Over the course of the last few weeks equity markets has felt shocks, with the German DAX index dropping by more than 10% signifying correction territory. As we explained last week, a combination of consolidation/maturity issues (talk of mini-correction), geopolitical conflicts (Middle East, Ukraine), and some economic news (earnings, rise in expectations of an earlier than expected increase in interest rates, housing prices, and less than expected employment growth) put a brake on market dynamics, making the groom to extend his wait at the altar.

However, we believe that the last four months of the year have the potential of not only demonstrating decent returns that will make up for the previous eight months, but also setting up the stage for decent returns in 2015, at least for the US. The reasons for such optimism – among others – are:

- Strengthening demand for business loans

- Strengthening demand for mortgages

- An increase in the number of banks reporting stronger lending activity

- Upward trends in manufacturing and service activity which point to a GDP growth for the third quarter of at least 3%

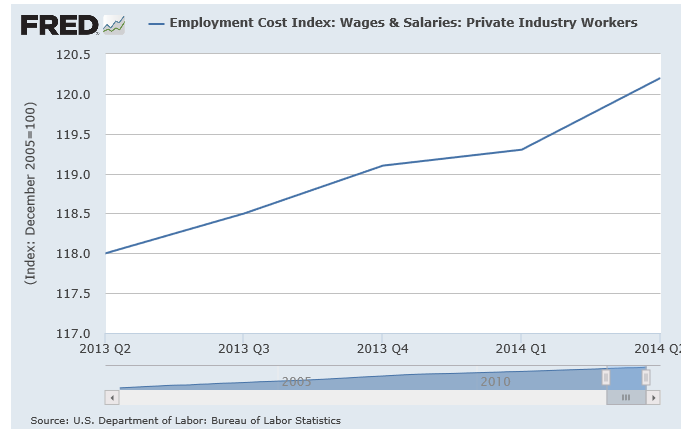

- Pickup in employment cost, that deflates talks on deflationary pressures

Let’s look then, at some of the macro-factors which in turn will set the micro-foundations for equities growth in the medium term, absent a major geopolitical earthquake.

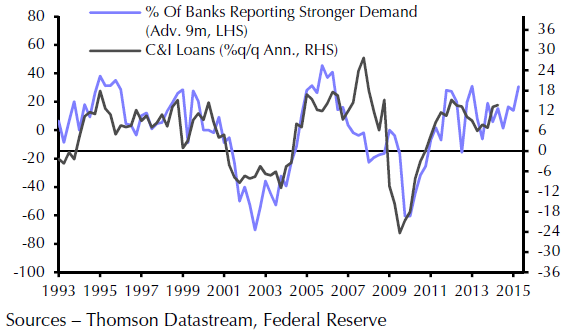

As the first graph below demonstrates both the demand for business loans and the actual business loans are on the rise. Rising lending activity will advance output, employment, and the bottom line, boosting earnings and thus providing a basis for higher stock prices.

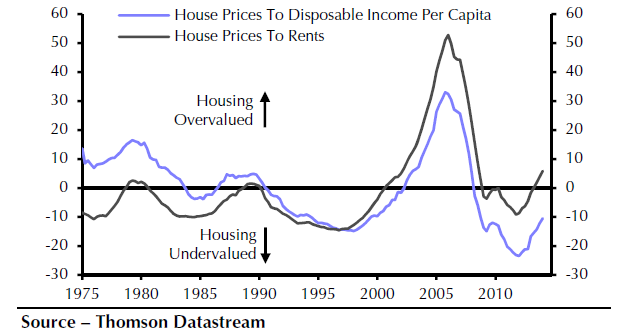

While there has been stagnation recently in housing prices, homes are still undervalued relative to incomes as shown below, and therefore given their inventory levels, we expect that the overall positive economic environment will boost housing prices about 5-6% annually for the foreseeable future.

