The figure below shows the six forces which we believe are at work in determining the trajectory of the Euro in the foreseeable future. The analysis below discusses the six forces that are affecting the Euro’s future and hence the Euro zone’s potential. We present the pressures that may start as soon as this summer and could culminate with a Spanish bailout and conclude with a French tremor that could shake up the Euro like any other.

Let’s start with the Greek elections scheduled for May 6. All polls show that the two main parties that have governed Greece in the last 40 years will have less than 40% of the vote. Some private polls show them with an upward limit of 36%. If that materializes, then Greece will enter into an historic period that will turn the political scenery upside-down in a region that is already shaken by political instability. At the same time it is projected that this region will play a vital role in the energy dynamics of the 21st century given the vast amounts of hydrocarbons in the area, as well as the potential of renewable energy projects in the region (wind and photovoltaic). A period of political instability could be followed by the strengthening of the anti-austerity forces and the practical non-compliance of the voted austerity measures (which already were very difficult to be enforced), which most probably will lead to the cancellation of the bailout program and the first major blow to the Euro and the German Central Bank which through the Target2 program may face as much as €500 billion hole. The troika (ECB, EU, and the IMF) is fearful of such a scenario, and hence its indirect intervention in local Greek politics through speeches and aphorisms is full of messages that inject fear in the population. While this scenario points to an exit of Greece from the Euro zone, our opinion is that most of the damaging consequences could be limited if the new drachma is tied to an anchor such as the USD, while the cleanup of the economic and political mess takes place.

On that same day (May 6), the second round of the French elections will also conclude, and the projection is that Mr. Francois Hollande will defeat Mr. Sarkozy and will be elected president of France. Mr. Hollande is not a friend of the emerged alliance between Germany and France that is pushing for the extreme austerity measures. That alliance will most probably break apart and with that the “cohesiveness” of the austerity forces will also break apart. We have been on the record that France faces the worst combination of public and private debt and its banks’ “assets” stand on very questionable ground. As previous commentaries have shown, when we take into account France’s unfunded pension and health care liabilities, its debt-to-GDP ratio exceeds 400%. If Hollande ends up opposing the recently executed EU fiscal compact, then that blow to the Euro will surpass the Greek impact. We would not be surprised if France ends up anchoring its new Franc to the Chinese Yuan (RMB).

The European Stability Treaty on fiscal discipline demanded by Germany and which demands a balanced budget while imposing penalties and sanctions for the “undisciplined” (i.e. questioning the sovereignty of a nation), will be put to a test/referendum in Ireland during the month of May. Nations that do not ratify the Treaty cannot participate in the EU permanent bailout mechanism (which by-the-way is too small and inefficient to rescue the EU nations). If we take into account the first quakes coming from Greece and France, the Irish history of voting No to similar EU-related referendum, and the continuous suffering of the Irish people through deep recession and austerity measures, we should not be surprised if the Irish people vote No. That will be the third blow to the Euro.

However, none of the above three forces may be as lethal as a Spanish need for a bailout. Let’s be straight forward. Unless the ECB commits to targeting the ten-year yields of Spain and Italy a.k.a. unlimited cash to keep the rates below 5.4%, the pressure on the Euro would be such that it will become unsustainable as a currency. The events of the last two weeks are indicative of just that. As soon as the impact of the ECB’s LTRO programs started fading, the tremors started again in Spain. Last week Spanish banks received almost 70% of all loans given out by the ECB to EU banks. The yield on the Spanish bonds has started its upward climbing again, and the earthquake is being felt in Spanish banks as well. The 2011 budget deficit of 8.5% is underestimated due to the fact that it does not reflect the deficits of regional provinces, which now demand that the central government absorbs their health and education expenses. Given an official unemployment rate of 23%, a real estate market that has not fully corrected yet, a shaky banking sector, and a net investment position of -93% (meaning that the amounts the Spanish people owe to foreigners is 93% of the GDP), the room for optimism is limited (if it exists at all).

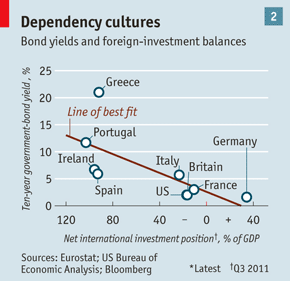

We anticipate that Spain will be asking for a rescue which will throw the most significant blow to the Euro prospects thus far, and which probably will roll over to Italy and France, creating an unbearable situation for the EU stability/bailout mechanism (ESM) just as it is starting its operations this summer. As the graph below shows a regression model seems to fit well into the data where the higher the negative net investment position is, the greater the yield on the ten-year bond is. Based on that projection, the yields on Spanish and Irish bonds are still too low.

