The markets were rattled in the last few days. Let’s review what the conventional wisdom underwrote as the main causes (we use the plural causes, since the explanation was changing almost on a daily basis, as heuristics – the hard wired tendency of humans to perform abstract reasoning in cognitive economic ways – tried to process information).

Originally we were told that the main cause is the unwillingness of the Fed – as interpreted by those who specialize in deciphering the Fed’s minutes – to print more money. By all accounts this is not rational. If printing money is the engine of prosperity, then Zimbabwe should have been one of the most prosperous nations! As we have pointed out before, it’s not the exogenous ability of the Fed to print money that counts, but rather the endogenous ability of the economic system to convert the increased monetary base into money supply and credit to be circulated in the real economy. To believe that an increased monetary base (mainly the bank reserves) translates automatically into money supply is another irrationality.

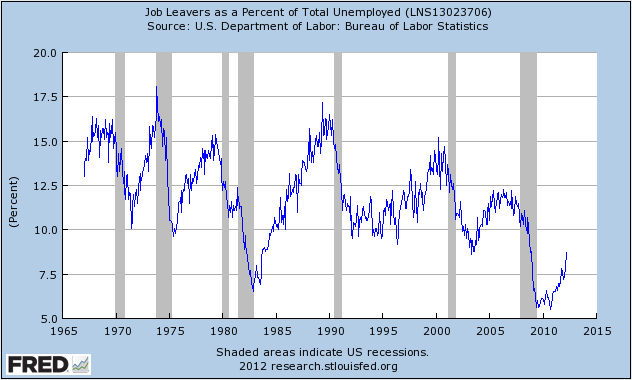

A couple of days later, we were told that the cause of the markets’ nervousness was that the number of jobs created was lower than expected. With all due respect to Nouriel Roubini who tweeted last Friday that people are leaving the labor force because they are discouraged is simply wrong. People do not leave their jobs if the prospects of finding another – probably better – job are not good. Historically, people leave their jobs when the economy is strengthening and recovery is solid. At least this is what the figure below shows.

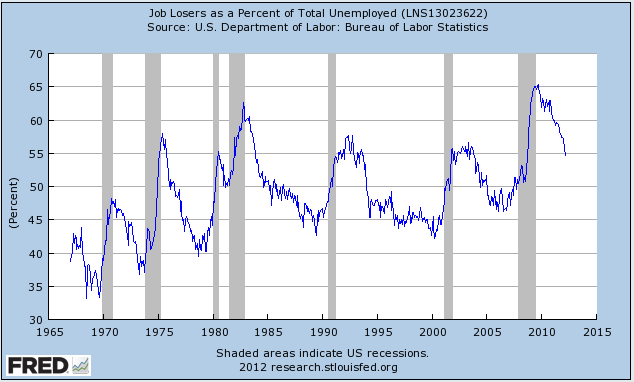

The beginning of solid recoveries, as the figure above shows, coincides with higher numbers of people leaving their jobs. Hence, the phenomenon of people quitting their jobs should encourage us rather than discourage us. We are of the opinion that when we think rationally, the employment picture is much better than proclaimed by the popular numbers. In that sense, when we look at the number of job losers as a fraction of the unemployment rate, we observe that the number has been dropping for more than two years now, as the following graph demonstrates.

Again, and as the graph above affirms, the plunging of the job losers’ number takes place every time the economic recovery is on solid footing (at least since the 1960s).

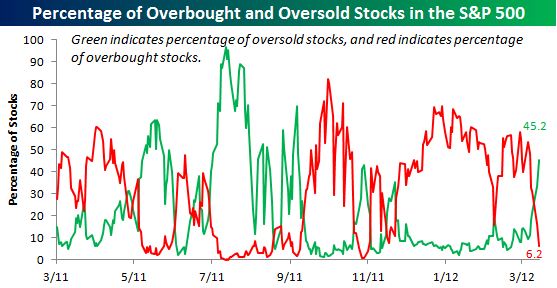

We believe that there might be risk-mitigation efforts that make analysts and commentators to think that the risks are migrating back to the labor market i.e. not a solid recovery, but that is a delusion. For our understanding the recovery is solid, the US market should do well – Alcoa’s earnings surprise is an affirmation to that – for the foreseeable future, and the risks are in the migration of capital from the EU to the US (without claiming that the US is immune to EU financial and economic happenings). In a nutshell we believe that the number of oversold stocks has reached last October’s highs (see graph below) and from that standpoint and despite some possible volatility in the next few weeks – due to the EU instability as mentioned below – the trend should continue to be upwards.

According to the chart above, about 45% of S&P 500 stocks are oversold, and when we take into account the trading range (defined as one standard deviation above or below the 50-day moving average), we could say that the lower volatility in combination with the solid recovery should give a boost to the US equities.

