As those lines are being drafted, the ECB announced – under its new leadership – a reduction in its interbank lending rate by 25 bps. The EU and the US markets seemed to like it, in the midst of the Greek political and economic developments. It is widely expected that a new Greek government will be formed that will try to revive negotiations with the troika of the IMF, the EU and the ECB. Prime Minister Papandreou announced a referendum on the new bailout package. The question is how could the people vote without knowing the terms and conditions of the bailout package? We may return in the near future to our proposal for a moratorium/seisacthia/jubilee on interest payments of heavily- indebted countries, rather than bailing them out, something that does not require haircuts and actually reduces debt levels instantly -and not in 10 years as the proposed bailouts promise – creates primary surpluses in the first year, and puts the countries back to a growth trajectory immediately.

The current Eurozone crisis has been forcing us to focus on the responsibility of the ECB to distinguish between insolvency and illiquidity. This in turn highlights the need to re-learn the distinction between financial shocks and solvency characteristics that allows a well-structured interbank market to function efficiently. If those things do not take place, then such a failure will cause moral hazard issues which when they accumulate inject financial pain, cause declines in market confidence, and become cornerstones of recessions and economic stagnation with all the real- economy attributes of high long-term unemployment, cyclical deficits, uncertainty, and business bankruptcies.

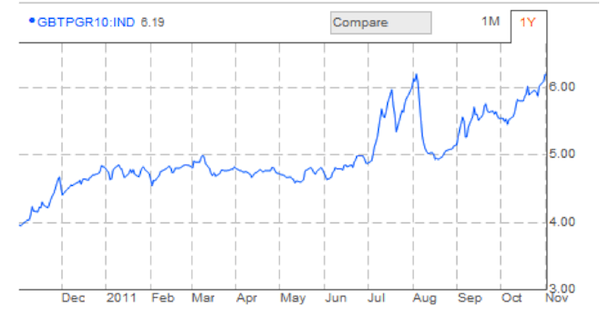

It seems that the ECB is not functioning as a real lender of last resort, which when combined with the absence of an EU-wide Treasury Department (Ministry of Economics & Finance), enhances an environment where a fully collateralized swap market is not augmented by open market operations that smooth liquidity pressures and relieve markets from credit freeze pressures. The result has been and may continue to be pressures on spreads, money market funds that retreat in the face of fear, and economies on the run that are unable to reverse financial tremors from becoming real-economy disasters. The following graph that represents the latest yield on Italian 10-year bonds is representative of the story described above. It’s worth noting that the Italian yield has increased by more than 55% in ten months, and reflects the beginning of a domino effect that could have stopped by a true LLR at its origin.

As contagion starts spreading and ineffective policies continue to undershoot the mark, a domino effect is building up that can destabilize banks, countries, and form a tsunami that can cross the Atlantic.

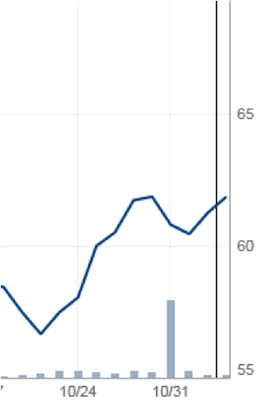

In the meantime, we started cautiously singing the ode to hard, real, and tangible assets, and the graph below reflects a comprehensive picture of such a stand/move and singing, and the declining credibility of any LLR under whose watch such an increase takes place.

Ode to any real LLR!

The ECB and the Eurozone Crisis: The Role of a Lender of Last Resort (LLR)

Author : John E. Charalambakis

Date : November 3, 2011

As those lines are being drafted, the ECB announced – under its new leadership – a reduction in its interbank lending rate by 25 bps. The EU and the US markets seemed to like it, in the midst of the Greek political and economic developments. It is widely expected that a new Greek government will be formed that will try to revive negotiations with the troika of the IMF, the EU and the ECB. Prime Minister Papandreou announced a referendum on the new bailout package. The question is how could the people vote without knowing the terms and conditions of the bailout package? We may return in the near future to our proposal for a moratorium/seisacthia/jubilee on interest payments of heavily- indebted countries, rather than bailing them out, something that does not require haircuts and actually reduces debt levels instantly -and not in 10 years as the proposed bailouts promise – creates primary surpluses in the first year, and puts the countries back to a growth trajectory immediately.

The current Eurozone crisis has been forcing us to focus on the responsibility of the ECB to distinguish between insolvency and illiquidity. This in turn highlights the need to re-learn the distinction between financial shocks and solvency characteristics that allows a well-structured interbank market to function efficiently. If those things do not take place, then such a failure will cause moral hazard issues which when they accumulate inject financial pain, cause declines in market confidence, and become cornerstones of recessions and economic stagnation with all the real- economy attributes of high long-term unemployment, cyclical deficits, uncertainty, and business bankruptcies.

It seems that the ECB is not functioning as a real lender of last resort, which when combined with the absence of an EU-wide Treasury Department (Ministry of Economics & Finance), enhances an environment where a fully collateralized swap market is not augmented by open market operations that smooth liquidity pressures and relieve markets from credit freeze pressures. The result has been and may continue to be pressures on spreads, money market funds that retreat in the face of fear, and economies on the run that are unable to reverse financial tremors from becoming real-economy disasters. The following graph that represents the latest yield on Italian 10-year bonds is representative of the story described above. It’s worth noting that the Italian yield has increased by more than 55% in ten months, and reflects the beginning of a domino effect that could have stopped by a true LLR at its origin.

As contagion starts spreading and ineffective policies continue to undershoot the mark, a domino effect is building up that can destabilize banks, countries, and form a tsunami that can cross the Atlantic.

In the meantime, we started cautiously singing the ode to hard, real, and tangible assets, and the graph below reflects a comprehensive picture of such a stand/move and singing, and the declining credibility of any LLR under whose watch such an increase takes place.

Ode to any real LLR!