It has been almost three years now since the rumors started that something was rotten with the Greek public finances. Excesses have been documented. Wasteful expenditures, inefficiencies, and corrupt practices have also been documented and dominated the news. There is no doubt that the Greek state needs major reformation, restructuring, and restoration not only on its methods and practices, but also in its thinking, planning, and execution.

However, like we have previously written that we cannot blame the subprime mortgages for the financial collapse that took place in the US in 2008, we cannot similarly blame Greece for the upcoming collapse of the EU. In the case of the 2008 financial collapse, the number of subprime borrowers represented too small of a percentage to cause the collapse of the financial system. The system collapsed due to the enormous value of derivatives and other toxic “assets”. The former were well in excess of $700 trillion, while the securitization of worthless paper exacerbated this tower of credit. The foundation of this tower was designed for a structure of ten floors but the architects kept adding floors to the structure. Before long the occupants of the penthouse on the fiftieth floor were admiring the view, oblivious to the impending collapse when the first storm hit! The tower of credit was destined for collapse – as it will again. It was and is an accident waiting to happen.

Similarly, the EU banks have collateralized “assets” that in some instances are not worth the paper they are printed on. Then, they pooled the credit extensions into “investment-grade” securities and sold the bonds to fools who thought that they could find greater fools to buy the bonds at a premium. That game of musical chairs has now ended, and if it had not been for the Fed that feeding the ECB with liquidity and the latter’s cash infusions into EU banks, the banking system in the EU would have collapsed.

The truth of the matter is that Germany would have collapsed if it were not for the US Fed that bailed out its major banks in 2008. There is little doubt that when a developed country’s financial system collapses, the country collapses soon thereafter. That would have been the outcome for Germany during the 2008 financial collapse if the US Fed had not intervened.

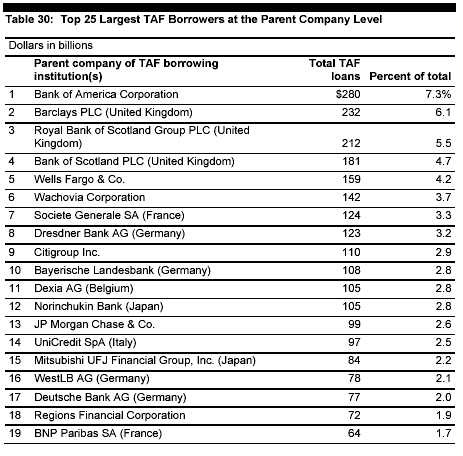

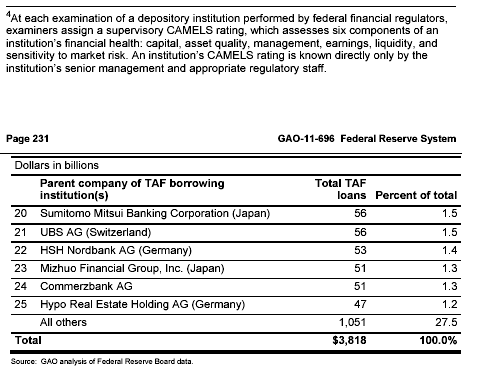

The table below is taken from the GAO (the US Government Accountability Office) that conducted an audit of the great bailouts during the 2008-’09 period. Let’s review this table.

Here are some interesting observations derived from the table above: First, there are seven German financial institutions that were bailed out. Second, among those that were bailed out we find that the most prominent German banks are included, such as Deutsche Bank. Third, the amounts involved are large by any standard. Fourth, if it were not for the US Fed to bail out those German financial institutions, they would have gone bankrupt, which meant that Germany and the whole EU region would have fallen into a depression. Last time I checked the US was not a member of the EU nor had any fiduciary responsibility to bail out Germany!

Let’s see the actual numbers: On the page above the reader can verify that Dresdner got $123 billion, Bayerische $108 billion, West LB $78 billion, Deutsche Bank got $77 billion, HSH $53 billion, Commerzbank received $51 billion, while Hypo got $47 billion, for a grand total of $531 billion.

Were the German banks’ finances in order? Were those banks solvent? Could they have survived the financial tsunami without the US bailout? Would they be alive today if it were not for us in the US to bail them out? Could they boast and dictate today their will throughout the EU without the US assistance that kept them alive?

