A few days ago Jose Manuel Barroso (President of the European Commission) declared that austerity has its limits. The Eureka moment which says that you cannot add by subtracting finally arrived in the EU. When Archimedes proclaimed the “Eureka” moment he run with excitement in the streets of Syracuse. I doubt that we could expect something similar by the leadership of the EU. Archimedes’ discovery (among so many of the most famous scientist of the Antiquity) was important because it allowed measurements of an object’s density and thus its purity. The displacement of water that Archimedes observed was related to the volume of the part that he submerged into the water.

The latest tragic developments in Cyprus signify a trajectory painted with bleak colors. We expect Cyprus to fall into a depression within a year and to leave the Euro zone within 20 months. The expected Cypriot displacement will crack the glass and make the heavyweights liable for the impending damages. The subordinate positions of the southern peripheral states will be worsening by the heaviness of a currency that they cannot control and to which they are indebted to. The fact that they have forsaken in the process a good part of their sovereignty makes things worse.

By all measures it seems that mutualization of risk and a true banking union is out of the question for the EU (which measures by themselves would have just postponed the inevitable), and thus the imposition of the austerity programs will displace some and make the whole structure even more unstable. In that case – and as we wrote last November in our Newsletter – not even Germany could afford the Euro. The problem is not just divergence in competitiveness. It goes much deeper and has to do with shaky balance sheets in the banking sector and too much debt that lacks a sound collateral foundation. The Fed cannot keep supporting the Euro zone banks via the swap lines to the ECB. The question is not whether the music will stop, but rather when will the music stop?

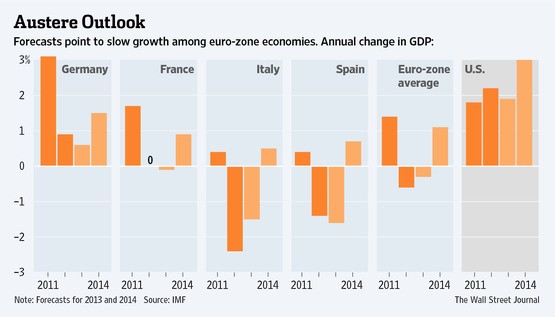

As I am drafting these lines, the Dow Jones is crossing the 15,000 mark for the first time. When we pay close attention to the sectors that have benefited the most in this rally (which we anticipated and wrote about at the end of last year), we see that it’s mostly about defensive sectors, such as healthcare, utilities, and consumer staples. On the contrary industrials, materials and energy have not participated as someone would have expected in this rally. What does that mean? Could it imply an impending fall? Or is it just a sign of sluggish growth prospects? For the foreseeable future we would say that it reflects the latter rather than the former, as the graph below portrays.

However, we would not be surprised if a correction between 4-6% takes place in the next 8-10 weeks. We anticipate that the more cyclical stocks will start participating in the rally for the rest of the year (mainly after the possible correction) and that the energy sector will also become a player (especially if action is taken against Syria). Therefore some portfolio hedging might be advisable at this stage.

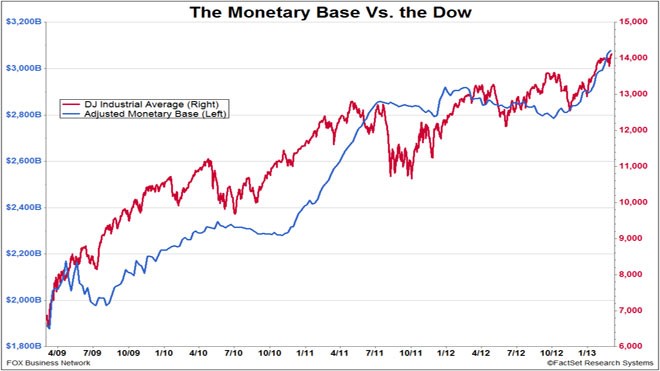

The message of fiscal consolidation in times of depression (how else could we characterize record levels of unemployment in the EU and also a 27% unemployment rate in Spain and Greece?) while the capital markets rally in most of the world, could point to a bifurcated reality. In that bifurcated reality we artificially sustain – using monetary means – the capital markets while we are searching for the deus ex machina to appear. For the time being and as the graph below shows, the 350% increase in the monetary base since late 2008, has been stimulating the market rally. The Japanese are trying to replicate the US experience.

