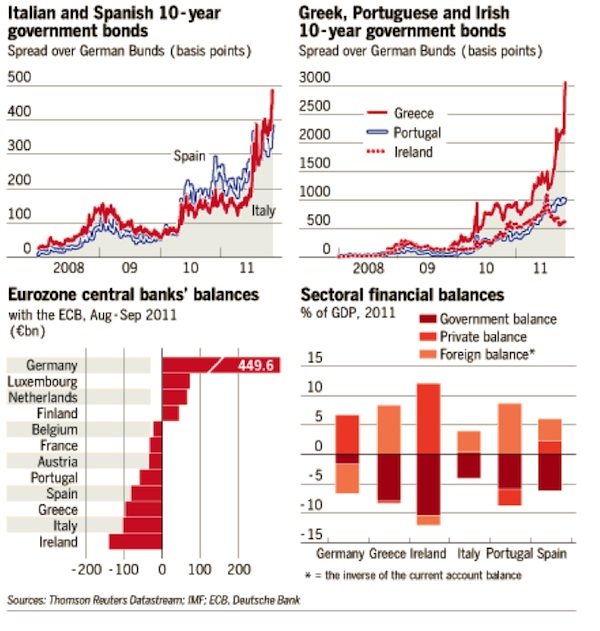

Since early July we have posted comments about Italy’s shaky position. In late 2009 the ten-year spread of Greek bonds over the German Bunds was approximately 400 bps. Greek ten-year bonds were yielding about 7%, as the graph below shows. Two years later the spread is 3000 bps and investors are forced to take a 50% haircut.

At that same time, Italian and Spanish bonds had a spread of less than 100 bps, again as the figure below demonstrates.

Moreover, the figure above shows that Greece was a net capital exporter, implying an inability to attract foreign capital with negative consequences for growth, employment, and tax revenues. It’s interesting to note that Portugal, Spain and Italy falls into the same category. Now, before, we look into the current Italian situation, we also need to point out that only four countries (Germany, Netherlands, Luxemburg, and Finland) have positive balances with the ECB. For how long could those four countries afford to play the bankers for the other thirteen members of the Eurozone?

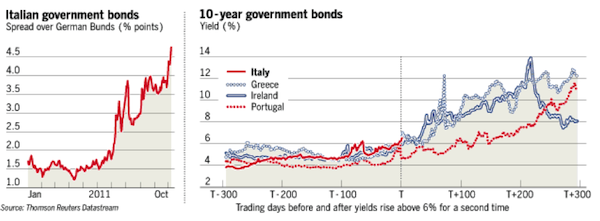

The Italian ten-year bonds (despite recent ECB’s purchases) have approached unsustainable levels of over 7%, as the following graph demonstrates. If history is repeated – and many of the ingredients are present for such repetition – then, Italy could soon find herself in the hands of the troika (IMF, ECB, and EU Commission), asking for a bailout, with all the implications of austerity measures that backfire on growth, employment and deficits.

The problem is that the bailout fund (EFSF) does not have enough money to save Italy, let alone to honor its bailout commitments to Greece, Portugal, and Ireland. Moreover, in its recent auction for bonds, the EFSF had to offer higher yields in order to attract investors, and recent indications point to an inability to leverage its capital to the target of €1 billion.

As Italian bond prices are falling (i.e. yields climbing to higher levels) a negative feedback loop is developing which forces fund managers to sell the bonds in order to protect returns, causing inflection points to kick in while margin calls are taking place. As bonds lose value, their collateral value declines which in turn causes credit contraction that slows down businesses, raises red flags for other Eurozone bonds, and decelerates the repo market that is used to fund working capital needs. This process could feed herself i.e. become a negative feedback loop, with the result that spreads could get out of control, as it happened to the Greek case.

