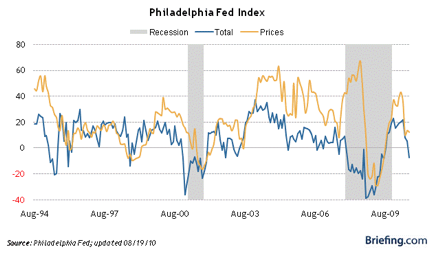

It seems that the economic slowdown is taking root. The consensus forecast for the Philly Index that portrays manufacturing activity for the Eastern part of the country was expected to rise from 5.1 to about 7. On the contrary it fell to negative 7.7.

This is a big swing. At the same time the Index of Leading Economic Indicators (LEI) rose by less than expected. In the Philly Index all the sub-indexes (new orders, shipments, unfilled orders, etc) were contractionary for the first time since July 2009.

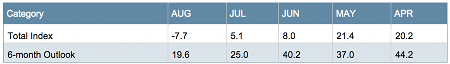

The figures below show the graph of the Philly index and the table below the numbers themselves.

As the table below shows, the 6-month outlook is deteriorating. That means that if the Chicago ISM (Institute of Supply Management) number reflects the same trends by the end of the month, then the deterioration in manufacturing activity will keep unemployment claims high. On that, the new unemployment claims that came out today surpassed 500K, which is the usual mark for recession.

The market this morning is not digesting the news very well. Volume is still light, selling is accelerating, oil is dropping, currencies are confused, the bond market is in a bubble territory (with 2-year notes yielding less than 50 bps and the 10-year almost at 2.5%, bonds seem to be very expensive), but gold is holding up and is actually increasing.

Of course, in the midst of this confusion the markets can turn around. They are desperate for some good news and an anchor. They are looking for roses among the thorns and for some direction.

Our opinion is that this confusion will continue until a final catharsis comes. We anticipate such a catharsis to take place within the first few months of 2011. The catharsis will cleanse the balance sheets of institutions, corporations and even nations. Once it takes place, it will be a new day and era. In the meantime, we hedge risks, and hold on to hard assets.

Ode to anchors again!

The Economic Outlook: Still Looking for the Roses Among the Thorns

Author : John E. Charalambakis

Date : August 19, 2010

It seems that the economic slowdown is taking root. The consensus forecast for the Philly Index that portrays manufacturing activity for the Eastern part of the country was expected to rise from 5.1 to about 7. On the contrary it fell to negative 7.7.

This is a big swing. At the same time the Index of Leading Economic Indicators (LEI) rose by less than expected. In the Philly Index all the sub-indexes (new orders, shipments, unfilled orders, etc) were contractionary for the first time since July 2009.

The figures below show the graph of the Philly index and the table below the numbers themselves.

As the table below shows, the 6-month outlook is deteriorating. That means that if the Chicago ISM (Institute of Supply Management) number reflects the same trends by the end of the month, then the deterioration in manufacturing activity will keep unemployment claims high. On that, the new unemployment claims that came out today surpassed 500K, which is the usual mark for recession.

The market this morning is not digesting the news very well. Volume is still light, selling is accelerating, oil is dropping, currencies are confused, the bond market is in a bubble territory (with 2-year notes yielding less than 50 bps and the 10-year almost at 2.5%, bonds seem to be very expensive), but gold is holding up and is actually increasing.

Of course, in the midst of this confusion the markets can turn around. They are desperate for some good news and an anchor. They are looking for roses among the thorns and for some direction.

Our opinion is that this confusion will continue until a final catharsis comes. We anticipate such a catharsis to take place within the first few months of 2011. The catharsis will cleanse the balance sheets of institutions, corporations and even nations. Once it takes place, it will be a new day and era. In the meantime, we hedge risks, and hold on to hard assets.

Ode to anchors again!