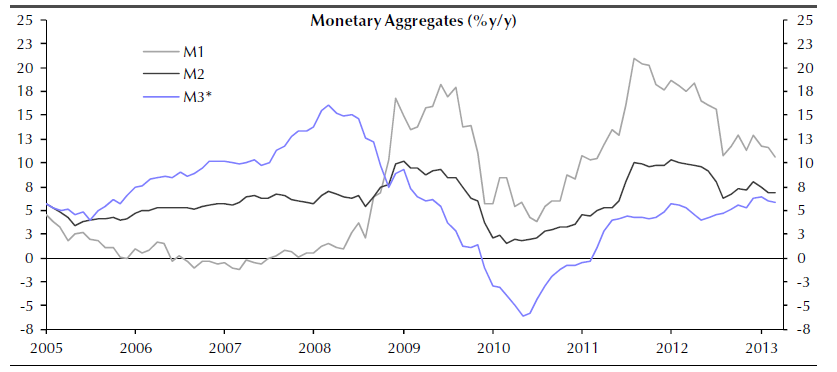

However, we believe that the growth rate of the broad monetary aggregates is slowing down, as the figure below portrays. Such slowdown in the M3 aggregate may reflect the first baby steps in stopping the subsidization of the ECB, as noted above (figures below were taken from Capital Economics Monetary Indicators Monitor).

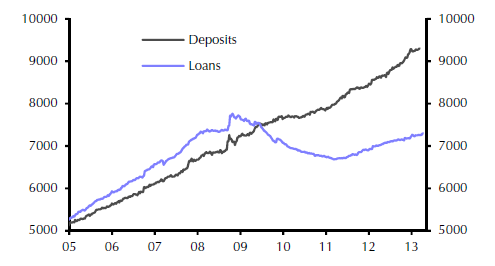

Our expectation that the markets may continue enjoying healthy returns in the foreseeable future lies in the fact that US banks’ cash positions are significantly higher than the outstanding value of their loans, as the graph below shows. The momentum created between US and Japanese monetary stimulus uplifts the rest of the markets.

As deposits rise, the banks’ reliance on short term borrowed funds drops, and thus their ability to increase lending is enhanced. Therefore, we anticipate that the hemorrhage in the so-called money multiplier (as shown below) will stop and hence the cyclical sectors may join the temporary rally in a similar fashion to the reversal observed in the cyclical sectors between 2003 and 2007.

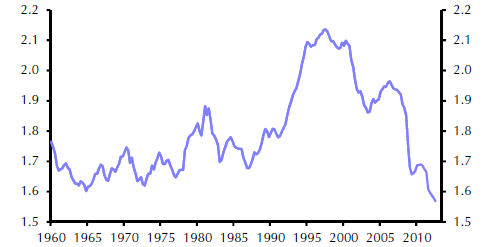

Money Velocity (M2) as a Percentage of GDP

How then should we conclude this commentary? Let’s recall the lyrics by the legendary Pink Floyd in their album titled “The Dark Side of the Moon”

All that is now

All that is gone

All that’s to come

and everything under the sun is in tune

but the sun is eclipsed by the moon.