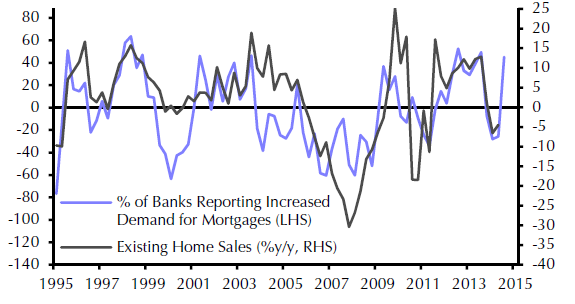

The fact is that not only are houses still undervalued relative to incomes, but also demand for mortgages is strengthening – as shown below – which in turn signifies an overall pickup in economic activity.

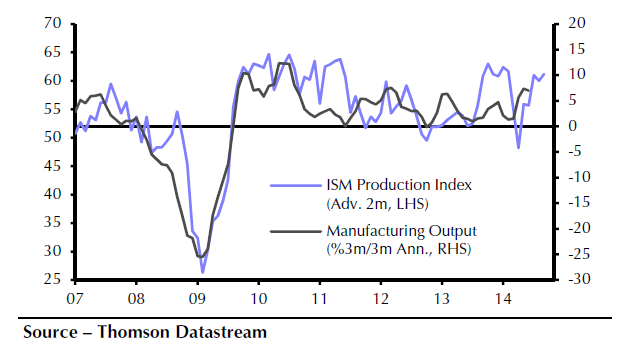

Manufacturing output as measured by both the ISM index as well as by Markit surveys is rising, (see graph below) which signifies output increases at healthy paces. That in turn will improve incomes, spending, as well as consumer confidence, which in turn may benefit consumer cyclical and discretionary companies. The fact also that the non-manufacturing index reached an eight-year high in July points to an overall good and upward trending economic trajectory which could be sustained by the liquidity provided by the banking sector.

Also, and as we pointed out last week, the healthy pace by which the employment cost is rising over the course of the last year, and as demonstrated below, is a good indicator that wage income is on an upward trajectory which in turn points out that consumption spending is sustainable and probably would rise.

All the above suggest that the groom is right waiting at the altar of higher equities’ return.

The Groom Still Waiting at the Altar: The Medium-Term Brightening of the Economic Outlook

Author : John E. Charalambakis

Date : August 10, 2014

Over the course of the last few weeks equity markets has felt shocks, with the German DAX index dropping by more than 10% signifying correction territory. As we explained last week, a combination of consolidation/maturity issues (talk of mini-correction), geopolitical conflicts (Middle East, Ukraine), and some economic news (earnings, rise in expectations of an earlier than expected increase in interest rates, housing prices, and less than expected employment growth) put a brake on market dynamics, making the groom to extend his wait at the altar.

However, we believe that the last four months of the year have the potential of not only demonstrating decent returns that will make up for the previous eight months, but also setting up the stage for decent returns in 2015, at least for the US. The reasons for such optimism – among others – are:

Let’s look then, at some of the macro-factors which in turn will set the micro-foundations for equities growth in the medium term, absent a major geopolitical earthquake.

As the first graph below demonstrates both the demand for business loans and the actual business loans are on the rise. Rising lending activity will advance output, employment, and the bottom line, boosting earnings and thus providing a basis for higher stock prices.

While there has been stagnation recently in housing prices, homes are still undervalued relative to incomes as shown below, and therefore given their inventory levels, we expect that the overall positive economic environment will boost housing prices about 5-6% annually for the foreseeable future.

The fact is that not only are houses still undervalued relative to incomes, but also demand for mortgages is strengthening – as shown below – which in turn signifies an overall pickup in economic activity.

Manufacturing output as measured by both the ISM index as well as by Markit surveys is rising, (see graph below) which signifies output increases at healthy paces. That in turn will improve incomes, spending, as well as consumer confidence, which in turn may benefit consumer cyclical and discretionary companies. The fact also that the non-manufacturing index reached an eight-year high in July points to an overall good and upward trending economic trajectory which could be sustained by the liquidity provided by the banking sector.

Also, and as we pointed out last week, the healthy pace by which the employment cost is rising over the course of the last year, and as demonstrated below, is a good indicator that wage income is on an upward trajectory which in turn points out that consumption spending is sustainable and probably would rise.

All the above suggest that the groom is right waiting at the altar of higher equities’ return.