In the last few days the markets tried to breathe a breath of new life and optimism in the midst of developments in the EU and the initiatives taken by central banks.

It has been our position that the EU is suffering from two deadly problems, namely: cancer (public debt) and heart failure (bank financial debt). The former can lead to long or medium-term death. The latter to instant death. Let’s review the major events that took place, then highlight what we consider to be the most important and vital steps taken, and finally close with an introductory assessment of what we expect in 2012.

- The EU summit agreed on measures that advance fiscal discipline among its members, and specifically they agreed to limit their structural deficits (those that exclude the effects of the business cycle) to 0.5% of their respective GDP, and their cyclical deficits to 3% of their GDP. In addition, they agreed on passing constitutional amendments that limit deficits, and automatic penalties and enforcements if country-members violate those deficit limits.

- In a move that compromises national sovereignty, they also agreed that officials in Brussels, will have veto power over national budgets, while Euro-bureaucrats will be able to implement special measures on countries that violate deficit and debt reduction limits.

- The permanent bailout mechanism known as European Stability Mechanism (ESM) – which will replace the EFSF – will start a year earlier, in June 2012, with a firepower of €500 billion.

- EU-member countries’ central banks will advance €200 billion to the IMF, which in turn can use it as its discretion for bailout and bond purchases purposes.

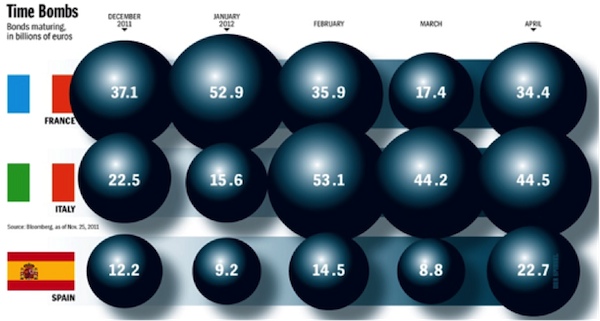

We are of the opinion that the above measures are necessary but not sufficient for the impending Euro-crisis, which is primarily a private debt crisis (bank-originated via unsecured instruments that they circulated). Hence, they address some of the cancerous problems but do nothing for the immediate problem which is heart failure a.k.a. bank failure and collapse of the credit system. The graph below shows the public face of the crisis, which now is thought to be addressed via making the markets to believe that measures taken put the EU-house in order for the purpose of refinancing those public debts.

Now, let’s review the actions taken by the central banks.

- The six central banks of the US, EU, Switzerland, UK, Canada, and Japan agreed to extend swap lines and relieve the pressures that EU banks were facing in terms of dollar shortages, especially given the maturities of financial instruments denominated in USD. At the same time, they reduced the rate at which they can borrow from the Fed, making it cheaper for EU banks to borrow from the Fed than US banks. It has been our claim that these swap lines and the possible repatriation of EU funds back into the Euro-zone are sustaining the value of the Euro, which otherwise, should have depreciated by at least another 15%, given the shaky fundamentals in the Euro-zone.

- Let’s not pretend that these swap lines, are just temporary loans. We claim that to a large extent they are a form of quantitative easing, that provides liquidity and possibly can save major EU banks, while keeps the dollars away from the US (and hence the fear of inflation is removed), and in the scheme of things advances US international interests including exports.

- Once the above lines were in place, the president of the ECB, Mr. Draghi, announced before even the Euro-summit started, that the ECB has decided three things: Namely, to reduce the interbank rate by 25 bps; to extend unlimited funding to EU banks for 36 and not 13 months; and to widen the collateral base of assets that ECB can accept against loans to EU banks.

With all due respect to the EU leaders, the above measures were the ones that will possibly avert the heart failure and save the patient now, so that the cancer problems could be addressed later via measures agreed by the EU leaders. The ECB having the backup of the Fed (the unsecured paper that EU banks have circulated is denominated in USD), has unlimited USD funding (private money market funds do not trust EU banks and have mostly frozen their credit lines to them), and now has declared “come you thou have toxic assets, and find comfort under my wings. You shall rest assured that I shall bear your burden and take it upon me and in my balance sheet”.

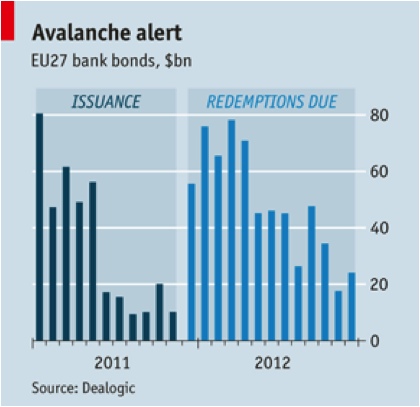

The graph below shows two things: First, that the bank-issued unsecured debt in the EU has declined substantially, and second, it shows the magnitude of the financial debt issued by EU banks which needs immediate refinancing in the next few months.

The lowering of the standards by the ECB and the assurance of the Fed that it will backup the ECB with swap lines, postpones the problem of instant death due to banking collapse/heart failure, it buys time, but does not address the issues of limited – if any – growth, joblessness, business liquidity, and capital formation in the EU. However, it does address – at least partially – the banking issue, and hence, establishes a safety net for banks (or at least for the majority of them). Of course, banks would need to raise additional capital, continue deleveraging, keep selling assets and unloading toxic ones (partially to the ECB via the new credit facilities for three years and the lowering of standards), reduce lending (hence Eastern Europe’s reduced credit lines), and generally increase tightening which makes austerity even harder.