The $531 billion is taken out from only one section of the GAO’s audit. Needless to say that the amount involved seems to be much larger. This whole story of trying to find the ultimate scapegoat to blame the upcoming collapse in the EU – due to banks manipulations and practices – remind me of JoyBell’s saying:

“The difference between my darkness and your darkness is that I can look at my own badness in the face and accept its existence while you are busy covering your mirror with a white linen sheet. The difference between my sins and your sins is that when I sin I know I’m sinning while you have actually fallen prey to your own fabricated illusions. I am a siren, a mermaid; I know that I am beautiful while basking on the ocean’s waves and I know that I can eat flesh and bones at the bottom of the sea. You are a white witch, a wizard; your spells are manipulations and your cauldron from hell yet you wrap yourself in white and wear a silver wig.”

The Great Bailout of Germany

Author : John E. Charalambakis

Date : August 26, 2012

It has been almost three years now since the rumors started that something was rotten with the Greek public finances. Excesses have been documented. Wasteful expenditures, inefficiencies, and corrupt practices have also been documented and dominated the news. There is no doubt that the Greek state needs major reformation, restructuring, and restoration not only on its methods and practices, but also in its thinking, planning, and execution.

However, like we have previously written that we cannot blame the subprime mortgages for the financial collapse that took place in the US in 2008, we cannot similarly blame Greece for the upcoming collapse of the EU. In the case of the 2008 financial collapse, the number of subprime borrowers represented too small of a percentage to cause the collapse of the financial system. The system collapsed due to the enormous value of derivatives and other toxic “assets”. The former were well in excess of $700 trillion, while the securitization of worthless paper exacerbated this tower of credit. The foundation of this tower was designed for a structure of ten floors but the architects kept adding floors to the structure. Before long the occupants of the penthouse on the fiftieth floor were admiring the view, oblivious to the impending collapse when the first storm hit! The tower of credit was destined for collapse – as it will again. It was and is an accident waiting to happen.

Similarly, the EU banks have collateralized “assets” that in some instances are not worth the paper they are printed on. Then, they pooled the credit extensions into “investment-grade” securities and sold the bonds to fools who thought that they could find greater fools to buy the bonds at a premium. That game of musical chairs has now ended, and if it had not been for the Fed that feeding the ECB with liquidity and the latter’s cash infusions into EU banks, the banking system in the EU would have collapsed.

The truth of the matter is that Germany would have collapsed if it were not for the US Fed that bailed out its major banks in 2008. There is little doubt that when a developed country’s financial system collapses, the country collapses soon thereafter. That would have been the outcome for Germany during the 2008 financial collapse if the US Fed had not intervened.

The table below is taken from the GAO (the US Government Accountability Office) that conducted an audit of the great bailouts during the 2008-’09 period. Let’s review this table.

Here are some interesting observations derived from the table above: First, there are seven German financial institutions that were bailed out. Second, among those that were bailed out we find that the most prominent German banks are included, such as Deutsche Bank. Third, the amounts involved are large by any standard. Fourth, if it were not for the US Fed to bail out those German financial institutions, they would have gone bankrupt, which meant that Germany and the whole EU region would have fallen into a depression. Last time I checked the US was not a member of the EU nor had any fiduciary responsibility to bail out Germany!

Let’s see the actual numbers: On the page above the reader can verify that Dresdner got $123 billion, Bayerische $108 billion, West LB $78 billion, Deutsche Bank got $77 billion, HSH $53 billion, Commerzbank received $51 billion, while Hypo got $47 billion, for a grand total of $531 billion.

Were the German banks’ finances in order? Were those banks solvent? Could they have survived the financial tsunami without the US bailout? Would they be alive today if it were not for us in the US to bail them out? Could they boast and dictate today their will throughout the EU without the US assistance that kept them alive?

The $531 billion is taken out from only one section of the GAO’s audit. Needless to say that the amount involved seems to be much larger. This whole story of trying to find the ultimate scapegoat to blame the upcoming collapse in the EU – due to banks manipulations and practices – remind me of JoyBell’s saying:

“The difference between my darkness and your darkness is that I can look at my own badness in the face and accept its existence while you are busy covering your mirror with a white linen sheet. The difference between my sins and your sins is that when I sin I know I’m sinning while you have actually fallen prey to your own fabricated illusions. I am a siren, a mermaid; I know that I am beautiful while basking on the ocean’s waves and I know that I can eat flesh and bones at the bottom of the sea. You are a white witch, a wizard; your spells are manipulations and your cauldron from hell yet you wrap yourself in white and wear a silver wig.”