As a break from our continued attention to the banking sector and the financial stress that persists around the globe we’d like to offer some thoughts on more general economic activity occurring at present, but which demonstrates the seeds of a new international economic and political structure.

Revealed in an article in Foreign Policy earlier this month were some major needed developments for Chinese energy needs. Chinese national companies secured pipeline access to Turkmenistan’s vast reserves of natural gas near the hotly contested Caspian Sea. Both Russian and Western energy companies have had trouble gaining rights in the region as a whole and specifically with Turkmenistan. As the Wall St. Journal reported, China has become the world’s greatest energy consumer and with its rapid growth rate, industrial needs, and thirst for electricity expansion, securing access to energy is a chief priority.

While China’s activities in Turkmenistan and Central Asia as whole will not go without difficulties, this event is an example of the shifting sands of global power. Geopolitical history demonstrates that a systemic shift in the political-economic order catalyzes the rise of new powers in both economic and military forms. However, historically speaking those powers (Ottoman, Spanish, Russian, Austro-Hungarian, Britain, U.S) need to be tested before they become spring boards of reserve status. Thus among other reasons, our call that the Chinese will have to experience a major crisis prior to resuming reserve global power status. The financial crisis was such a shift, striking a blow at the priorities and leverage of the U.S. and Europe.

The rising power of the BRIC countries (Brazil, Russia, India, and China) as well as others like Turkey and Indonesia places new priorities and agendas at the forefront of the world’s meeting room. These emerging powers benefited from the Bretton Woods liberalization scheme, but used such institutions to open their own doors, and construct their own paths to development. As a result, this group has accumulated vast reserves of assets or a variety of asset classes. Moreover, these particular economies often identify with the concerns and wishes of other parts of the developing world on issues of trade, finance, poverty, infrastructure and governance. Turkey is becoming a greater voice of the Muslim world; Brazil looks out for South America; Indonesia has the respect of Southeast Asia. In Parag Khanna’s battle for what he calls the “Second World,” (those countries who are not giants like the EU, China and US but also not poverty stricken like Zimbabwe and Ethiopia) the class of emerging economies are becoming a force to be reckoned with due to their diplomatic relations that have secured them hard assets in countries like Turkmenistan or the Caspian Sea region. These hard assets will serve as the foundation for new international structures. At this point we need to emphasize the claim that we made a few years ago in public lectures, that is that the Caspian Sea possibly has more combined oil and gas reserves than the Middle East.

An article in the New York Times on Friday July 23 titled “Awash in Oil, Awaiting a Pipeline” was very relevant to those claims. Sleeping assets are abundant in Central Asia and particularly around the Caspian Sea. The pipelines that will carry oil and gas are major assets for both the private and the public sector, and controlling those sleeping assets in that region – as well as in the Black Sea transportation region (see map below) – will hold the key for growth, profits, reserve status, and power in the years to come. Awaking sleeping assets is the key to collateralization and the resurgence of securitization that advances liquidity and lending so that the arteries of the global financial system could be unclogged. Russia positions herself as the big player and stands ready to gain from a Chinese crisis.

Almost a year ago Daniel Yergin, the esteemed author of The Prize, considered by most to be the book on the history of oil, wrote an article in Foreign Policy magazine about the short-term need for oil as an energy source. While the article emphasized the logistics of the oil industry Yergin revealed an important consideration about oil, but which can be applied to the majority of natural endowments: their role as a financial asset and a driver of financial activity and the banking industry. Thus, we need to come to a synthesis of the above ideas.

While the U.S. was on a consumption binge of fast food/finance these aforementioned countries built up their economic health through the vitamins of hard assets. Their diplomatic and economic policies strengthened relations with the powers of the developed world, built ties with other parts of the developing world, and gained access to the hard assets to meet their consumptive demands. These hard assets strengthened the industrial capacity of emerging markets but also provided pillars upon which it could energize and lay a foundation for financial activity. Attaining the rights to these assets propels emerging markets into both a higher level of development but also a greater voice at the geopolitical table.

When the bubble in the U.S. and Europe popped, the global economic system was in disarray. What followed was a shift in power, a transfer of wealth and leverage will continue to manifest itself in a new era of global ideas and priorities. As we mentioned in our July 2009 newsletter, the damage to Western economies has afforded these emerging giants the prospects of developing capital markets that are much more sophisticated and liquid. We also anticipate domestic bond markets to be born that will further develop these economies. The Economist’s Intelligence Unit reported earlier this week that Russia is moving forward to make Moscow a global financial center, which we also noted a couple of issues back. China, along with others, has called for a new international reserve system. India and Turkey are turning to Russia for energy needs as opposed to Western companies.

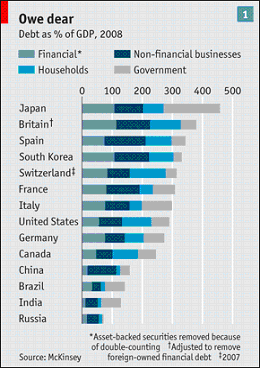

Forecasting this sort of economic and political future is usually an exercise in futility. However, the depth and reach of this financial crisis signifies a line crossed that we cannot go back to. The challenge for the United States is one of its external identity, how it wants to be regarded and what it wants to be responsible for in this coming age. The debt (both financial and non-financial) primarily of the private sector – as opposed to the public sector – was and continues to be one of the most destabilizing factors in the West that could wash away any sense of security and stability, as the following figure shows.

Securing a viable pipeline of hard assets that become the solid foundations of growth, financial and employment stability is a dilemma of titanic proportions in its own right, let alone the difficulties that remain here at home. Yet the United States would never be where it is if it regarded itself as vacuum; we experimented with that for far too long earlier this century and we know what happened with that. It financed, inflated and stretched an unsustainable balloon, one whose damage we are still trying to sort out.