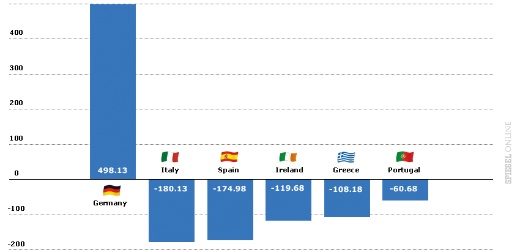

The unbearable lightness of complacency however, should be found in Germany and its Bundesbank’s exposure to the peripheral countries through loans up to €500 billion a.k.a. Target2 program among central banks in the ECB system. The president of the very respectable German IFO Economics Institute, Mr. Hans Werner Sinn has warned that the Bundesbank faces hidden risks of almost $650 billion given the amount of loan and loan guarantees extended to countries such as Spain, Greece, and Portugal. If any of those countries leave the Euro zone, the Bundesbank will have to eat the losses. As the graph above shows, Germany is the only country with a positive net international investment position (accumulated through the years via the trade surpluses it enjoyed selling its products to the likes of Spain, Greece and Portugal). This is an unsustainable situation.

The figure below shows the makeup of this unbalanced position and the hole in Bundesbank’s balance sheet.

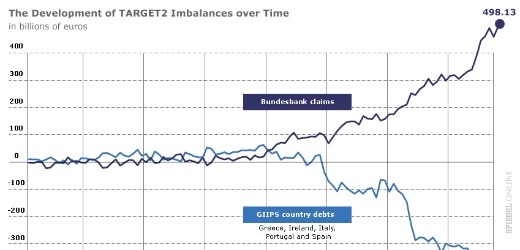

The EU-wide trade and central bank imbalances in combination with the culmination of the forces as explained above will force the periphery out of the Euro zone and will expose Germany to huge losses at a time when the only thing that has postponed the disintegration of the EU banking system is the temporary loans of the ECB through the LTRO operations. (As a side note to this force, it should be noted that the paper-collateral pledged to the Bundesbank for the Target2 interbank loans as well as to the ECB for the LTRO operations will become worthless at a time of an exit from the Euro zone).

The buildup of cash flow imbalances among central banks, as shown below is destined to destruct the credit mechanism in the EU and with it the end to the Euro dream as an alternative currency to the dollar will take effect. As those forces take effect the USD will be strengthening as capital will fly to the US.

The analysis above leads us to a conclusion that the Euro may not exist as a currency (or at least not in its present form) in a short four-five year time.

Who is then to replace the Euro as an alternative reserve currency? It should not surprise us that the claims of Chinese officials wanting a greater role for the RMB could materialize as soon as the Euro is clearly destined for collapse. However, for the RMB to play role in the reserve currency mix, it has to be freely floated. Is it surprising then that last week the central bank of China announced the doubling of the trading band for the RMB effective Monday April 16? We anticipate that by the time when the Euro is at the hospice, the RMB would be freely traded as US and China seem to co-determine their trajectories.

Strategic Disintegration Part III: A Hexagon of Forces and the Trajectory of the Euro

Author : John E. Charalambakis

Date : April 18, 2012

The figure below shows the six forces which we believe are at work in determining the trajectory of the Euro in the foreseeable future. The analysis below discusses the six forces that are affecting the Euro’s future and hence the Euro zone’s potential. We present the pressures that may start as soon as this summer and could culminate with a Spanish bailout and conclude with a French tremor that could shake up the Euro like any other.

Let’s start with the Greek elections scheduled for May 6. All polls show that the two main parties that have governed Greece in the last 40 years will have less than 40% of the vote. Some private polls show them with an upward limit of 36%. If that materializes, then Greece will enter into an historic period that will turn the political scenery upside-down in a region that is already shaken by political instability. At the same time it is projected that this region will play a vital role in the energy dynamics of the 21st century given the vast amounts of hydrocarbons in the area, as well as the potential of renewable energy projects in the region (wind and photovoltaic). A period of political instability could be followed by the strengthening of the anti-austerity forces and the practical non-compliance of the voted austerity measures (which already were very difficult to be enforced), which most probably will lead to the cancellation of the bailout program and the first major blow to the Euro and the German Central Bank which through the Target2 program may face as much as €500 billion hole. The troika (ECB, EU, and the IMF) is fearful of such a scenario, and hence its indirect intervention in local Greek politics through speeches and aphorisms is full of messages that inject fear in the population. While this scenario points to an exit of Greece from the Euro zone, our opinion is that most of the damaging consequences could be limited if the new drachma is tied to an anchor such as the USD, while the cleanup of the economic and political mess takes place.

