The dream became a nightmare for both Greece and Cyprus. Who is to be blamed for this? The purpose of this brief is not to present an outline for all the causes. The objective is to identify the root parallels that have created a universe of uncertainty for both countries, and to suggest a way forward.

We could have started with the usual suspects like government waste, inefficient operations, massive tax evasion, too much public spending, misallocation of resources, corruption, misbehaved unions, incompetent leadership that could not plan for the future and/or execute plans, etc. However, I prefer to concentrate on two things, namely: debt and the inability to develop the competitive advantages of the respective nations.

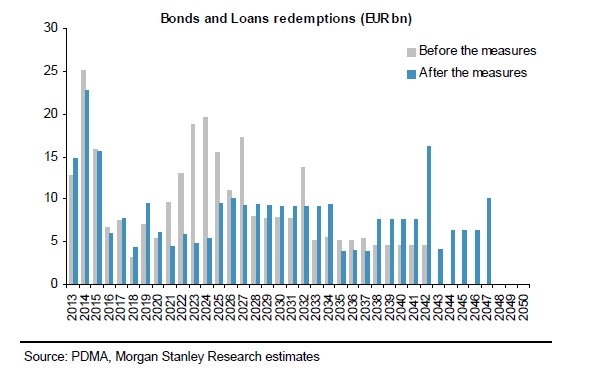

I will start with Greece. The graph below shows that despite the significant haircut on Greek debt last year, the debt continues to be unbearable, and the repayment issues have been exacerbated and extended for the next 30+ years. Therefore, unless a substantial haircut is implemented for the public institutions that hold the Greek debt, the Greek economy will work like a slave to pay off a debt that the troika and its mismanagement has made it worse.

Despite the good intentions and efforts by the new Greek government in the last several months, the core issues of the crisis have not been touched, namely: realistic programs to reduce the unacceptably high unemployment rate which is expected to exceed 31% this year (given that GDP is projected to decline by over 5%); and the liquidity issues of the Greek economy. It is my opinion that unless these two issues are addressed the cosmetic surgeries will continue so in the end we may end up with nice marbles on a grave, but a grave is always a grave.

It is quite absurd to hear well-known Greek personalities to proclaim victory because the trade deficit disappears! Of course it will disappear when people don’t have money to spend. On the other hand, the declining government revenue point to a divergence from the austerity program’s goals, and the insistence on taxing everything can only backfire and increase the instability and the uncertainty. When in just five years the country’s GDP has declined by almost 25%, we are talking about depression. Selling off assets (especially the money- public sector enterprises, hopefully at decent prices) is good but the hole is so big and the business climate so depressed that requires dramatic measures and out-of-the-box solutions, such as debt cancellation, massive foreign investments based on well-designed incentives and independent – from the ECB – monetary policy. Unless those things happen the money from the tranches will be wasted and a year from now Greece may be searching for new funding. The EU monetary integration ties the hands of fiscal prudence given the absence of fiscal transfers within the EU. Fiscal prudence in that sense is the ability to incentivize the private sector to jumpstart the economy based on its natural advantages.

The declining Greek competitiveness is a symptom of the cause called inability to exploit the nation’s advantages. The figure below shows that decline which reflects the absence of fiscal prudence, the tied hands of local monetary policy, and the disintegration of the Greek economy.

The situation in Cyprus reflects its own parallel universe where banks were encouraged and bought government bonds (Cypriot and Greek), and loaded up on paper that was someone else’s liability! When that someone else (respective governments) could not pay, the banks collapsed and were nationalized by a state that itself needed a bailout!

At this point Cyprus needs a bailout of more than 100% of its GDP and politics in the EU make it very difficult. I am encouraged by the new Cypriot leadership and especially the economic team that I met in Cyprus a couple of days after the election. However, they have a Herculean task that requires them to move mountains. Talks by ECB and EU officials of deposits’ haircuts in Cyprus could trigger a banking crisis in the EU unlike any other. Let’s not forget that the EU-wide banking system is a disaster and resembles a house of cards. Once a card falls, the whole system may collapse. I believe that if the banking issues are addressed the rest of the issues are pretty manageable.

