels in the United States have surpassed their 2008 peak. The New York Federal Reserve released a report on Wednesday that showed U.S. collective household debt balances totaled $12.73 trillion in March 2017, surpassing the 2008 peak of $12.68 trillion. The percentage of debt that is at least 90 days delinquent rose to 3.37 percent in the first quarter, the second consecutive quarterly gain. This is the first time those delinquency figures have risen twice in a row since the end of 2009 and beginning of 2010.

- According to an article this week in the Wall Street Journal, 41% of the S&P 500’s market-capitalization advance this year was due to five of the best-known technology companies: Facebook, Amazon, Apple, Google parent Alphabet, and Microsoft. Of the 101 top-performing actively managed U.S. stock funds this year, 84 count two or more of those technology firms in their top five holdings, according to Morningstar Inc.

- Survey data for May showed Japan’s private sector economy enjoying the strongest expansion in over three years, fueling expectations that economic growth will gain momentum in the second quarter.

- South Africa has entered recession for the first time in eight years, data showed on Tuesday, putting pressure on a government already facing corruption allegations and credit downgrades. This is the first time two consecutive quarters showed contraction – the definition of recession – since the second quarter of 2009, although there have been individual quarters of negative growth in recent years.

- Saudi Arabia, the United Arab Emirates (UAE), Egypt and Bahrain severed ties with Qatar on Monday over allegations that Doha was courting Iran and fomenting instability in the region. U.S. President Donald Trump on Friday called on Qatar to stop funding terrorism as his State Department urged Arab states to ease their blockade on the country and calm tensions that intensified with a Turkish offer to send military forces to aid its Qatari ally.

This Week from Blacksummit

Disintegration in the Age of Discontent: Unraveling Realities and the Market

John E. Charalambakis

Recommended Reads

The Unsung Heroes of Investing

Phil Huber

Michael Batnick

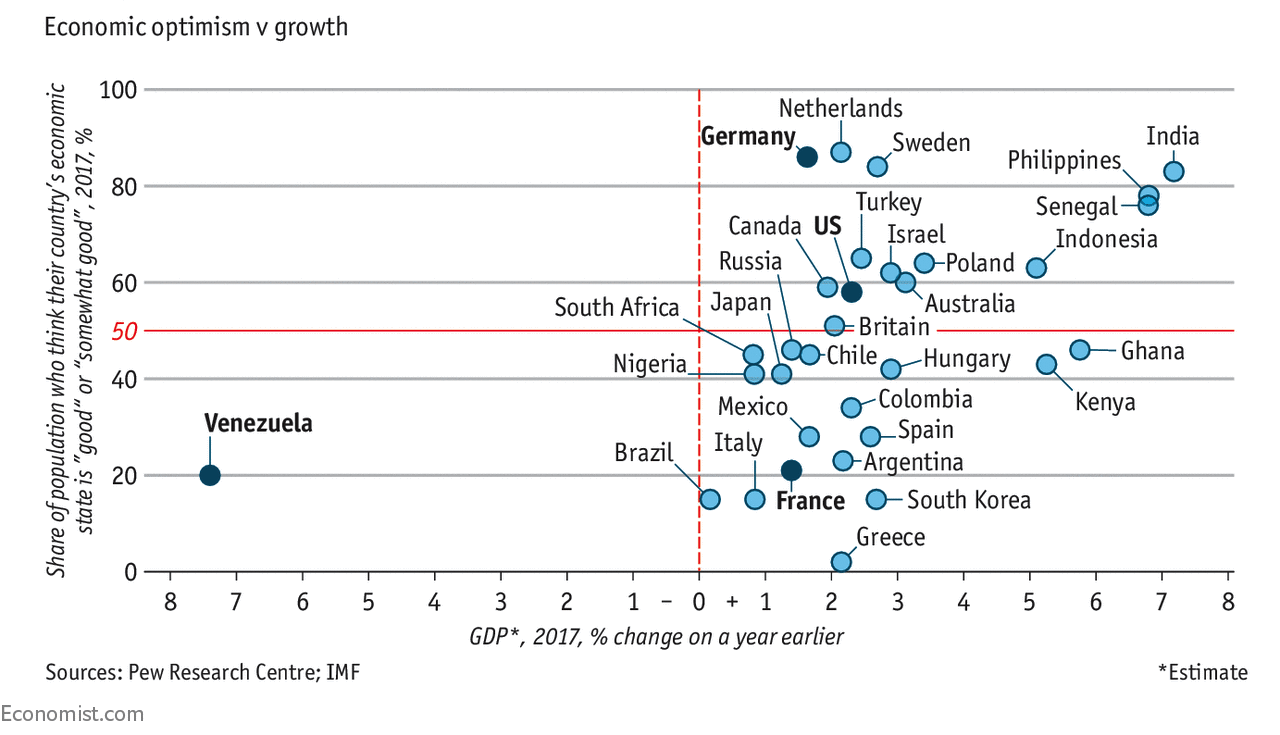

Image of the Week: A scatter plot of economic optimism vs. growth.