The equities market continues its upswing trend and as its tide rises, other equity markets around the world follow it too, given that expectations and economic fundamentals in other places around the globe (Asia, Europe) are rising too. A couple of weeks ago we wrote that the market has legs to continue rising in the short term, see here.

Given the increasing corporate earnings, the rising investors’ sentiment, the spillover effects of the unorthodox monetary measures of the last several years, the higher household incomes, the rising consumer confidence, and the increasing business activity (to name some of the elements that make up the upswing), we continue to believe that the upswing tide has legs to go in the foreseeable future, especially when we take into account that tax policy and infrastructure spending issues have not been presented yet, and also legislation related to repatriating cash from abroad has not been touched either (we may gain some understanding of these issues next Tuesday).

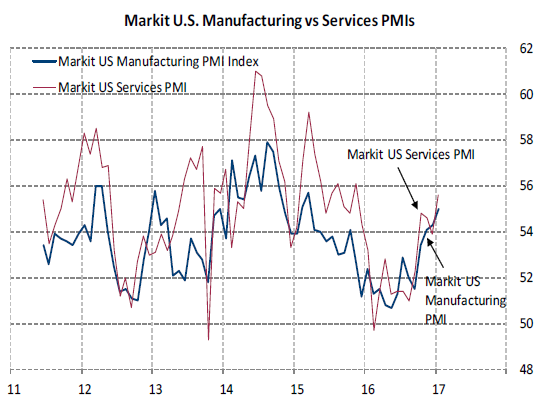

As the following figure shows, both the manufacturing as well as the services index indicates rising activity which boosts corporate expectations further.

Both indexes signify expansionary activity and given the healthy profit margins, the bottom line of corporate earnings is expected to enjoy greater gains, with some analysts raising the earnings to as high as 11% by the fourth quarter vs. 7% just a couple of months ago.

Turning now to the European markets, we observed earlier this month some consolidation below the January’s high. However, European data continue coming in strong, relative of course to the performance observed over the course of the last several years; therefore there are reasons to believe that European markets are also projected to do well in the near future. The two things that may hold back European markets are political risks due to elections this year, and Brexit.

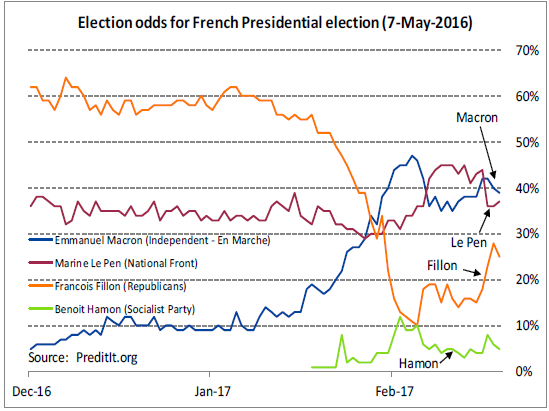

Speaking of the forthcoming elections, the uncertainty regarding French elections (see graph below) is also reflected in the French bonds where the yields are rising and the spread between them and the German bonds is also widening.

It is also interesting to note that the latest polls in German show that Chancellor Merkel’s ruling Christian Democrats (CDU/CSU) are trailing the rising prospects of Martin Schultz who will be the Social Democrats (SPD) candidate. Overall, our assessment at this stage is that Le Pen will not be elected President in France, but Schultz has a pretty good chance of being the next Chancellor of Germany and the de facto EU leader. Such a development most probably will boost European economic prospects by the fourth quarter of this year which may carry the markets to even higher levels.

In conclusion, our opinion is that despite European political uncertainties, equity market convergence will take place as weeks and months pass by.

U.S. Economic Developments Meet European Politics: Upswing Targets Convergence

Author : John E. Charalambakis

Date : February 22, 2017

The equities market continues its upswing trend and as its tide rises, other equity markets around the world follow it too, given that expectations and economic fundamentals in other places around the globe (Asia, Europe) are rising too. A couple of weeks ago we wrote that the market has legs to continue rising in the short term, see here.

Given the increasing corporate earnings, the rising investors’ sentiment, the spillover effects of the unorthodox monetary measures of the last several years, the higher household incomes, the rising consumer confidence, and the increasing business activity (to name some of the elements that make up the upswing), we continue to believe that the upswing tide has legs to go in the foreseeable future, especially when we take into account that tax policy and infrastructure spending issues have not been presented yet, and also legislation related to repatriating cash from abroad has not been touched either (we may gain some understanding of these issues next Tuesday).

As the following figure shows, both the manufacturing as well as the services index indicates rising activity which boosts corporate expectations further.

Both indexes signify expansionary activity and given the healthy profit margins, the bottom line of corporate earnings is expected to enjoy greater gains, with some analysts raising the earnings to as high as 11% by the fourth quarter vs. 7% just a couple of months ago.

Turning now to the European markets, we observed earlier this month some consolidation below the January’s high. However, European data continue coming in strong, relative of course to the performance observed over the course of the last several years; therefore there are reasons to believe that European markets are also projected to do well in the near future. The two things that may hold back European markets are political risks due to elections this year, and Brexit.

Speaking of the forthcoming elections, the uncertainty regarding French elections (see graph below) is also reflected in the French bonds where the yields are rising and the spread between them and the German bonds is also widening.

It is also interesting to note that the latest polls in German show that Chancellor Merkel’s ruling Christian Democrats (CDU/CSU) are trailing the rising prospects of Martin Schultz who will be the Social Democrats (SPD) candidate. Overall, our assessment at this stage is that Le Pen will not be elected President in France, but Schultz has a pretty good chance of being the next Chancellor of Germany and the de facto EU leader. Such a development most probably will boost European economic prospects by the fourth quarter of this year which may carry the markets to even higher levels.

In conclusion, our opinion is that despite European political uncertainties, equity market convergence will take place as weeks and months pass by.