The late Kenneth Lay of Enron renamed his company from Enteron to Enron and moved the headquarters to Houston, Texas, ready to become the global trading conglomerate of energy, with the help of some powerful friends. (As things turned out Enteron – which in Greek means intestines – was a more appropriate name).

One of the main problems with Enron was the trading itself. Hypothetically, Enron traded everything from gas to internet bandwidth. Trading contracts became the “assets” that were used as collateral for the explosion of credit. Money supply grew, too, because of that process. “Asset”-price inflation was written all over the financial world, however warnings that it was a bubble – like those of John Law and the Mississippi Company – were ignored. In this scheme of things, credit is demand-driven by assets that are collateralized for the sake of funding. To some extent, we could state that this is how credit has been created for centuries now. The problem, of course, is that these were the kinds of assets used in the collateralization process that resulted in securitization and tranches of financial instruments sold to pension funds and other institutional and individual investors.

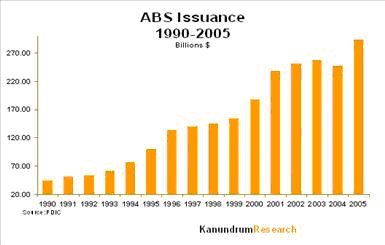

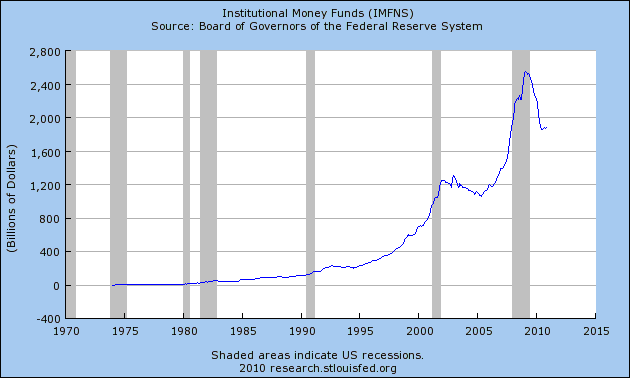

The figure below –along with similar figures from other statistics we published in the past – shows the securitization process in one of the asset classes. It seems that the financial world took the wrong path to prosperity. They thought that they could achieve prosperity by trading paper assets, and consuming themselves to death, rather than by building up competitive advantages that the future requires. The wrong path metamorphosized the credit creation and made it an endogenous process controlled by collateralization of paper assets and contracts similar to the ones that Enron presented to the banking circles.

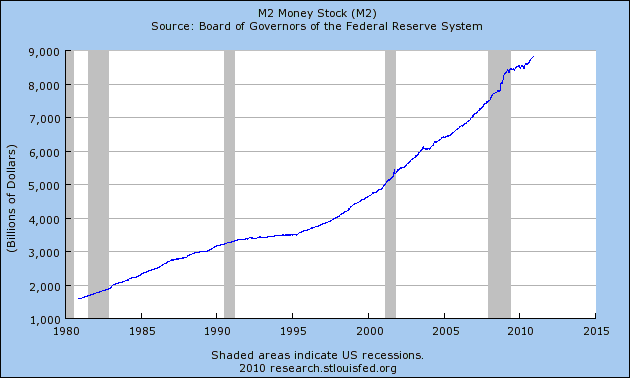

The process described above led to the growth of the money supply while the money multipliers failed to follow those increases (defined as money supply divided by the monetary base, the later being currency circulated and bank reserves). The following three figures are indicative of those results.

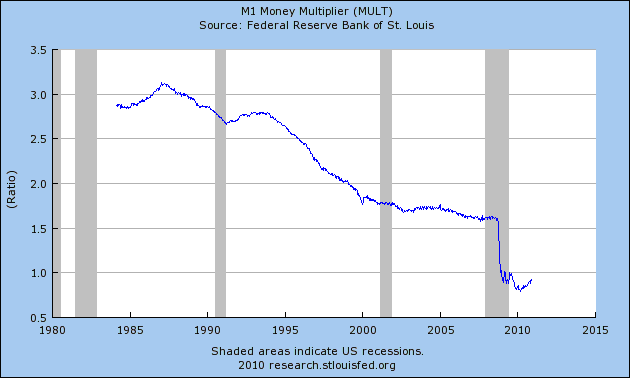

The figure above shows the explosion of money supply (by its broader definition of M3 that the Fed discontinued in 2006 the rate of growth is even more dramatic), especially in the last 15 years. The problem is that as money supply increased, the money multiplier decreased, and that decrease became dramatic since the bursting of the paper/toxic assets bubble, as the following figure demonstrates.

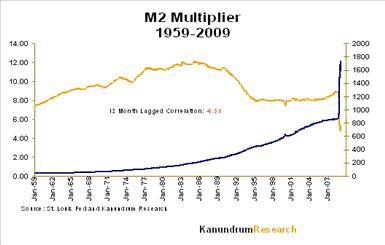

The Fed is trying to reignite the money multiplier process, but it cannot yet record significant results. The QE2 is nothing but an effort towards that objective of reflating the money multiplier process again, and as the following figure shows, the increases in the monetary base are accompanied by greater decreases in the M2 multiplier (M2 is a broader definition of money supply). The sharp declines in the money multipliers (it should be noted that matters in the EU are much worse) may lead to the misallocation and maldistribution of central bank’s reserves which in turn will lead to monetary shocks, including, but not limited to, currency debasements in a mild scenario or the abandonment of currencies altogether (the Euro is not out of the woods yet).