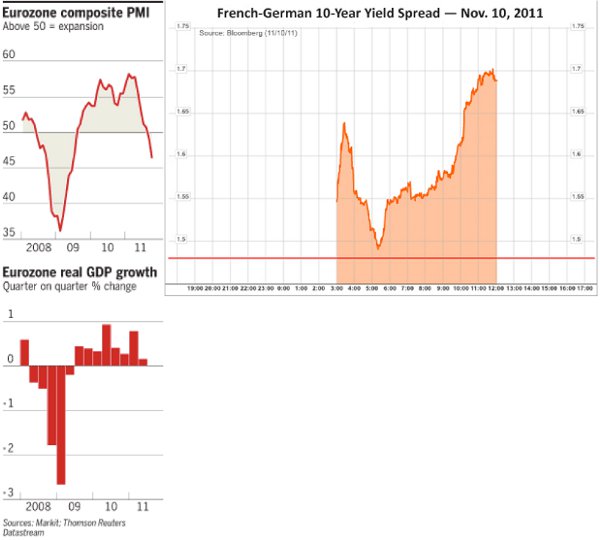

Given that the EU is headed for a recession – if it is not already there – according to the composite Purchasing Managers Index (see figure below), we are of the opinion that things could start unraveling fast for Italy, making us to wonder if the train from Athens to Rome becomes an express one whose next stop might be Paris. The French bonds’ spread over German Bunds is approaching historic high levels, at a time when the French total debt (private and public) is the worst in the Eurozone, as we have shown in previous postings.

Once the liquidity squeeze starts settling, the precious metals time will start shining.

Ode to catharsis from unreliable assets that are nothing but liabilities!

The Athens-Rome Express: Next Stop Paris

Author : John E. Charalambakis

Date : November 11, 2011

Since early July we have posted comments about Italy’s shaky position. In late 2009 the ten-year spread of Greek bonds over the German Bunds was approximately 400 bps. Greek ten-year bonds were yielding about 7%, as the graph below shows. Two years later the spread is 3000 bps and investors are forced to take a 50% haircut.

At that same time, Italian and Spanish bonds had a spread of less than 100 bps, again as the figure below demonstrates.

Moreover, the figure above shows that Greece was a net capital exporter, implying an inability to attract foreign capital with negative consequences for growth, employment, and tax revenues. It’s interesting to note that Portugal, Spain and Italy falls into the same category. Now, before, we look into the current Italian situation, we also need to point out that only four countries (Germany, Netherlands, Luxemburg, and Finland) have positive balances with the ECB. For how long could those four countries afford to play the bankers for the other thirteen members of the Eurozone?

The Italian ten-year bonds (despite recent ECB’s purchases) have approached unsustainable levels of over 7%, as the following graph demonstrates. If history is repeated – and many of the ingredients are present for such repetition – then, Italy could soon find herself in the hands of the troika (IMF, ECB, and EU Commission), asking for a bailout, with all the implications of austerity measures that backfire on growth, employment and deficits.

The problem is that the bailout fund (EFSF) does not have enough money to save Italy, let alone to honor its bailout commitments to Greece, Portugal, and Ireland. Moreover, in its recent auction for bonds, the EFSF had to offer higher yields in order to attract investors, and recent indications point to an inability to leverage its capital to the target of €1 billion.

As Italian bond prices are falling (i.e. yields climbing to higher levels) a negative feedback loop is developing which forces fund managers to sell the bonds in order to protect returns, causing inflection points to kick in while margin calls are taking place. As bonds lose value, their collateral value declines which in turn causes credit contraction that slows down businesses, raises red flags for other Eurozone bonds, and decelerates the repo market that is used to fund working capital needs. This process could feed herself i.e. become a negative feedback loop, with the result that spreads could get out of control, as it happened to the Greek case.

Given that the EU is headed for a recession – if it is not already there – according to the composite Purchasing Managers Index (see figure below), we are of the opinion that things could start unraveling fast for Italy, making us to wonder if the train from Athens to Rome becomes an express one whose next stop might be Paris. The French bonds’ spread over German Bunds is approaching historic high levels, at a time when the French total debt (private and public) is the worst in the Eurozone, as we have shown in previous postings.

Once the liquidity squeeze starts settling, the precious metals time will start shining.

Ode to catharsis from unreliable assets that are nothing but liabilities!