A year ago equity and commodity markets were in a panic mode. Chinese tremors, fears of deflation, oil prices below $30 a barrel, declining commodity prices (such as copper), and corporate earnings recession had infused fear in the markets. Now, a year later we found ourselves overconfident to the tune of proclaiming that the unleashing of the animal spirits is a reality. Traditionally such an expression is tied to the period when gains in production, employment, incomes, profits, and productivity lead to an era of spending and innovation that not only changes page but a whole new chapter is drafted in economic and political history.

While we have stated before that for the short term (trading strategy) we also believe that the equity markets have more room to grow, we also want to reiterate that for the long term (investment strategy) caution is needed given that the fundamental issues have not been addressed. I think that there is little doubt that the spill-over effects of the extraordinary accommodative monetary policy around the world since 2008, have been having positive effects on main street nowadays (and not just on Wall Street), which coincides with rising incomes, spending, confidence, and investors’ sentiment.

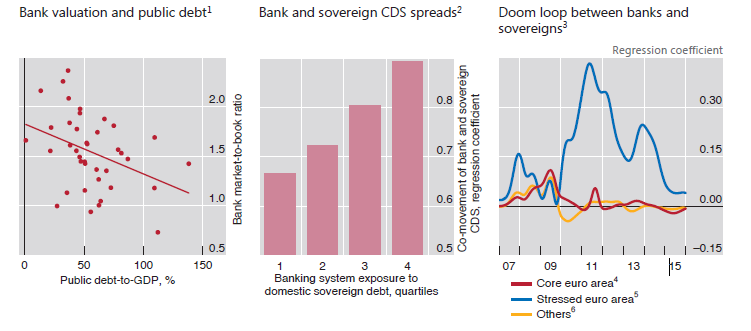

However, the caution that we are calling about deals with the fundamental issue of what the Bank of International Settlements (BIS) calls the “Doom Loop”. The latter refers to the fact that financial and sovereign risks are mutually reinforcing and intertwined. The two-way feedback loop signifies significant contagion between them. This is due to three main factors:

First, the co-dependence and co-movement between sovereign and credit default swap (CDS) spreads makes the whole enterprise of financial stability an issue that is removed from market forces and is rather at the hands of central authorities (governments and central banks). We all know that when our confidence and reliance depends too much on central planning, the risks could be too big to absorb and contain.

Second, fiscally weak states (due to high debts and unfunded liabilities) are associated with financially weak banks (just look at the EU case which is a textbook case). Similarly, weak banks (as measured by market to book ratios), are associated with states that have high debts and unfunded liabilities. The risks are much more elevated when the financial sector in a fiscally weak economy is disproportionally large.

Third, if the balance sheets of the banks contain a lot of sovereign debt, then the risk is much greater for instability, inability to grow, and the possibility of a prolonged stagnation or even worse for a crisis that can be caused by a shock.

The graph below (taken from BIS annual report), illustrates the above three points.

The graph shows in a vivid way that as the financial crisis of 2008 was unfolding, CDS spreads rose dramatically, to be followed by rising sovereign risk spreads when the bailouts and government guarantees took place.

Our word of caution for the investment strategy is due to the fact that the main issues that caused the 2008 crisis have not been eclipsed or addressed (at least in the great majority of cases) and therefore, while we ride the upswing we also want our readers to keep that in mind and make some preparations for a potential downturn because the central authorities too face limitations in the feeding of the animal spirits.

Has the Unleashing of Animal Spirits Time Arrived? A Little Caution due to the Doom Loop

Author : John E. Charalambakis

Date : March 2, 2017

A year ago equity and commodity markets were in a panic mode. Chinese tremors, fears of deflation, oil prices below $30 a barrel, declining commodity prices (such as copper), and corporate earnings recession had infused fear in the markets. Now, a year later we found ourselves overconfident to the tune of proclaiming that the unleashing of the animal spirits is a reality. Traditionally such an expression is tied to the period when gains in production, employment, incomes, profits, and productivity lead to an era of spending and innovation that not only changes page but a whole new chapter is drafted in economic and political history.

While we have stated before that for the short term (trading strategy) we also believe that the equity markets have more room to grow, we also want to reiterate that for the long term (investment strategy) caution is needed given that the fundamental issues have not been addressed. I think that there is little doubt that the spill-over effects of the extraordinary accommodative monetary policy around the world since 2008, have been having positive effects on main street nowadays (and not just on Wall Street), which coincides with rising incomes, spending, confidence, and investors’ sentiment.

However, the caution that we are calling about deals with the fundamental issue of what the Bank of International Settlements (BIS) calls the “Doom Loop”. The latter refers to the fact that financial and sovereign risks are mutually reinforcing and intertwined. The two-way feedback loop signifies significant contagion between them. This is due to three main factors:

First, the co-dependence and co-movement between sovereign and credit default swap (CDS) spreads makes the whole enterprise of financial stability an issue that is removed from market forces and is rather at the hands of central authorities (governments and central banks). We all know that when our confidence and reliance depends too much on central planning, the risks could be too big to absorb and contain.

Second, fiscally weak states (due to high debts and unfunded liabilities) are associated with financially weak banks (just look at the EU case which is a textbook case). Similarly, weak banks (as measured by market to book ratios), are associated with states that have high debts and unfunded liabilities. The risks are much more elevated when the financial sector in a fiscally weak economy is disproportionally large.

Third, if the balance sheets of the banks contain a lot of sovereign debt, then the risk is much greater for instability, inability to grow, and the possibility of a prolonged stagnation or even worse for a crisis that can be caused by a shock.

The graph below (taken from BIS annual report), illustrates the above three points.

The graph shows in a vivid way that as the financial crisis of 2008 was unfolding, CDS spreads rose dramatically, to be followed by rising sovereign risk spreads when the bailouts and government guarantees took place.

Our word of caution for the investment strategy is due to the fact that the main issues that caused the 2008 crisis have not been eclipsed or addressed (at least in the great majority of cases) and therefore, while we ride the upswing we also want our readers to keep that in mind and make some preparations for a potential downturn because the central authorities too face limitations in the feeding of the animal spirits.