The falling multipliers could indicate one of two major developments (among other culprits): Either that the markets cannot absorb the new credit, or that the credit cannot be channeled into the market (and can only remain as reserves into the banking system) due to an insufficient asset base.

The solution to the first problem is the stimulation of aggregate demand via non-monetary stimuli. The solution to the second problem is the enhancement of the global asset base via the introduction of new assets.

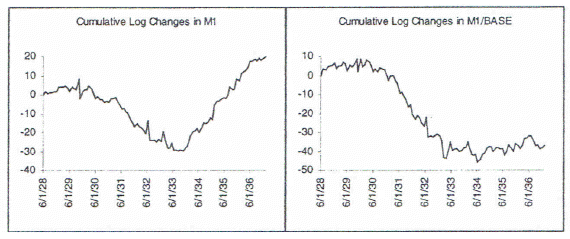

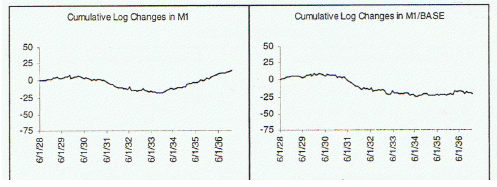

The following two figures demonstrate the horrible position of multiplier deflation in the US (first figure below) and globally (second figure below) in the starting years of the Great Depression.

The dramatic decreases in the money multiplier need to be addressed ASAP. A combination of the two options described above might be the optimal solution. We live in historical times when the balance of powers is reconfigured and new markets are developing along with new technologies and products. It will be a time of destructive creation, as institutional money funds are declining and are seeking safe havens and new ports of destiny.

We hope that this commentary will be the prelude to the ones that follow (including newsletters) that point to the direction of those new ports.

Until then, ode to the Aisimnitis who can lead the markets to the path of destructive creation.

The Descent of Currencies: Reflating Distressed Economies in the Post-Bubble Period

Author : John E. Charalambakis

Date : December 20, 2010

The late Kenneth Lay of Enron renamed his company from Enteron to Enron and moved the headquarters to Houston, Texas, ready to become the global trading conglomerate of energy, with the help of some powerful friends. (As things turned out Enteron – which in Greek means intestines – was a more appropriate name).

One of the main problems with Enron was the trading itself. Hypothetically, Enron traded everything from gas to internet bandwidth. Trading contracts became the “assets” that were used as collateral for the explosion of credit. Money supply grew, too, because of that process. “Asset”-price inflation was written all over the financial world, however warnings that it was a bubble – like those of John Law and the Mississippi Company – were ignored. In this scheme of things, credit is demand-driven by assets that are collateralized for the sake of funding. To some extent, we could state that this is how credit has been created for centuries now. The problem, of course, is that these were the kinds of assets used in the collateralization process that resulted in securitization and tranches of financial instruments sold to pension funds and other institutional and individual investors.

The figure below –along with similar figures from other statistics we published in the past – shows the securitization process in one of the asset classes. It seems that the financial world took the wrong path to prosperity. They thought that they could achieve prosperity by trading paper assets, and consuming themselves to death, rather than by building up competitive advantages that the future requires. The wrong path metamorphosized the credit creation and made it an endogenous process controlled by collateralization of paper assets and contracts similar to the ones that Enron presented to the banking circles.

The process described above led to the growth of the money supply while the money multipliers failed to follow those increases (defined as money supply divided by the monetary base, the later being currency circulated and bank reserves). The following three figures are indicative of those results.

The figure above shows the explosion of money supply (by its broader definition of M3 that the Fed discontinued in 2006 the rate of growth is even more dramatic), especially in the last 15 years. The problem is that as money supply increased, the money multiplier decreased, and that decrease became dramatic since the bursting of the paper/toxic assets bubble, as the following figure demonstrates.

The Fed is trying to reignite the money multiplier process, but it cannot yet record significant results. The QE2 is nothing but an effort towards that objective of reflating the money multiplier process again, and as the following figure shows, the increases in the monetary base are accompanied by greater decreases in the M2 multiplier (M2 is a broader definition of money supply). The sharp declines in the money multipliers (it should be noted that matters in the EU are much worse) may lead to the misallocation and maldistribution of central bank’s reserves which in turn will lead to monetary shocks, including, but not limited to, currency debasements in a mild scenario or the abandonment of currencies altogether (the Euro is not out of the woods yet).

The falling multipliers could indicate one of two major developments (among other culprits): Either that the markets cannot absorb the new credit, or that the credit cannot be channeled into the market (and can only remain as reserves into the banking system) due to an insufficient asset base.

The solution to the first problem is the stimulation of aggregate demand via non-monetary stimuli. The solution to the second problem is the enhancement of the global asset base via the introduction of new assets.

The following two figures demonstrate the horrible position of multiplier deflation in the US (first figure below) and globally (second figure below) in the starting years of the Great Depression.

The dramatic decreases in the money multiplier need to be addressed ASAP. A combination of the two options described above might be the optimal solution. We live in historical times when the balance of powers is reconfigured and new markets are developing along with new technologies and products. It will be a time of destructive creation, as institutional money funds are declining and are seeking safe havens and new ports of destiny.

We hope that this commentary will be the prelude to the ones that follow (including newsletters) that point to the direction of those new ports.

Until then, ode to the Aisimnitis who can lead the markets to the path of destructive creation.