It’s time to pour more concrete for the foundations of our economic structure.

The Majestic Ride of Sleeping Assets

Author : John E. Charalambakis

Date : July 26, 2010

As a break from our continued attention to the banking sector and the financial stress that persists around the globe we’d like to offer some thoughts on more general economic activity occurring at present, but which demonstrates the seeds of a new international economic and political structure.

Revealed in an article in Foreign Policy earlier this month were some major needed developments for Chinese energy needs. Chinese national companies secured pipeline access to Turkmenistan’s vast reserves of natural gas near the hotly contested Caspian Sea. Both Russian and Western energy companies have had trouble gaining rights in the region as a whole and specifically with Turkmenistan. As the Wall St. Journal reported, China has become the world’s greatest energy consumer and with its rapid growth rate, industrial needs, and thirst for electricity expansion, securing access to energy is a chief priority.

While China’s activities in Turkmenistan and Central Asia as whole will not go without difficulties, this event is an example of the shifting sands of global power. Geopolitical history demonstrates that a systemic shift in the political-economic order catalyzes the rise of new powers in both economic and military forms. However, historically speaking those powers (Ottoman, Spanish, Russian, Austro-Hungarian, Britain, U.S) need to be tested before they become spring boards of reserve status. Thus among other reasons, our call that the Chinese will have to experience a major crisis prior to resuming reserve global power status. The financial crisis was such a shift, striking a blow at the priorities and leverage of the U.S. and Europe.

The rising power of the BRIC countries (Brazil, Russia, India, and China) as well as others like Turkey and Indonesia places new priorities and agendas at the forefront of the world’s meeting room. These emerging powers benefited from the Bretton Woods liberalization scheme, but used such institutions to open their own doors, and construct their own paths to development. As a result, this group has accumulated vast reserves of assets or a variety of asset classes. Moreover, these particular economies often identify with the concerns and wishes of other parts of the developing world on issues of trade, finance, poverty, infrastructure and governance. Turkey is becoming a greater voice of the Muslim world; Brazil looks out for South America; Indonesia has the respect of Southeast Asia. In Parag Khanna’s battle for what he calls the “Second World,” (those countries who are not giants like the EU, China and US but also not poverty stricken like Zimbabwe and Ethiopia) the class of emerging economies are becoming a force to be reckoned with due to their diplomatic relations that have secured them hard assets in countries like Turkmenistan or the Caspian Sea region. These hard assets will serve as the foundation for new international structures. At this point we need to emphasize the claim that we made a few years ago in public lectures, that is that the Caspian Sea possibly has more combined oil and gas reserves than the Middle East.

An article in the New York Times on Friday July 23 titled “Awash in Oil, Awaiting a Pipeline” was very relevant to those claims. Sleeping assets are abundant in Central Asia and particularly around the Caspian Sea. The pipelines that will carry oil and gas are major assets for both the private and the public sector, and controlling those sleeping assets in that region – as well as in the Black Sea transportation region (see map below) – will hold the key for growth, profits, reserve status, and power in the years to come. Awaking sleeping assets is the key to collateralization and the resurgence of securitization that advances liquidity and lending so that the arteries of the global financial system could be unclogged. Russia positions herself as the big player and stands ready to gain from a Chinese crisis.

Almost a year ago Daniel Yergin, the esteemed author of The Prize, considered by most to be the book on the history of oil, wrote an article in Foreign Policy magazine about the short-term need for oil as an energy source. While the article emphasized the logistics of the oil industry Yergin revealed an important consideration about oil, but which can be applied to the majority of natural endowments: their role as a financial asset and a driver of financial activity and the banking industry. Thus, we need to come to a synthesis of the above ideas.

While the U.S. was on a consumption binge of fast food/finance these aforementioned countries built up their economic health through the vitamins of hard assets. Their diplomatic and economic policies strengthened relations with the powers of the developed world, built ties with other parts of the developing world, and gained access to the hard assets to meet their consumptive demands. These hard assets strengthened the industrial capacity of emerging markets but also provided pillars upon which it could energize and lay a foundation for financial activity. Attaining the rights to these assets propels emerging markets into both a higher level of development but also a greater voice at the geopolitical table.

When the bubble in the U.S. and Europe popped, the global economic system was in disarray. What followed was a shift in power, a transfer of wealth and leverage will continue to manifest itself in a new era of global ideas and priorities. As we mentioned in our July 2009 newsletter, the damage to Western economies has afforded these emerging giants the prospects of developing capital markets that are much more sophisticated and liquid. We also anticipate domestic bond markets to be born that will further develop these economies. The Economist’s Intelligence Unit reported earlier this week that Russia is moving forward to make Moscow a global financial center, which we also noted a couple of issues back. China, along with others, has called for a new international reserve system. India and Turkey are turning to Russia for energy needs as opposed to Western companies.

Forecasting this sort of economic and political future is usually an exercise in futility. However, the depth and reach of this financial crisis signifies a line crossed that we cannot go back to. The challenge for the United States is one of its external identity, how it wants to be regarded and what it wants to be responsible for in this coming age. The debt (both financial and non-financial) primarily of the private sector – as opposed to the public sector – was and continues to be one of the most destabilizing factors in the West that could wash away any sense of security and stability, as the following figure shows.

Securing a viable pipeline of hard assets that become the solid foundations of growth, financial and employment stability is a dilemma of titanic proportions in its own right, let alone the difficulties that remain here at home. Yet the United States would never be where it is if it regarded itself as vacuum; we experimented with that for far too long earlier this century and we know what happened with that. It financed, inflated and stretched an unsustainable balloon, one whose damage we are still trying to sort out.

It’s time to pour more concrete for the foundations of our economic structure.