The markets’ developments in the last few months may resemble Zeno’s paradox. According to it, the flight of an arrow signifies the impossibility of change or motion. At any given moment of an arrow’s flight the latter is where it is or where it is not. If it happens to move where it is, it must be standing still, and in case that it moves where it is not, then it simply cannot be there, hence it can’t move. Our belief is that the messages we see regarding the fiscal cliff in the US, the dead-end and amorphous “solutions” in the EU, the wall that the BRICS are facing, the twenty-year sickness of the Japanese economy, and the slowdown in emerging markets, point to significant coming instability, that will result in substantial gains for precious metals. Hence the markets can neither move nor remain where they are going sideways.

The magnitude of the crisis that started in the summer of 2007 was such that trillions of dollars in cash and guarantees needed to be dispensed by governments and central banks in order to save the financial system from disaster. We have provided the data before which show that the US literally bailed out Deutsche Bank (let alone US banks) with hundreds of billions of dollars. The QEs are nothing but a continuation of an effort to sustain the system, and in that sense it may reflect the belief that such movements represent a continuous and contiguous series of infinitesimal movements that will move the economy to a seamless recovery, avoiding the catastrophic chaos that may encircle us all if things are allowed to proceed without it. The Fed has been assuring us that it can reverse the ballooning of its balance sheet, and thus can traverse what it seems an infinite series of QEs in finite time, thus enabling a smooth landing after the crisis.

The financial crisis has been evolving into a sovereign debt crisis (especially in the EU), and the responses that we have been witnessing there are nothing but of the same belief, i.e. unlimited bond purchases for an infinite amount of time while they mutualize debts, create a banking union, and bail out country-after-country.

This never-ending continuity, not only is complex but it also resembles a transfinite reality, where infinity takes a totally different style since the sky is the limit and numbers are represented by aleph sets  ,

, ,

, etc., all of which reflect the size of infinite possibilities of cardinal numbers. The problem of course with such an approach of an infinite series of “solutions” in resolving the crisis, is that it is at odds with the fact that neither the economic and monetary spaces are continuous nor time is elastic and continuous, but rather both are contingent upon the limits of human behavior.

etc., all of which reflect the size of infinite possibilities of cardinal numbers. The problem of course with such an approach of an infinite series of “solutions” in resolving the crisis, is that it is at odds with the fact that neither the economic and monetary spaces are continuous nor time is elastic and continuous, but rather both are contingent upon the limits of human behavior.

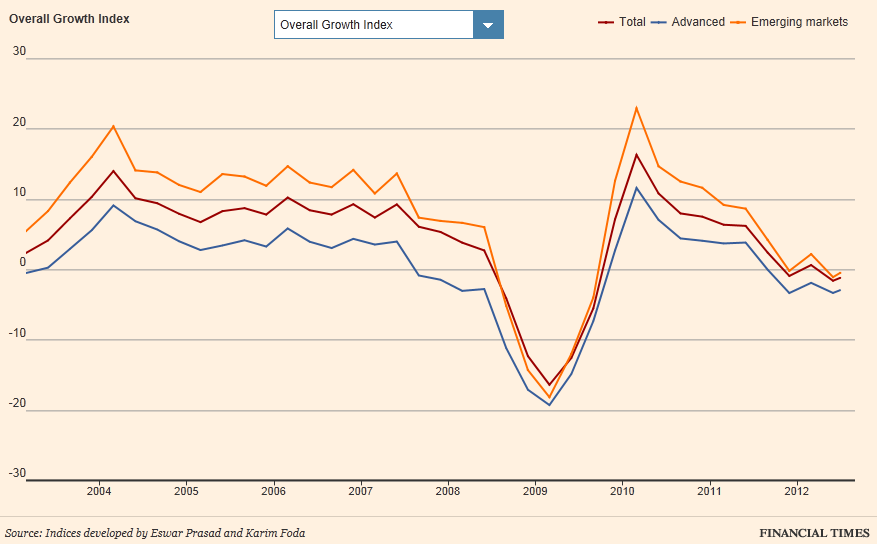

Bringing it all down to two graphs, allows us to conclude this commentary by first looking at the Tracking Indices for the Global Economic Recovery (developed by the Financial Times and the Brookings Institution).

As the graph above shows, we are facing a major challenge in both developed and emerging markets. In a word, the global trajectory is headed down, amidst unsustainable public finances, ballooning central banks balance sheets, anemic growth, and geopolitical instability. In such environment uncertainty will prevail that will prevent real production-oriented investments to take place.