On that same day (May 6), the second round of the French elections will also conclude, and the projection is that Mr. Francois Hollande will defeat Mr. Sarkozy and will be elected president of France. Mr. Hollande is not a friend of the emerged alliance between Germany and France that is pushing for the extreme austerity measures. That alliance will most probably break apart and with that the “cohesiveness” of the austerity forces will also break apart. We have been on the record that France faces the worst combination of public and private debt and its banks’ “assets” stand on very questionable ground. As previous commentaries have shown, when we take into account France’s unfunded pension and health care liabilities, its debt-to-GDP ratio exceeds 400%. If Hollande ends up opposing the recently executed EU fiscal compact, then that blow to the Euro will surpass the Greek impact. We would not be surprised if France ends up anchoring its new Franc to the Chinese Yuan (RMB).

The European Stability Treaty on fiscal discipline demanded by Germany and which demands a balanced budget while imposing penalties and sanctions for the “undisciplined” (i.e. questioning the sovereignty of a nation), will be put to a test/referendum in Ireland during the month of May. Nations that do not ratify the Treaty cannot participate in the EU permanent bailout mechanism (which by-the-way is too small and inefficient to rescue the EU nations). If we take into account the first quakes coming from Greece and France, the Irish history of voting No to similar EU-related referendum, and the continuous suffering of the Irish people through deep recession and austerity measures, we should not be surprised if the Irish people vote No. That will be the third blow to the Euro.

However, none of the above three forces may be as lethal as a Spanish need for a bailout. Let’s be straight forward. Unless the ECB commits to targeting the ten-year yields of Spain and Italy a.k.a. unlimited cash to keep the rates below 5.4%, the pressure on the Euro would be such that it will become unsustainable as a currency. The events of the last two weeks are indicative of just that. As soon as the impact of the ECB’s LTRO programs started fading, the tremors started again in Spain. Last week Spanish banks received almost 70% of all loans given out by the ECB to EU banks. The yield on the Spanish bonds has started its upward climbing again, and the earthquake is being felt in Spanish banks as well. The 2011 budget deficit of 8.5% is underestimated due to the fact that it does not reflect the deficits of regional provinces, which now demand that the central government absorbs their health and education expenses. Given an official unemployment rate of 23%, a real estate market that has not fully corrected yet, a shaky banking sector, and a net investment position of -93% (meaning that the amounts the Spanish people owe to foreigners is 93% of the GDP), the room for optimism is limited (if it exists at all).

We anticipate that Spain will be asking for a rescue which will throw the most significant blow to the Euro prospects thus far, and which probably will roll over to Italy and France, creating an unbearable situation for the EU stability/bailout mechanism (ESM) just as it is starting its operations this summer. As the graph below shows a regression model seems to fit well into the data where the higher the negative net investment position is, the greater the yield on the ten-year bond is. Based on that projection, the yields on Spanish and Irish bonds are still too low.

The unbearable lightness of complacency however, should be found in Germany and its Bundesbank’s exposure to the peripheral countries through loans up to €500 billion a.k.a. Target2 program among central banks in the ECB system. The president of the very respectable German IFO Economics Institute, Mr. Hans Werner Sinn has warned that the Bundesbank faces hidden risks of almost $650 billion given the amount of loan and loan guarantees extended to countries such as Spain, Greece, and Portugal. If any of those countries leave the Euro zone, the Bundesbank will have to eat the losses. As the graph above shows, Germany is the only country with a positive net international investment position (accumulated through the years via the trade surpluses it enjoyed selling its products to the likes of Spain, Greece and Portugal). This is an unsustainable situation.

The figure below shows the makeup of this unbalanced position and the hole in Bundesbank’s balance sheet.

The EU-wide trade and central bank imbalances in combination with the culmination of the forces as explained above will force the periphery out of the Euro zone and will expose Germany to huge losses at a time when the only thing that has postponed the disintegration of the EU banking system is the temporary loans of the ECB through the LTRO operations. (As a side note to this force, it should be noted that the paper-collateral pledged to the Bundesbank for the Target2 interbank loans as well as to the ECB for the LTRO operations will become worthless at a time of an exit from the Euro zone).

The buildup of cash flow imbalances among central banks, as shown below is destined to destruct the credit mechanism in the EU and with it the end to the Euro dream as an alternative currency to the dollar will take effect. As those forces take effect the USD will be strengthening as capital will fly to the US.

The analysis above leads us to a conclusion that the Euro may not exist as a currency (or at least not in its present form) in a short four-five year time.

Who is then to replace the Euro as an alternative reserve currency? It should not surprise us that the claims of Chinese officials wanting a greater role for the RMB could materialize as soon as the Euro is clearly destined for collapse. However, for the RMB to play role in the reserve currency mix, it has to be freely floated. Is it surprising then that last week the central bank of China announced the doubling of the trading band for the RMB effective Monday April 16? We anticipate that by the time when the Euro is at the hospice, the RMB would be freely traded as US and China seem to co-determine their trajectories.