We do not expect the increased liquidity (via the central banks’ lines) to leak into the marketplace. It will remain electronic entries into the central and commercial/investment banks’ books, and hence there is no fear of uncontrolled inflation. Of course, it is of major concern that growth, income, and employment issues are not addressed, and that more austerity measures will emerge in the horizon.

However, all those central bank measures are forms of quantitative easing, and thus in the medium and long term they are but a bullish sign for hard assets and precious metals. The latter may experience some downward pressure temporarily due to liquidity squeeze, but ultimately should benefit.

At the same time, EU banks are using complex maneuvers that improve their balance sheets and capital levels. Specifically, they use liability management techniques by buying back (or exchanging) hybrid securities- such as convertible bonds – at a discount. Then, they book the difference as a profit. While this scheme improves the capital ratios, it drains the banks from liquidity, and if for some reason something goes wrong in the swap lines or the lowering of ECB’s standards, then those major EU banks will face Hades.

In conclusion, we believe that while the US will be experiencing moderate growth in 2012 (which may actually be above expectations), it will be a safe haven attracting capital, with good chances for single digit returns in the equities market. The EU will suffer from recession, but if proper measures are taken especially in the area of common Treasury Department (ministry of Finance responsible for Euro-bonds), and the ECB starts acting more like a lender of last resort (by expanding its announced form of buying the toxic assets of EU banks and including more purchases of government bonds), then we would not be surprised if the Euro-wide equities market turns positive for the EU too.

In the meantime, we look into what we believe will be the interim main form of energy (between the petro and the renewable era), and will be reporting on it in our January-February newsletter.

Allow us to say again, ode to hard assets and to arks, but woe to snakes!

The Incubation of a Crisis: Dum Spiro Spero in the Life of Swap Lines and Hybrid Accounting

Author : John E. Charalambakis

Date : December 12, 2011

In the last few days the markets tried to breathe a breath of new life and optimism in the midst of developments in the EU and the initiatives taken by central banks.

It has been our position that the EU is suffering from two deadly problems, namely: cancer (public debt) and heart failure (bank financial debt). The former can lead to long or medium-term death. The latter to instant death. Let’s review the major events that took place, then highlight what we consider to be the most important and vital steps taken, and finally close with an introductory assessment of what we expect in 2012.

We are of the opinion that the above measures are necessary but not sufficient for the impending Euro-crisis, which is primarily a private debt crisis (bank-originated via unsecured instruments that they circulated). Hence, they address some of the cancerous problems but do nothing for the immediate problem which is heart failure a.k.a. bank failure and collapse of the credit system. The graph below shows the public face of the crisis, which now is thought to be addressed via making the markets to believe that measures taken put the EU-house in order for the purpose of refinancing those public debts.

Now, let’s review the actions taken by the central banks.

With all due respect to the EU leaders, the above measures were the ones that will possibly avert the heart failure and save the patient now, so that the cancer problems could be addressed later via measures agreed by the EU leaders. The ECB having the backup of the Fed (the unsecured paper that EU banks have circulated is denominated in USD), has unlimited USD funding (private money market funds do not trust EU banks and have mostly frozen their credit lines to them), and now has declared “come you thou have toxic assets, and find comfort under my wings. You shall rest assured that I shall bear your burden and take it upon me and in my balance sheet”.

The graph below shows two things: First, that the bank-issued unsecured debt in the EU has declined substantially, and second, it shows the magnitude of the financial debt issued by EU banks which needs immediate refinancing in the next few months.

The lowering of the standards by the ECB and the assurance of the Fed that it will backup the ECB with swap lines, postpones the problem of instant death due to banking collapse/heart failure, it buys time, but does not address the issues of limited – if any – growth, joblessness, business liquidity, and capital formation in the EU. However, it does address – at least partially – the banking issue, and hence, establishes a safety net for banks (or at least for the majority of them). Of course, banks would need to raise additional capital, continue deleveraging, keep selling assets and unloading toxic ones (partially to the ECB via the new credit facilities for three years and the lowering of standards), reduce lending (hence Eastern Europe’s reduced credit lines), and generally increase tightening which makes austerity even harder.

We do not expect the increased liquidity (via the central banks’ lines) to leak into the marketplace. It will remain electronic entries into the central and commercial/investment banks’ books, and hence there is no fear of uncontrolled inflation. Of course, it is of major concern that growth, income, and employment issues are not addressed, and that more austerity measures will emerge in the horizon.

However, all those central bank measures are forms of quantitative easing, and thus in the medium and long term they are but a bullish sign for hard assets and precious metals. The latter may experience some downward pressure temporarily due to liquidity squeeze, but ultimately should benefit.

At the same time, EU banks are using complex maneuvers that improve their balance sheets and capital levels. Specifically, they use liability management techniques by buying back (or exchanging) hybrid securities- such as convertible bonds – at a discount. Then, they book the difference as a profit. While this scheme improves the capital ratios, it drains the banks from liquidity, and if for some reason something goes wrong in the swap lines or the lowering of ECB’s standards, then those major EU banks will face Hades.

In conclusion, we believe that while the US will be experiencing moderate growth in 2012 (which may actually be above expectations), it will be a safe haven attracting capital, with good chances for single digit returns in the equities market. The EU will suffer from recession, but if proper measures are taken especially in the area of common Treasury Department (ministry of Finance responsible for Euro-bonds), and the ECB starts acting more like a lender of last resort (by expanding its announced form of buying the toxic assets of EU banks and including more purchases of government bonds), then we would not be surprised if the Euro-wide equities market turns positive for the EU too.

In the meantime, we look into what we believe will be the interim main form of energy (between the petro and the renewable era), and will be reporting on it in our January-February newsletter.

Allow us to say again, ode to hard assets and to arks, but woe to snakes!