What do the US and UK political developments as well as the stock market valuation have to do with the Peloponnesian War fought between Athens and Sparta (431-404 BCE)? In all cases, observers want to know the future as unique (possibly extraordinary) developments are taking place. However, as the great chronicler of the Peloponnesian War (Thucydides) noted, the future originates in the past and then departs from it with vengeance!

The Spartans were warriors, focusing on military strength, training constantly, fighting infrequently (celebrating a moon festival rather than being present at the battle of Marathon in 490 BCE), but when their fury aroused, they were the mighty warriors to whom even the Athenians entrusted their land defense.

The Athenians were maritime people whose trading network stretched from the Atlantic to the Black Sea. The Athenians built the finest of navy power but their great politician and general (Themistocles) also wanted a wall on a grand scale. Thus, he endeavored on a mission to outmaneuver (some would say to deceive) the Spartans while in the meantime the Athenians were building the wall to fortify Athens and its port city of Piraeus. The building of the wall was the grand beginning of mispricing strengths, repricing expectations for the Athenians, while searching for a new strategy of domination.

Nowadays, as the UK endeavors into its Brexit and the US debates the impeachment of its president, the value of the stock market (taking as a proxy the Wilshire 5000 Index) relative to GDP stands at about 140%. It seems that the income side (GDP) is trying to support an oversized balance sheet (level of the stock market index) at a time when more than $15 trillion of bonds worldwide trade at levels providing negative yields to the bondholders (and therefore guaranteeing them to lose money if they hold those bonds until maturity)!

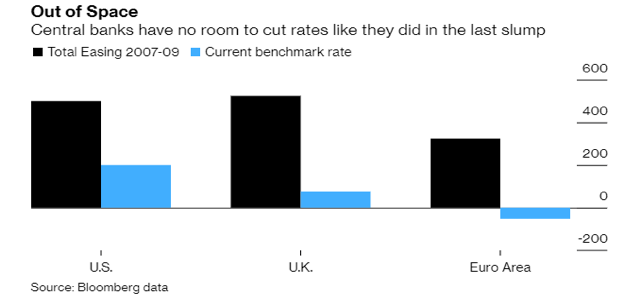

It seems that something is missing in the grand valley of the investment world and as the search goes on for a new grand strategy in the era that is unfolded (given that central banks’ tools will be insufficient when the new crisis emerges), pundits left and right applaud “innovative thinking” of free (helicopter) money, deficit spending, and monetization of debt (a.k.a. Modern Monetary Theory).

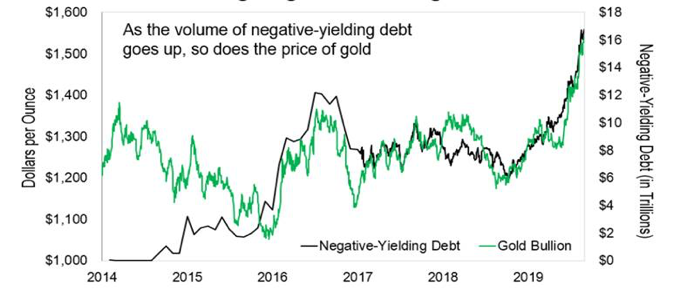

The problem of course with such “innovative thinking” is that it is a recipe coming from the old times when nations and empires debased their currencies, and as a coincidence the historical record shows that it started with debasing the bond market (at least in the last seven centuries). Here is a picture of what happens to real money when such debasing takes place in the form of negative yields.

Source: Bloomberg

Pericles, the great orator would argue “We have forced every sea and land to be the highway of our daring, and everywhere, whether for evil or for good, have left imperishable monuments behind us.”

The problem of course was that such great new grand strategy did not match aspirations with capabilities and in the race with the Spartans Pericles’s vision produced ruins including the ruins of democracy that took another 2,000 years to rebuild. Rather than cooperating and finding synergies (given the rising dangers) the two cities-states embarked on a devastating war incinerating in the process the civilization they had saved.

The lyrics of Bob Dylan’s song titled “No Time to Think” refer to a valley of a missing link where there is no time to think.

Ode to Reason!

The Mispricing of Assets, the Repricing of Expectations, and the Incineration of Reason: Investment Strategy in the Valley of the Missing Link

Author : John E. Charalambakis

Date : September 26, 2019

What do the US and UK political developments as well as the stock market valuation have to do with the Peloponnesian War fought between Athens and Sparta (431-404 BCE)? In all cases, observers want to know the future as unique (possibly extraordinary) developments are taking place. However, as the great chronicler of the Peloponnesian War (Thucydides) noted, the future originates in the past and then departs from it with vengeance!

The Spartans were warriors, focusing on military strength, training constantly, fighting infrequently (celebrating a moon festival rather than being present at the battle of Marathon in 490 BCE), but when their fury aroused, they were the mighty warriors to whom even the Athenians entrusted their land defense.

The Athenians were maritime people whose trading network stretched from the Atlantic to the Black Sea. The Athenians built the finest of navy power but their great politician and general (Themistocles) also wanted a wall on a grand scale. Thus, he endeavored on a mission to outmaneuver (some would say to deceive) the Spartans while in the meantime the Athenians were building the wall to fortify Athens and its port city of Piraeus. The building of the wall was the grand beginning of mispricing strengths, repricing expectations for the Athenians, while searching for a new strategy of domination.

Nowadays, as the UK endeavors into its Brexit and the US debates the impeachment of its president, the value of the stock market (taking as a proxy the Wilshire 5000 Index) relative to GDP stands at about 140%. It seems that the income side (GDP) is trying to support an oversized balance sheet (level of the stock market index) at a time when more than $15 trillion of bonds worldwide trade at levels providing negative yields to the bondholders (and therefore guaranteeing them to lose money if they hold those bonds until maturity)!

It seems that something is missing in the grand valley of the investment world and as the search goes on for a new grand strategy in the era that is unfolded (given that central banks’ tools will be insufficient when the new crisis emerges), pundits left and right applaud “innovative thinking” of free (helicopter) money, deficit spending, and monetization of debt (a.k.a. Modern Monetary Theory).

The problem of course with such “innovative thinking” is that it is a recipe coming from the old times when nations and empires debased their currencies, and as a coincidence the historical record shows that it started with debasing the bond market (at least in the last seven centuries). Here is a picture of what happens to real money when such debasing takes place in the form of negative yields.

Source: Bloomberg

Pericles, the great orator would argue “We have forced every sea and land to be the highway of our daring, and everywhere, whether for evil or for good, have left imperishable monuments behind us.”

The problem of course was that such great new grand strategy did not match aspirations with capabilities and in the race with the Spartans Pericles’s vision produced ruins including the ruins of democracy that took another 2,000 years to rebuild. Rather than cooperating and finding synergies (given the rising dangers) the two cities-states embarked on a devastating war incinerating in the process the civilization they had saved.

The lyrics of Bob Dylan’s song titled “No Time to Think” refer to a valley of a missing link where there is no time to think.

Ode to Reason!