There is almost no doubt that the extraordinary measures taken by the central banks around the world over the last several years uplifted equities, lowered cost of capital, increased corporate prospects and in general created a market upswing at a time when global fundamentals may have not warranted such rises. It seems that we may be entering into a period when this credit cycle is coming to a slow end. So the question is whether the market upswing can be sustained.

We can identify three primary reasons and three secondary reasons that could possibly sustain the upswing, although at a slower growth rate. The primary reasons are increased merger and acquisition (M&A) activity, EU institutional reforms, and higher volumes of trade. The secondary reasons are stable oil prices and investments in renewable energy, a structural economic change related to lifestyle choices, and biotech/scientific developments. In this commentary, we choose to discuss how M&A activity can play a significant role in partially sustaining the upswing along with the other factors mentioned above. We hope to discuss the other factors too in the future.

Mergers and acquisitions tend to pick up speed at this stage of the economic cycle, especially when financing is available, rates are low, companies are holding abundant cash, labor markets tighten up, efficiencies are desired, and reasons are sought to keep the equity party going. Our expectation is that global companies will take a major lead in the M&A activity, especially with the pile of cash they have accumulated. Therefore, and as the figure below shows, their share in the M&A activity may well surpass in the next 12-18 months the percentage reached prior to the financial crisis.

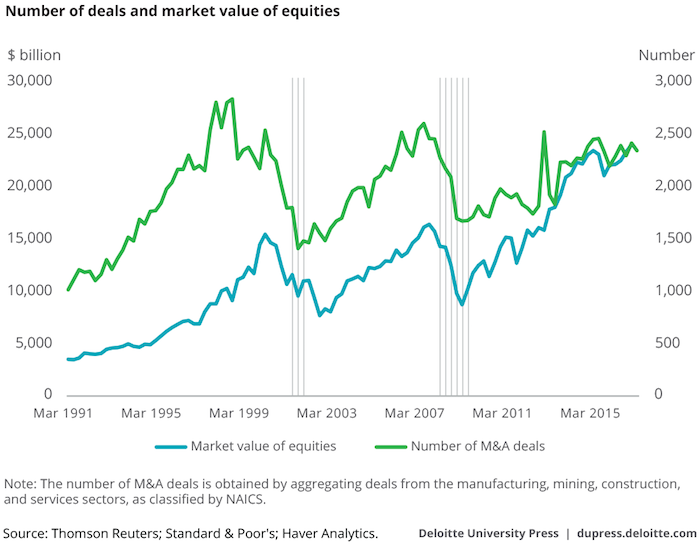

From a historical standpoint, M&A activity picks up speed in close correlation to rising equity prices, as shown below. As the M&A activity picks up speed, the equity market is sustained at high levels and goes even higher. We expect the M&A trend of the past several years to continue and accelerate, especially in the services and tech-related sectors.

As the credit cycle slows down and comes to an end, the number of deals is expected to increase significantly; as the number of deals increases, the search for non-organic growth will accelerate which may advance a deal mania in the market that can keep the equities rally going.

The expected increase in M&A activity is likely to affect some industries more than others. The five sectors in which we expect the most M&A activity are telecoms, packaging, electrical equipment, consumer staples, and the chemicals industry. Investors who desire to explore opportunities to take advantage of the rising M&A activity could look at ETFs that focus on M&As as well as identify potential target companies whose shares are likely to experience significant gains if they end up being acquisition targets.

Substituting for the Credit Cycle: An Optimistic Perspective

Author : John E. Charalambakis

Date : July 13, 2017

There is almost no doubt that the extraordinary measures taken by the central banks around the world over the last several years uplifted equities, lowered cost of capital, increased corporate prospects and in general created a market upswing at a time when global fundamentals may have not warranted such rises. It seems that we may be entering into a period when this credit cycle is coming to a slow end. So the question is whether the market upswing can be sustained.

We can identify three primary reasons and three secondary reasons that could possibly sustain the upswing, although at a slower growth rate. The primary reasons are increased merger and acquisition (M&A) activity, EU institutional reforms, and higher volumes of trade. The secondary reasons are stable oil prices and investments in renewable energy, a structural economic change related to lifestyle choices, and biotech/scientific developments. In this commentary, we choose to discuss how M&A activity can play a significant role in partially sustaining the upswing along with the other factors mentioned above. We hope to discuss the other factors too in the future.

Mergers and acquisitions tend to pick up speed at this stage of the economic cycle, especially when financing is available, rates are low, companies are holding abundant cash, labor markets tighten up, efficiencies are desired, and reasons are sought to keep the equity party going. Our expectation is that global companies will take a major lead in the M&A activity, especially with the pile of cash they have accumulated. Therefore, and as the figure below shows, their share in the M&A activity may well surpass in the next 12-18 months the percentage reached prior to the financial crisis.

From a historical standpoint, M&A activity picks up speed in close correlation to rising equity prices, as shown below. As the M&A activity picks up speed, the equity market is sustained at high levels and goes even higher. We expect the M&A trend of the past several years to continue and accelerate, especially in the services and tech-related sectors.

As the credit cycle slows down and comes to an end, the number of deals is expected to increase significantly; as the number of deals increases, the search for non-organic growth will accelerate which may advance a deal mania in the market that can keep the equities rally going.

The expected increase in M&A activity is likely to affect some industries more than others. The five sectors in which we expect the most M&A activity are telecoms, packaging, electrical equipment, consumer staples, and the chemicals industry. Investors who desire to explore opportunities to take advantage of the rising M&A activity could look at ETFs that focus on M&As as well as identify potential target companies whose shares are likely to experience significant gains if they end up being acquisition targets.