The events that shaped last week – and potentially the weeks and months, if not years to come – had both geoeconomics and geopolitical dimensions. In situations like these, the beneficiaries could be viewed as those who shape the path towards the ultimate outcome. Let’s briefly review what has taken place and what the implications are for investors.

Following ECB’s QE measures on September 6th, the Fed announced another round of QE. In our estimate this round could be as high as $1.8 trillion, especially when we consider that there is no definitive time limit ($40 billion per week until about the unemployment rate drops to about 6.7%, i.e. based on the current working model approximately 45 months, assuming that other current programs will be sterilized). We are of the opinion –as we wrote before – that central banks will coordinate QE measures targeting spreads and having as upper limit the percentage (35-40%?) of GDP that their balance sheets control. At the same time – and given its significant slowdown – China provided us with a prelude of further stimulus in order to accelerate its growth rate and avoid internal turmoil due to rising unemployment and exports’ decline. These two events wrap up the summary on the geoeconomic front.

On the geopolitical front we observed mobs attacking US Embassies, killing US officials, and creating chaotic situations, while Israel kept pushing for an attack on Iran. We believe that the majority of the people in the countries that experienced the attacks from those mobs favor the US. However weak governments and civil societies do not allow that majority to surface. The result is that those who have vested interests from such turmoil occupy the news and create upheavals. The greatest accomplishment of the Arab Spring is that the lead of fear in those countries is gone. It was unimaginable to revolt against the old regimes. Now, that the fear is gone the baby democracies will grow, but it takes time, effort, patience, energy, and collaboration from the West. The other major geopolitical development was the increased tone of confrontation between China and Japan regarding some disputed islands in the East China Sea. We believe that the threat of a major war in that area is real and could create significant tremors around the world.

It seems that some vested interests are pushing for war as the ultimate dues ex machina. They view their targets as Agamemnon viewed Troy. The problem was the Trojan War and everything about it was a lie and a deception. Achilles ended up dead. Odysseus wasted over ten years in order to return home, and Troy became a necropolis. Only the suitors after Odysseus’ estate had a good time! Even Agamemnon ended up dead upon return home. His wife had to take revenge for killing their beloved daughter Iphigenia in order to please the gods and get favorable sailing winds. (Let’s not forget that the sacrificial knife was made up of the finest gold). We have serious doubts if we should sail to Troy again.

What does all that mean for individual and institutional investors? We believe that QE measures buy time, but do not address the real issues of too much debt, inability to wake up dormant assets, and over-collateralization/securitization of toxic “assets”. In the best-case scenarios the central banks will have to take significant haircuts that will shake the foundations upon which they are built.

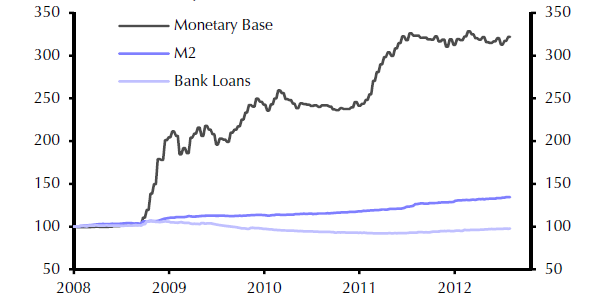

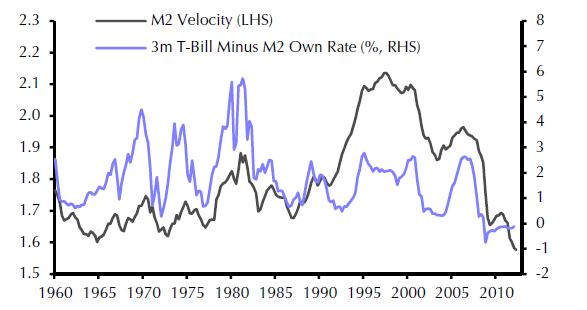

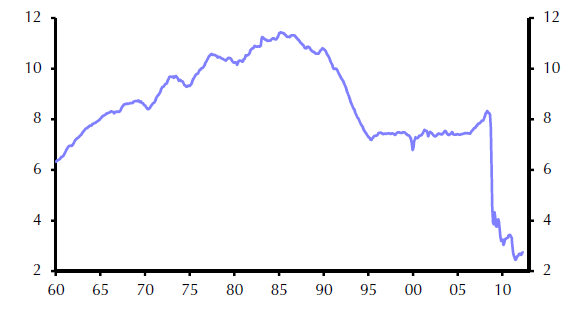

In the following three graphs we demonstrate why QE measures only have limited time effect and experience diminishing returns while distorting credit equilibrium. These three critical graphs show the impact of QE on monetary aggregates (data from Thomson Datastream, and Capital Economics). The first one shows that money supply falls far behind the growth in the monetary base. The result is that the velocity of money cannot support desired economic activity, as confirmed by the second graph (and hence the lack of inflationary pressures in basic goods). As money velocity drops, the money multiplier collapses (see third graph below), thus the fractional reserve system needs continuous shots of QEs in order to sustain an ephemeral monetary stability.

