The results of the EU-wide stress tests on banks are out. The EU banks seem to celebrate that all is well. Catastrophe was avoided. The capital that some of them would need to raise seem to be so low that a celebratory tone is raised in the sky. Tranquility needs a poem to be celebrated. Welcome to a new version of Alexander’s Feast, originally composed by Dryden in 1697 and made into a choral by Handel in 1736. The poem describes the banquet organized by Alexander the Great when he defeated Darius and captured Persepolis. The thesis of this commentary is that while credit overextension is taking place with the various forms of QEs, repos, and reverses repos, a divorce is at works between credit markets and true market liquidity. The final separation (which could easily start within two years) will remind us all of what happened to Persepolis following that grand banquet.

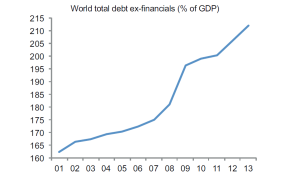

In a recent report by the Geneva-based International Center for Monetary and Banking Studies (ICMB) and the London-based Centre for Economic Policy Research (CEPR), the authors clearly demonstrate that the dynamics of debt accumulation, its changing nature over time and across the globe, the systemic risks arising from leverage cycles and the overbuilt capacity for credit extension, lead us to a predictable crisis due to further debt accumulation as shown below (i.e. the report exposes the myth of deleveraging).

The expansion of debt at a time when growth rates are below their potential reduces multi-factor productivity. At the same time central banks try to keep interest rates below their natural rates through financial repression. By pushing the rates of interest below their natural level they jeopardize risk premia to increase due to any unforeseen reason since the markets have learned to live by credit extensions rather than by cathartic measures that clean up the balance sheets of banks and corporations.

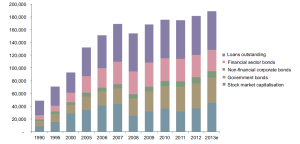

As debt rises, the pertinent instruments that represent third-party liabilities rise too, and hence we have come to the point that debt instruments dwarf equity instruments in developed markets.

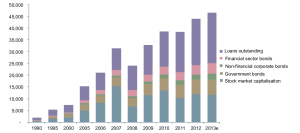

The problem is worse in emerging markets where debt growth follows an exponential rate, as can be seen in the graph below.

The explosion of debt instruments is also accompanied by an explosion in the balance sheets of central banks, while liquidity has barely increased relative to the debt instruments’ increase. Welcome to the tranquility of a boiling chaotic disequilibrium. The rise in debt has not been accompanied by a rise in the formation of liquid assets, and hence repayment capacity is restricted. Therefore, the ratio of debt servicing expenditure to income – the litmus test of debt sustainability – depends on future income streams, the interest rate charged, and the risk premia. The problem is that all of them are inversely related to liquidity.

We created a temple of debt-worshipping and through monetary manipulations we have managed to keep interest rates depressed to abnormal levels. What would happen then when for some reason the holders of the debt instruments want to exit? The liquidity would not be there to support the exit, and hence as Jeremy Stein – former Fed governor – explained in an article, the market will face a situation where people will have “liquid claims on illiquid assets”.

Welcome to the last act of Alexander’s Feast. While Timotheus plays his lyre and sings, he arouses various moods in Alexander, until he finally responds to Timotheus’ call to avenge his comrades lying dead in the battlefield by burning Persepolis. The climax and apotheosis is signified by Handel’s astonishing composition when the orchestra contributes a mighty crescendo with six gradations beginning on first violin and cellos, followed by the other instruments entering in groups, and with the drums last of all.

It would be quite a party that could end all parties and feasts.

The Tranquility of a Chaotic Disequilibrium: Alexander’s Feast and the Risks of Divorcing Credit from Liquidity

Author : John E. Charalambakis

Date : October 27, 2014

The results of the EU-wide stress tests on banks are out. The EU banks seem to celebrate that all is well. Catastrophe was avoided. The capital that some of them would need to raise seem to be so low that a celebratory tone is raised in the sky. Tranquility needs a poem to be celebrated. Welcome to a new version of Alexander’s Feast, originally composed by Dryden in 1697 and made into a choral by Handel in 1736. The poem describes the banquet organized by Alexander the Great when he defeated Darius and captured Persepolis. The thesis of this commentary is that while credit overextension is taking place with the various forms of QEs, repos, and reverses repos, a divorce is at works between credit markets and true market liquidity. The final separation (which could easily start within two years) will remind us all of what happened to Persepolis following that grand banquet.

In a recent report by the Geneva-based International Center for Monetary and Banking Studies (ICMB) and the London-based Centre for Economic Policy Research (CEPR), the authors clearly demonstrate that the dynamics of debt accumulation, its changing nature over time and across the globe, the systemic risks arising from leverage cycles and the overbuilt capacity for credit extension, lead us to a predictable crisis due to further debt accumulation as shown below (i.e. the report exposes the myth of deleveraging).

The expansion of debt at a time when growth rates are below their potential reduces multi-factor productivity. At the same time central banks try to keep interest rates below their natural rates through financial repression. By pushing the rates of interest below their natural level they jeopardize risk premia to increase due to any unforeseen reason since the markets have learned to live by credit extensions rather than by cathartic measures that clean up the balance sheets of banks and corporations.

As debt rises, the pertinent instruments that represent third-party liabilities rise too, and hence we have come to the point that debt instruments dwarf equity instruments in developed markets.

The problem is worse in emerging markets where debt growth follows an exponential rate, as can be seen in the graph below.

The explosion of debt instruments is also accompanied by an explosion in the balance sheets of central banks, while liquidity has barely increased relative to the debt instruments’ increase. Welcome to the tranquility of a boiling chaotic disequilibrium. The rise in debt has not been accompanied by a rise in the formation of liquid assets, and hence repayment capacity is restricted. Therefore, the ratio of debt servicing expenditure to income – the litmus test of debt sustainability – depends on future income streams, the interest rate charged, and the risk premia. The problem is that all of them are inversely related to liquidity.

We created a temple of debt-worshipping and through monetary manipulations we have managed to keep interest rates depressed to abnormal levels. What would happen then when for some reason the holders of the debt instruments want to exit? The liquidity would not be there to support the exit, and hence as Jeremy Stein – former Fed governor – explained in an article, the market will face a situation where people will have “liquid claims on illiquid assets”.

Welcome to the last act of Alexander’s Feast. While Timotheus plays his lyre and sings, he arouses various moods in Alexander, until he finally responds to Timotheus’ call to avenge his comrades lying dead in the battlefield by burning Persepolis. The climax and apotheosis is signified by Handel’s astonishing composition when the orchestra contributes a mighty crescendo with six gradations beginning on first violin and cellos, followed by the other instruments entering in groups, and with the drums last of all.

It would be quite a party that could end all parties and feasts.