The Eureka Moment of the EU, Market Cyclicality, and Monetary Aggregates: Approaching a Crossroad

Author : John E. Charalambakis

Date : May 3, 2013

A few days ago Jose Manuel Barroso (President of the European Commission) declared that austerity has its limits. The Eureka moment which says that you cannot add by subtracting finally arrived in the EU. When Archimedes proclaimed the “Eureka” moment he run with excitement in the streets of Syracuse. I doubt that we could expect something similar by the leadership of the EU. Archimedes’ discovery (among so many of the most famous scientist of the Antiquity) was important because it allowed measurements of an object’s density and thus its purity. The displacement of water that Archimedes observed was related to the volume of the part that he submerged into the water.

The latest tragic developments in Cyprus signify a trajectory painted with bleak colors. We expect Cyprus to fall into a depression within a year and to leave the Euro zone within 20 months. The expected Cypriot displacement will crack the glass and make the heavyweights liable for the impending damages. The subordinate positions of the southern peripheral states will be worsening by the heaviness of a currency that they cannot control and to which they are indebted to. The fact that they have forsaken in the process a good part of their sovereignty makes things worse.

By all measures it seems that mutualization of risk and a true banking union is out of the question for the EU (which measures by themselves would have just postponed the inevitable), and thus the imposition of the austerity programs will displace some and make the whole structure even more unstable. In that case – and as we wrote last November in our Newsletter – not even Germany could afford the Euro. The problem is not just divergence in competitiveness. It goes much deeper and has to do with shaky balance sheets in the banking sector and too much debt that lacks a sound collateral foundation. The Fed cannot keep supporting the Euro zone banks via the swap lines to the ECB. The question is not whether the music will stop, but rather when will the music stop?

As I am drafting these lines, the Dow Jones is crossing the 15,000 mark for the first time. When we pay close attention to the sectors that have benefited the most in this rally (which we anticipated and wrote about at the end of last year), we see that it’s mostly about defensive sectors, such as healthcare, utilities, and consumer staples. On the contrary industrials, materials and energy have not participated as someone would have expected in this rally. What does that mean? Could it imply an impending fall? Or is it just a sign of sluggish growth prospects? For the foreseeable future we would say that it reflects the latter rather than the former, as the graph below portrays.

However, we would not be surprised if a correction between 4-6% takes place in the next 8-10 weeks. We anticipate that the more cyclical stocks will start participating in the rally for the rest of the year (mainly after the possible correction) and that the energy sector will also become a player (especially if action is taken against Syria). Therefore some portfolio hedging might be advisable at this stage.

The message of fiscal consolidation in times of depression (how else could we characterize record levels of unemployment in the EU and also a 27% unemployment rate in Spain and Greece?) while the capital markets rally in most of the world, could point to a bifurcated reality. In that bifurcated reality we artificially sustain – using monetary means – the capital markets while we are searching for the deus ex machina to appear. For the time being and as the graph below shows, the 350% increase in the monetary base since late 2008, has been stimulating the market rally. The Japanese are trying to replicate the US experience.

However, we believe that the growth rate of the broad monetary aggregates is slowing down, as the figure below portrays. Such slowdown in the M3 aggregate may reflect the first baby steps in stopping the subsidization of the ECB, as noted above (figures below were taken from Capital Economics Monetary Indicators Monitor).

Our expectation that the markets may continue enjoying healthy returns in the foreseeable future lies in the fact that US banks’ cash positions are significantly higher than the outstanding value of their loans, as the graph below shows. The momentum created between US and Japanese monetary stimulus uplifts the rest of the markets.

As deposits rise, the banks’ reliance on short term borrowed funds drops, and thus their ability to increase lending is enhanced. Therefore, we anticipate that the hemorrhage in the so-called money multiplier (as shown below) will stop and hence the cyclical sectors may join the temporary rally in a similar fashion to the reversal observed in the cyclical sectors between 2003 and 2007.

Money Velocity (M2) as a Percentage of GDP

How then should we conclude this commentary? Let’s recall the lyrics by the legendary Pink Floyd in their album titled “The Dark Side of the Moon”

All that is now

All that is gone

All that’s to come

and everything under the sun is in tune

but the sun is eclipsed by the moon.