As investors start feeling the diminishing effects of QEs in the medium term, they will seek safe haven in assets that cannot be printed. It seems that the long term may not be the period when we will all be dead, but rather the time when we awake from the nightmare of credit over-extension.

The Economy and the Necropolis of Troy: On Mobs, the Arab Spring, and QEs

Author : John E. Charalambakis

Date : September 18, 2012

The events that shaped last week – and potentially the weeks and months, if not years to come – had both geoeconomics and geopolitical dimensions. In situations like these, the beneficiaries could be viewed as those who shape the path towards the ultimate outcome. Let’s briefly review what has taken place and what the implications are for investors.

Following ECB’s QE measures on September 6th, the Fed announced another round of QE. In our estimate this round could be as high as $1.8 trillion, especially when we consider that there is no definitive time limit ($40 billion per week until about the unemployment rate drops to about 6.7%, i.e. based on the current working model approximately 45 months, assuming that other current programs will be sterilized). We are of the opinion –as we wrote before – that central banks will coordinate QE measures targeting spreads and having as upper limit the percentage (35-40%?) of GDP that their balance sheets control. At the same time – and given its significant slowdown – China provided us with a prelude of further stimulus in order to accelerate its growth rate and avoid internal turmoil due to rising unemployment and exports’ decline. These two events wrap up the summary on the geoeconomic front.

On the geopolitical front we observed mobs attacking US Embassies, killing US officials, and creating chaotic situations, while Israel kept pushing for an attack on Iran. We believe that the majority of the people in the countries that experienced the attacks from those mobs favor the US. However weak governments and civil societies do not allow that majority to surface. The result is that those who have vested interests from such turmoil occupy the news and create upheavals. The greatest accomplishment of the Arab Spring is that the lead of fear in those countries is gone. It was unimaginable to revolt against the old regimes. Now, that the fear is gone the baby democracies will grow, but it takes time, effort, patience, energy, and collaboration from the West. The other major geopolitical development was the increased tone of confrontation between China and Japan regarding some disputed islands in the East China Sea. We believe that the threat of a major war in that area is real and could create significant tremors around the world.

It seems that some vested interests are pushing for war as the ultimate dues ex machina. They view their targets as Agamemnon viewed Troy. The problem was the Trojan War and everything about it was a lie and a deception. Achilles ended up dead. Odysseus wasted over ten years in order to return home, and Troy became a necropolis. Only the suitors after Odysseus’ estate had a good time! Even Agamemnon ended up dead upon return home. His wife had to take revenge for killing their beloved daughter Iphigenia in order to please the gods and get favorable sailing winds. (Let’s not forget that the sacrificial knife was made up of the finest gold). We have serious doubts if we should sail to Troy again.

What does all that mean for individual and institutional investors? We believe that QE measures buy time, but do not address the real issues of too much debt, inability to wake up dormant assets, and over-collateralization/securitization of toxic “assets”. In the best-case scenarios the central banks will have to take significant haircuts that will shake the foundations upon which they are built.

In the following three graphs we demonstrate why QE measures only have limited time effect and experience diminishing returns while distorting credit equilibrium. These three critical graphs show the impact of QE on monetary aggregates (data from Thomson Datastream, and Capital Economics). The first one shows that money supply falls far behind the growth in the monetary base. The result is that the velocity of money cannot support desired economic activity, as confirmed by the second graph (and hence the lack of inflationary pressures in basic goods). As money velocity drops, the money multiplier collapses (see third graph below), thus the fractional reserve system needs continuous shots of QEs in order to sustain an ephemeral monetary stability.

As investors start feeling the diminishing effects of QEs in the medium term, they will seek safe haven in assets that cannot be printed. It seems that the long term may not be the period when we will all be dead, but rather the time when we awake from the nightmare of credit over-extension.