Returning to the different stories regarding the explanation of the recent market decline, and following the jobs’ reasoning, we were told that the EU debt crisis is back on the table, and that’s the reason for the market declines on Tuesday. The focus now is on Spain, and the possibility of haircuts there. Our question is: when did the risks migrate away from the EU? Some thought that the ECB loans to the EU banks had mitigated the risks of the possible EU-wide banking collapse. That is a delusion of those who have an escape mentality. We have been on the record stating those LTROs only postponed what seems to be an accident waiting to happen. Our surprise is that the Euro is still around $1.31, but again it seems that the swap lines among central banks are sustaining it at those irrational levels. In the medium to long run the Euro should experience significant losses.

The economic map is changing. Spain will exhibit major problems given that its deficit target for 2012 will be missed, its regional economies are deep into red (and hence the deficit is well-underestimated), its unemployment rate of 23% (officially) is the highest in the EU, its banks have a lot of toxic paper and non-performing loans in the books, while none of its major economic engine-sectors exhibit any signs of vitality.

It’s shaping up to be an interesting ride. The risks are endemic to the EU structure and its lack of real asset-based growth capable of extracting value and awakening dormant resources. Such endemic risks cannot migrate unless someone lives in the land of delusion.

The Migration of Delusion and the Epidemic of Irrationality

Author : John E. Charalambakis

Date : April 12, 2012

The markets were rattled in the last few days. Let’s review what the conventional wisdom underwrote as the main causes (we use the plural causes, since the explanation was changing almost on a daily basis, as heuristics – the hard wired tendency of humans to perform abstract reasoning in cognitive economic ways – tried to process information).

Originally we were told that the main cause is the unwillingness of the Fed – as interpreted by those who specialize in deciphering the Fed’s minutes – to print more money. By all accounts this is not rational. If printing money is the engine of prosperity, then Zimbabwe should have been one of the most prosperous nations! As we have pointed out before, it’s not the exogenous ability of the Fed to print money that counts, but rather the endogenous ability of the economic system to convert the increased monetary base into money supply and credit to be circulated in the real economy. To believe that an increased monetary base (mainly the bank reserves) translates automatically into money supply is another irrationality.

A couple of days later, we were told that the cause of the markets’ nervousness was that the number of jobs created was lower than expected. With all due respect to Nouriel Roubini who tweeted last Friday that people are leaving the labor force because they are discouraged is simply wrong. People do not leave their jobs if the prospects of finding another – probably better – job are not good. Historically, people leave their jobs when the economy is strengthening and recovery is solid. At least this is what the figure below shows.

The beginning of solid recoveries, as the figure above shows, coincides with higher numbers of people leaving their jobs. Hence, the phenomenon of people quitting their jobs should encourage us rather than discourage us. We are of the opinion that when we think rationally, the employment picture is much better than proclaimed by the popular numbers. In that sense, when we look at the number of job losers as a fraction of the unemployment rate, we observe that the number has been dropping for more than two years now, as the following graph demonstrates.

Again, and as the graph above affirms, the plunging of the job losers’ number takes place every time the economic recovery is on solid footing (at least since the 1960s).

We believe that there might be risk-mitigation efforts that make analysts and commentators to think that the risks are migrating back to the labor market i.e. not a solid recovery, but that is a delusion. For our understanding the recovery is solid, the US market should do well – Alcoa’s earnings surprise is an affirmation to that – for the foreseeable future, and the risks are in the migration of capital from the EU to the US (without claiming that the US is immune to EU financial and economic happenings). In a nutshell we believe that the number of oversold stocks has reached last October’s highs (see graph below) and from that standpoint and despite some possible volatility in the next few weeks – due to the EU instability as mentioned below – the trend should continue to be upwards.

According to the chart above, about 45% of S&P 500 stocks are oversold, and when we take into account the trading range (defined as one standard deviation above or below the 50-day moving average), we could say that the lower volatility in combination with the solid recovery should give a boost to the US equities.

Returning to the different stories regarding the explanation of the recent market decline, and following the jobs’ reasoning, we were told that the EU debt crisis is back on the table, and that’s the reason for the market declines on Tuesday. The focus now is on Spain, and the possibility of haircuts there. Our question is: when did the risks migrate away from the EU? Some thought that the ECB loans to the EU banks had mitigated the risks of the possible EU-wide banking collapse. That is a delusion of those who have an escape mentality. We have been on the record stating those LTROs only postponed what seems to be an accident waiting to happen. Our surprise is that the Euro is still around $1.31, but again it seems that the swap lines among central banks are sustaining it at those irrational levels. In the medium to long run the Euro should experience significant losses.

The economic map is changing. Spain will exhibit major problems given that its deficit target for 2012 will be missed, its regional economies are deep into red (and hence the deficit is well-underestimated), its unemployment rate of 23% (officially) is the highest in the EU, its banks have a lot of toxic paper and non-performing loans in the books, while none of its major economic engine-sectors exhibit any signs of vitality.

It’s shaping up to be an interesting ride. The risks are endemic to the EU structure and its lack of real asset-based growth capable of extracting value and awakening dormant resources. Such endemic risks cannot migrate unless someone lives in the land of delusion.