As we are drafting this commentary, the news is that a deal for the US debt limit is very close to be completed, that will involve the raising of the limit by at least $3 trillion in two phases. It seems that the political theater is approaching its end. Our opinions were expressed in our previous commentary where we reminded our readers that in the last 40 years, August has proven to be a pivotal month. We believe that this August, too, signifies an important moment in financial markets that may lead the global financial vessel into uncharted waters.

No matter the deal, the political theater in both the US and the EU may have inflicted unprecedented damage to the global economy. We would not be surprised if the US is eventually downgraded by the rating agencies irrespective of the kind of deal that will be reached (rating agencies are playing catch-up and trying hard to recover small pieces of their lost credibility).

In the EU, the markets may soon start focusing again on Italy, Spain, and soon thereafter, in France and Belgium. Greece was the tip of the iceberg as it is clear that the numbers simply do not add up. Balance sheets of banks reflect zero risk in “AAA” government instruments, which are nothing but liabilities with no real asset/collateral behind them.

The Balkans is known as a segmented geographical territory where symptoms of both World Wars erupted. We are afraid that we are entering a period where the fragmentation of the debt markets may create a period of financial instability where that safest place is not the port. The debt markets through their various instruments a.k.a. IOUs have created a mechanism that recycles liabilities close to 200 trillion dollars worldwide. If we add the derivative instruments to that amount (close to 700 trillion dollars globally), then someone may say that we have an unsustainable scheme, or an accident waiting to happen.

A downgrade on US paper will trigger a selloff of riskier paper in most bond funds, which will then create crowded markets, liquidity may dry up, interbank loans and the commercial paper market will freeze up, the repo market will suffer, and even money markets may face challenges. Banks’ balance sheets will be affected and the balkanization of the paper market will be a reality. The last Balkan war in the 1990s was bloody, created six nations out of the former Yugoslavian Republic, and poverty is still prevalent in the region.

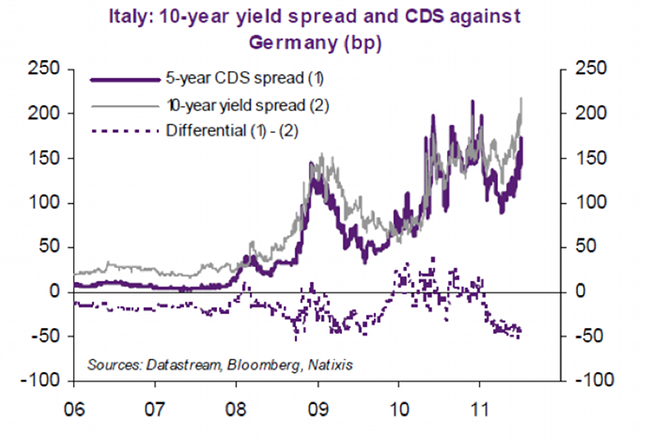

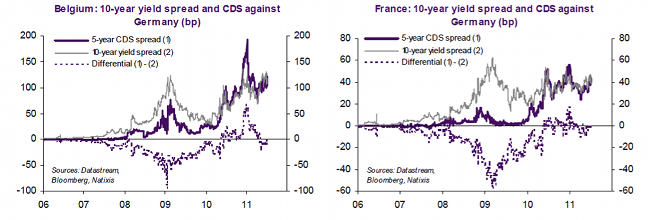

The graphs below portray the rising costs of insuring Italian, Belgian, and French debt. The rising spreads and the negative differentials against Germany’s bonds, signify also that in the next round of debt uncertainty a Machiavellian drama of love and fear will play out that will be the starting point of the balkanization of debt instruments with bottlenecks crowding investors on the wrong side of the curve. At that point a much needed devolution in the financial markets will start.

Ode to real assets that are no one else’s liabilities!

The Balkanization of the Debt Markets: Devolution in Uncharted Waters

Author : John E. Charalambakis

Date : August 1, 2011

As we are drafting this commentary, the news is that a deal for the US debt limit is very close to be completed, that will involve the raising of the limit by at least $3 trillion in two phases. It seems that the political theater is approaching its end. Our opinions were expressed in our previous commentary where we reminded our readers that in the last 40 years, August has proven to be a pivotal month. We believe that this August, too, signifies an important moment in financial markets that may lead the global financial vessel into uncharted waters.

No matter the deal, the political theater in both the US and the EU may have inflicted unprecedented damage to the global economy. We would not be surprised if the US is eventually downgraded by the rating agencies irrespective of the kind of deal that will be reached (rating agencies are playing catch-up and trying hard to recover small pieces of their lost credibility).

In the EU, the markets may soon start focusing again on Italy, Spain, and soon thereafter, in France and Belgium. Greece was the tip of the iceberg as it is clear that the numbers simply do not add up. Balance sheets of banks reflect zero risk in “AAA” government instruments, which are nothing but liabilities with no real asset/collateral behind them.

The Balkans is known as a segmented geographical territory where symptoms of both World Wars erupted. We are afraid that we are entering a period where the fragmentation of the debt markets may create a period of financial instability where that safest place is not the port. The debt markets through their various instruments a.k.a. IOUs have created a mechanism that recycles liabilities close to 200 trillion dollars worldwide. If we add the derivative instruments to that amount (close to 700 trillion dollars globally), then someone may say that we have an unsustainable scheme, or an accident waiting to happen.

A downgrade on US paper will trigger a selloff of riskier paper in most bond funds, which will then create crowded markets, liquidity may dry up, interbank loans and the commercial paper market will freeze up, the repo market will suffer, and even money markets may face challenges. Banks’ balance sheets will be affected and the balkanization of the paper market will be a reality. The last Balkan war in the 1990s was bloody, created six nations out of the former Yugoslavian Republic, and poverty is still prevalent in the region.

The graphs below portray the rising costs of insuring Italian, Belgian, and French debt. The rising spreads and the negative differentials against Germany’s bonds, signify also that in the next round of debt uncertainty a Machiavellian drama of love and fear will play out that will be the starting point of the balkanization of debt instruments with bottlenecks crowding investors on the wrong side of the curve. At that point a much needed devolution in the financial markets will start.

Ode to real assets that are no one else’s liabilities!