The stress tests for Europe’s banking system have come and gone and now we feel obliged to provide you with our take. We prefer not to trust the fox guarding the chicken coop just yet.

The stress tests are a pinnacle example of the world of finance that has gripped us all for the past two and half years: plenty of show and a sleek presentation, but still leaving much to be desired in terms of product and substance. We highlighted three concerns last week regarding the stress tests that economists were using to weight the reliability and credibility of these tests carried out by the Committee of European Banking Supervisors (CEBS). Unfortunately the tests did little, if anything to relieve those concerns.

First was the ability for economists to duplicate, or re-engineer, the results of the tests. As the New York Times reported in the wake of the tests, economists from the Peterson Institute for International Economics (a very prestigious think tank in Washington D.C.) have already complained that they are unable to reproduce the results. The latter two concerns revolved around what the assumptions of the tests were and what the future steps of bank capitalization would look like. It is here that the CEBS performed a masterpiece with its PR skills. The Financial Times’ Wolfgang Munchau explains that the barometer of Tier 1 capital was too convoluted, as many European banks count complex, hybrid instruments in this category. Some of these instruments act like equity, others like bonds. The tests don’t tell us which and to what extent Tier 1 capital is made up of these hybrid instruments. Moreover, the majority of German banks tested are operating under a state guarantee; who knows how that affected the stress tests. But most discomforting of the European stress tests is the lack of a true adverse scenario: the tests did not account for a sovereign default. Instead, the worst case scenarios accounted for by the CEBS was a slight growth contraction, but one which does not accurately depict the severity of instability that is choking Europe at the moment, as well as a haircut by debt-laden nations. Unfortunately, as much as we were pleased to learn of the haircut simulation it appears that the CEBS did not go as far as it should have. For instance, the stress tests assumed that Greece was the most troublesome economy and calculated a scenario of a 23% haircut on Greek debt. A more accurate calculation would have put that figure closer to 30% or possibly higher, as the Economists’ Intelligence Unit calculated a short while ago. This simply adds to Europe’s pattern over the last two years of being afraid to be bold and upfront regarding the state of its financial system and what it will take to cleanse the credit arteries. Even Germany, the prime engine of European growth, has been accused of trying to back out of stress tests and not being as truthful as it could.

Before the results of the tests were disclosed most estimates predicted that 10 banks would fail and that as much as $100 billion of capital would need to be raised. Thus, the announcement of only 7 banks and less than $10 billion needed sparked skepticism of the tests parameters and led to calls for more transparency by the International Monetary Fund. Most of all, we need only to look at what the markets did last week with the results of the tests fully known.

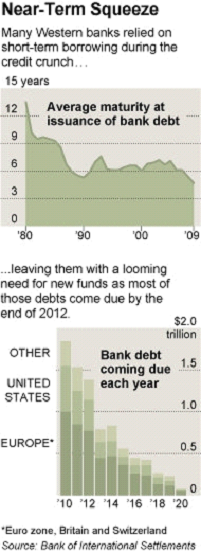

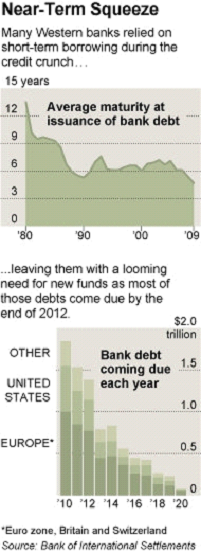

The next two charts demonstrate our point  regarding what an appropriate reaction to the stress tests should be. The first one on the right comes from the Bank of International Settlements and demonstrates why the next 12-18 months are a crucial time for the global economy. A huge amount of bank debt is coming due for U.S. and European banks in that time period as well as in 2012. In the thick of the crisis, banks opted for short term financing to cover holes and dress themselves as well capitalized institutions. Yet since the adoption of this short term debt, little has passed in terms of concern in both banking sectors.