Cyprus’ competitive advantage over the last several years has been its services (accounting, legal, banking, insurance, trust, etc.). At the same time is endowed with natural gas and oil. If the new Cypriot government starts thinking out-of-the-box and exploits a combination of its competitive advantages, then it can overcome its difficulties. Here are some measures that could be undertaken:

- Separate good and bad assets in the banks

- Create a good bank and sell either its assets or the whole good bank while deleveraging the sector

- Align more closely with the US and re-brand its image while securing strategic alliances that will target both banks and the overall geopolitical threats

- Identify alternative sources of funding besides the ones offered by the troika

- Create an energy bank that does not exist in the whole EU region (via collateralizing and securitizing future income cash flow from the energy fields and offer those securities as guarantees to investors)

In closing, I believe that the parallel trajectories of Greece and Cyprus require a firm approach that liberates from debt and advances the competitive advantages of the respective nations.

The Parallel Universe of Greece and Cyprus: Where Do they go from Here?

Author : John E. Charalambakis

Date : February 28, 2013

The dream became a nightmare for both Greece and Cyprus. Who is to be blamed for this? The purpose of this brief is not to present an outline for all the causes. The objective is to identify the root parallels that have created a universe of uncertainty for both countries, and to suggest a way forward.

We could have started with the usual suspects like government waste, inefficient operations, massive tax evasion, too much public spending, misallocation of resources, corruption, misbehaved unions, incompetent leadership that could not plan for the future and/or execute plans, etc. However, I prefer to concentrate on two things, namely: debt and the inability to develop the competitive advantages of the respective nations.

I will start with Greece. The graph below shows that despite the significant haircut on Greek debt last year, the debt continues to be unbearable, and the repayment issues have been exacerbated and extended for the next 30+ years. Therefore, unless a substantial haircut is implemented for the public institutions that hold the Greek debt, the Greek economy will work like a slave to pay off a debt that the troika and its mismanagement has made it worse.

Despite the good intentions and efforts by the new Greek government in the last several months, the core issues of the crisis have not been touched, namely: realistic programs to reduce the unacceptably high unemployment rate which is expected to exceed 31% this year (given that GDP is projected to decline by over 5%); and the liquidity issues of the Greek economy. It is my opinion that unless these two issues are addressed the cosmetic surgeries will continue so in the end we may end up with nice marbles on a grave, but a grave is always a grave.

It is quite absurd to hear well-known Greek personalities to proclaim victory because the trade deficit disappears! Of course it will disappear when people don’t have money to spend. On the other hand, the declining government revenue point to a divergence from the austerity program’s goals, and the insistence on taxing everything can only backfire and increase the instability and the uncertainty. When in just five years the country’s GDP has declined by almost 25%, we are talking about depression. Selling off assets (especially the money- public sector enterprises, hopefully at decent prices) is good but the hole is so big and the business climate so depressed that requires dramatic measures and out-of-the-box solutions, such as debt cancellation, massive foreign investments based on well-designed incentives and independent – from the ECB – monetary policy. Unless those things happen the money from the tranches will be wasted and a year from now Greece may be searching for new funding. The EU monetary integration ties the hands of fiscal prudence given the absence of fiscal transfers within the EU. Fiscal prudence in that sense is the ability to incentivize the private sector to jumpstart the economy based on its natural advantages.

The declining Greek competitiveness is a symptom of the cause called inability to exploit the nation’s advantages. The figure below shows that decline which reflects the absence of fiscal prudence, the tied hands of local monetary policy, and the disintegration of the Greek economy.

The situation in Cyprus reflects its own parallel universe where banks were encouraged and bought government bonds (Cypriot and Greek), and loaded up on paper that was someone else’s liability! When that someone else (respective governments) could not pay, the banks collapsed and were nationalized by a state that itself needed a bailout!

At this point Cyprus needs a bailout of more than 100% of its GDP and politics in the EU make it very difficult. I am encouraged by the new Cypriot leadership and especially the economic team that I met in Cyprus a couple of days after the election. However, they have a Herculean task that requires them to move mountains. Talks by ECB and EU officials of deposits’ haircuts in Cyprus could trigger a banking crisis in the EU unlike any other. Let’s not forget that the EU-wide banking system is a disaster and resembles a house of cards. Once a card falls, the whole system may collapse. I believe that if the banking issues are addressed the rest of the issues are pretty manageable.

Cyprus’ competitive advantage over the last several years has been its services (accounting, legal, banking, insurance, trust, etc.). At the same time is endowed with natural gas and oil. If the new Cypriot government starts thinking out-of-the-box and exploits a combination of its competitive advantages, then it can overcome its difficulties. Here are some measures that could be undertaken:

In closing, I believe that the parallel trajectories of Greece and Cyprus require a firm approach that liberates from debt and advances the competitive advantages of the respective nations.