The weak links between sovereigns and banks exacerbate fears, inspires demands for liquidity, while the policymakers impasse (both in the EU, the US, and between the EU and the IMF), allows Spain to keep postponing the request for a full bailout. The expectation of the latter along with the possibilities of an Eurozone disintegration, a US recession in 2013, and a hard landing in China, may make monetary policy tools impotent in the near future, since the cost of borrowing will start being disassociated from central banks’ ability to guide it.

Therefore, central banks trajectory and policy orientation summarized in the phrase “To Infinity and Beyond” will only result in higher prices for precious metals, as the following graph shows. The graph shows the cumulative balance sheets of the Fed, the ECB, China’s central bank, Japan’s central bank and Switzerland’s central bank, over the course of the last thirteen years. It also shows the effect such policy has had on the price of gold.

The only question we have is: Are we ready for the summit in precious metals’ prices?

The Markets and Zeno’s Dilemma: Transcending the Complexity of Transfinite Policies

Author : John E. Charalambakis

Date : October 19, 2012

The markets’ developments in the last few months may resemble Zeno’s paradox. According to it, the flight of an arrow signifies the impossibility of change or motion. At any given moment of an arrow’s flight the latter is where it is or where it is not. If it happens to move where it is, it must be standing still, and in case that it moves where it is not, then it simply cannot be there, hence it can’t move. Our belief is that the messages we see regarding the fiscal cliff in the US, the dead-end and amorphous “solutions” in the EU, the wall that the BRICS are facing, the twenty-year sickness of the Japanese economy, and the slowdown in emerging markets, point to significant coming instability, that will result in substantial gains for precious metals. Hence the markets can neither move nor remain where they are going sideways.

The magnitude of the crisis that started in the summer of 2007 was such that trillions of dollars in cash and guarantees needed to be dispensed by governments and central banks in order to save the financial system from disaster. We have provided the data before which show that the US literally bailed out Deutsche Bank (let alone US banks) with hundreds of billions of dollars. The QEs are nothing but a continuation of an effort to sustain the system, and in that sense it may reflect the belief that such movements represent a continuous and contiguous series of infinitesimal movements that will move the economy to a seamless recovery, avoiding the catastrophic chaos that may encircle us all if things are allowed to proceed without it. The Fed has been assuring us that it can reverse the ballooning of its balance sheet, and thus can traverse what it seems an infinite series of QEs in finite time, thus enabling a smooth landing after the crisis.

The financial crisis has been evolving into a sovereign debt crisis (especially in the EU), and the responses that we have been witnessing there are nothing but of the same belief, i.e. unlimited bond purchases for an infinite amount of time while they mutualize debts, create a banking union, and bail out country-after-country.

This never-ending continuity, not only is complex but it also resembles a transfinite reality, where infinity takes a totally different style since the sky is the limit and numbers are represented by aleph sets ,

, ,

, etc., all of which reflect the size of infinite possibilities of cardinal numbers. The problem of course with such an approach of an infinite series of “solutions” in resolving the crisis, is that it is at odds with the fact that neither the economic and monetary spaces are continuous nor time is elastic and continuous, but rather both are contingent upon the limits of human behavior.

etc., all of which reflect the size of infinite possibilities of cardinal numbers. The problem of course with such an approach of an infinite series of “solutions” in resolving the crisis, is that it is at odds with the fact that neither the economic and monetary spaces are continuous nor time is elastic and continuous, but rather both are contingent upon the limits of human behavior.

Bringing it all down to two graphs, allows us to conclude this commentary by first looking at the Tracking Indices for the Global Economic Recovery (developed by the Financial Times and the Brookings Institution).

As the graph above shows, we are facing a major challenge in both developed and emerging markets. In a word, the global trajectory is headed down, amidst unsustainable public finances, ballooning central banks balance sheets, anemic growth, and geopolitical instability. In such environment uncertainty will prevail that will prevent real production-oriented investments to take place.

The weak links between sovereigns and banks exacerbate fears, inspires demands for liquidity, while the policymakers impasse (both in the EU, the US, and between the EU and the IMF), allows Spain to keep postponing the request for a full bailout. The expectation of the latter along with the possibilities of an Eurozone disintegration, a US recession in 2013, and a hard landing in China, may make monetary policy tools impotent in the near future, since the cost of borrowing will start being disassociated from central banks’ ability to guide it.

Therefore, central banks trajectory and policy orientation summarized in the phrase “To Infinity and Beyond” will only result in higher prices for precious metals, as the following graph shows. The graph shows the cumulative balance sheets of the Fed, the ECB, China’s central bank, Japan’s central bank and Switzerland’s central bank, over the course of the last thirteen years. It also shows the effect such policy has had on the price of gold.

The only question we have is: Are we ready for the summit in precious metals’ prices?