Weekly Market Update

Weekly Market Update

-

Author : Ken Rietz

Date : October 15, 2016

Market Action

- The British Pound continue its slide this past week. At one point dropped below $1.20. The fact that the British government may be preparing for a hard exit – which the Financial Times estimate could cost her between £20-40 billion – seems to be main cause for turbulence. French Finance Minister Michael Sapin described to journalists that various large businesses and banks will move from the UK to the continent because staying in the UK would mean the loss of access to the single EU market.

- The unofficial exchange rate between the Egyptian Pound and the USD is over 15 when the official exchange rate is about 9. It seems that the marjet is expecting an imminent devaluation of the Egyptian Pound which may be close to 40%

- Wells Fargo has attempted to move past the scandal, fines, and outrage of the past few weeks with a variety of new efforts, including the resignation of the CEO John Stumpf His replacement, Tim Sloan, has been groomed for years for that job.

- Samsung decided to stop selling the Galaxy Note 7 smart phone while reducing significantly its estimate of quarterly profits. Is a reversal of fortune in the works for the Korean giant?

- The monthly optimism index from the National Federation of Independent Businesses dropped from 94.4 to 94.1, contrary to the increase that experts expected. The NFIB president cited deep uncertainty among small-business owners.

- The Federal Reserve’s FOMC minutes signaled once again that an interest rate increase is a possibility in December.

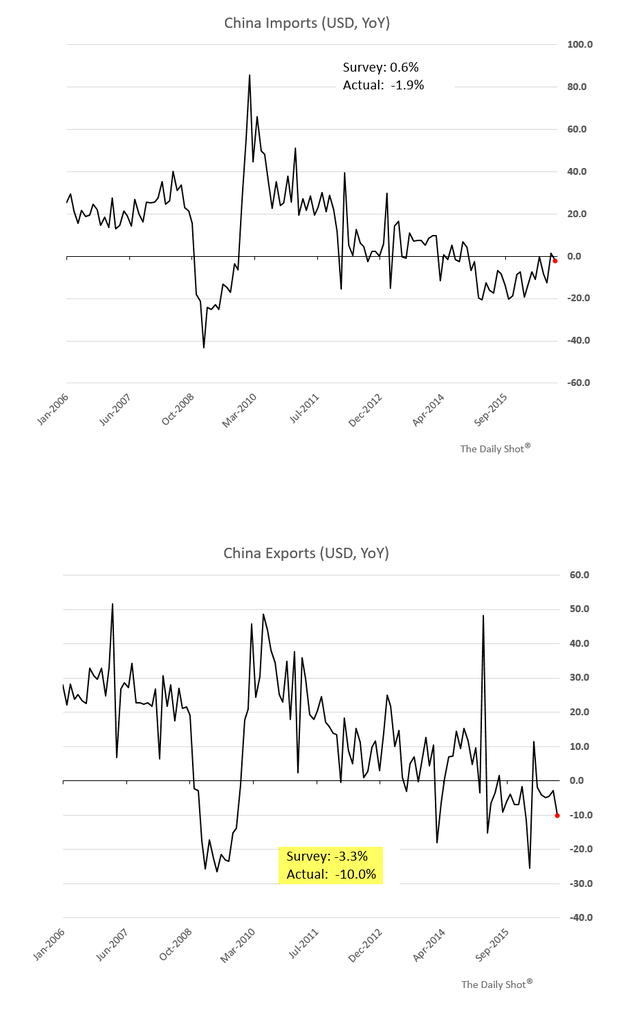

- Unexpectedly poor data about Chinese imports and exports (see the images below), assumed to reflect weakening internal demand, combined with a depreciation in the yuan (CNY) against the USD to cause global equities markets to drop on Thursday. Uncertainty about the Federal Reserve’s actions might also have contributed. At the same time it seems that the banking system in China is preparing for a debt-for-equity swap. The corporate debt in China has ballooned recently and it exceeds $18 trillion.

- Crude oil prices initially dropped when EIA report showed rising crude oil stockpiles. The price then rose upon closer examination of the data that detailed drawdowns of gasoline, diesel fuel, and heating oil.

This Week from Blacksummit

Hyperkinesis and Financial Ecology: The EU and a Lesson from the Kudzu Weed

John Charalambakis

Recommended Readings

Pound at Weakest Level in History against Currency Basket – Wall Street Journal

A $7 Trillion Moment of Truth in Markets is Just Three Days Away – Bloomberg

The Globalisation Litany – CEPS

Egyptian Economic Policy: See no evil, hear no evil – Brookings

Brexit Inspires Salvini Dream of Italy Ditching the Euro – Financial Times

Image of the Week