regarding what an appropriate reaction to the stress tests should be. The first one on the right comes from the Bank of International Settlements and demonstrates why the next 12-18 months are a crucial time for the global economy. A huge amount of bank debt is coming due for U.S. and European banks in that time period as well as in 2012. In the thick of the crisis, banks opted for short term financing to cover holes and dress themselves as well capitalized institutions. Yet since the adoption of this short term debt, little has passed in terms of concern in both banking sectors.  Thus, attempting to roll over this debt merely further inflates the debt burden, raises borrowing costs, and prolongs the problem. Moreover, attaining credit to pay off debts is an unsustainable path; the purpose of credit is to create new assets through investments, but this is not happening in the Euro zone or in the U.S. due to fears of counter-party risk. Thus, money is simply changing hands without any prospects of productive activity. The result will be a continued separation between creditors and those who are credit thirsty as the private sector will continue to save for the sake of deleveraging, consume less, and the business sector will fail to be expansive. So where will investors turn to in the face of dire growth prospects? This leads us to the second chart on the left.

Thus, attempting to roll over this debt merely further inflates the debt burden, raises borrowing costs, and prolongs the problem. Moreover, attaining credit to pay off debts is an unsustainable path; the purpose of credit is to create new assets through investments, but this is not happening in the Euro zone or in the U.S. due to fears of counter-party risk. Thus, money is simply changing hands without any prospects of productive activity. The result will be a continued separation between creditors and those who are credit thirsty as the private sector will continue to save for the sake of deleveraging, consume less, and the business sector will fail to be expansive. So where will investors turn to in the face of dire growth prospects? This leads us to the second chart on the left.

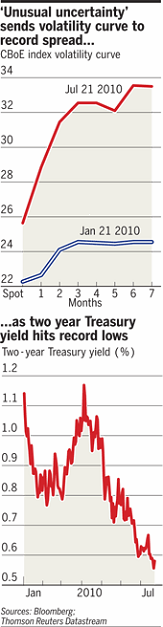

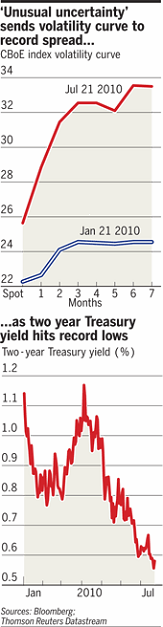

In the wake of Ben Bernanke’s testimony with the infamous “unusual uncertainty” quote, the Chicago Board of Exchange’s volatility curve hit record levels. Where did investors turn? To U.S. Treasuries as we noted in our commentary on July 22nd. Two year Treasury notes were driven down to record lows on the same day of Mr. Bernanke’s testimony, connecting our point that the most functional bond market today is that of U.S. sovereign debt and it is the most sought after financial asset in times of fear. Furthermore, indicators such as durable-goods orders and the Beige book (which highlights economic activity) cast a shadowy forecast on the U.S. recovery, especially when we count for medium and log term volatility which are rising. We expect news of this category to continue for the U.S. economy by year’s end, which will continue to weigh down risky assets and catalyze further holdings of U.S. Treasury debt, until the postman rings the bell again.

Waking Up From a Dream: An Assessment of Recent Events and Emerging Indicators

Author : John E. Charalambakis

Date : July 29, 2010

The stress tests for Europe’s banking system have come and gone and now we feel obliged to provide you with our take. We prefer not to trust the fox guarding the chicken coop just yet.

The stress tests are a pinnacle example of the world of finance that has gripped us all for the past two and half years: plenty of show and a sleek presentation, but still leaving much to be desired in terms of product and substance. We highlighted three concerns last week regarding the stress tests that economists were using to weight the reliability and credibility of these tests carried out by the Committee of European Banking Supervisors (CEBS). Unfortunately the tests did little, if anything to relieve those concerns.

First was the ability for economists to duplicate, or re-engineer, the results of the tests. As the New York Times reported in the wake of the tests, economists from the Peterson Institute for International Economics (a very prestigious think tank in Washington D.C.) have already complained that they are unable to reproduce the results. The latter two concerns revolved around what the assumptions of the tests were and what the future steps of bank capitalization would look like. It is here that the CEBS performed a masterpiece with its PR skills. The Financial Times’ Wolfgang Munchau explains that the barometer of Tier 1 capital was too convoluted, as many European banks count complex, hybrid instruments in this category. Some of these instruments act like equity, others like bonds. The tests don’t tell us which and to what extent Tier 1 capital is made up of these hybrid instruments. Moreover, the majority of German banks tested are operating under a state guarantee; who knows how that affected the stress tests. But most discomforting of the European stress tests is the lack of a true adverse scenario: the tests did not account for a sovereign default. Instead, the worst case scenarios accounted for by the CEBS was a slight growth contraction, but one which does not accurately depict the severity of instability that is choking Europe at the moment, as well as a haircut by debt-laden nations. Unfortunately, as much as we were pleased to learn of the haircut simulation it appears that the CEBS did not go as far as it should have. For instance, the stress tests assumed that Greece was the most troublesome economy and calculated a scenario of a 23% haircut on Greek debt. A more accurate calculation would have put that figure closer to 30% or possibly higher, as the Economists’ Intelligence Unit calculated a short while ago. This simply adds to Europe’s pattern over the last two years of being afraid to be bold and upfront regarding the state of its financial system and what it will take to cleanse the credit arteries. Even Germany, the prime engine of European growth, has been accused of trying to back out of stress tests and not being as truthful as it could.

Before the results of the tests were disclosed most estimates predicted that 10 banks would fail and that as much as $100 billion of capital would need to be raised. Thus, the announcement of only 7 banks and less than $10 billion needed sparked skepticism of the tests parameters and led to calls for more transparency by the International Monetary Fund. Most of all, we need only to look at what the markets did last week with the results of the tests fully known.

The next two charts demonstrate our point regarding what an appropriate reaction to the stress tests should be. The first one on the right comes from the Bank of International Settlements and demonstrates why the next 12-18 months are a crucial time for the global economy. A huge amount of bank debt is coming due for U.S. and European banks in that time period as well as in 2012. In the thick of the crisis, banks opted for short term financing to cover holes and dress themselves as well capitalized institutions. Yet since the adoption of this short term debt, little has passed in terms of concern in both banking sectors.

regarding what an appropriate reaction to the stress tests should be. The first one on the right comes from the Bank of International Settlements and demonstrates why the next 12-18 months are a crucial time for the global economy. A huge amount of bank debt is coming due for U.S. and European banks in that time period as well as in 2012. In the thick of the crisis, banks opted for short term financing to cover holes and dress themselves as well capitalized institutions. Yet since the adoption of this short term debt, little has passed in terms of concern in both banking sectors.  Thus, attempting to roll over this debt merely further inflates the debt burden, raises borrowing costs, and prolongs the problem. Moreover, attaining credit to pay off debts is an unsustainable path; the purpose of credit is to create new assets through investments, but this is not happening in the Euro zone or in the U.S. due to fears of counter-party risk. Thus, money is simply changing hands without any prospects of productive activity. The result will be a continued separation between creditors and those who are credit thirsty as the private sector will continue to save for the sake of deleveraging, consume less, and the business sector will fail to be expansive. So where will investors turn to in the face of dire growth prospects? This leads us to the second chart on the left.

Thus, attempting to roll over this debt merely further inflates the debt burden, raises borrowing costs, and prolongs the problem. Moreover, attaining credit to pay off debts is an unsustainable path; the purpose of credit is to create new assets through investments, but this is not happening in the Euro zone or in the U.S. due to fears of counter-party risk. Thus, money is simply changing hands without any prospects of productive activity. The result will be a continued separation between creditors and those who are credit thirsty as the private sector will continue to save for the sake of deleveraging, consume less, and the business sector will fail to be expansive. So where will investors turn to in the face of dire growth prospects? This leads us to the second chart on the left.

In the wake of Ben Bernanke’s testimony with the infamous “unusual uncertainty” quote, the Chicago Board of Exchange’s volatility curve hit record levels. Where did investors turn? To U.S. Treasuries as we noted in our commentary on July 22nd. Two year Treasury notes were driven down to record lows on the same day of Mr. Bernanke’s testimony, connecting our point that the most functional bond market today is that of U.S. sovereign debt and it is the most sought after financial asset in times of fear. Furthermore, indicators such as durable-goods orders and the Beige book (which highlights economic activity) cast a shadowy forecast on the U.S. recovery, especially when we count for medium and log term volatility which are rising. We expect news of this category to continue for the U.S. economy by year’s end, which will continue to weigh down risky assets and catalyze further holdings of U.S. Treasury debt, until the postman rings the bell again.