Last week we posted the presentation that Chairman Volcker gave at Warwick University approximately thirty-three years ago. We believe that speech set the foundation for a great economic reversal that revitalized the global economy. As we pointed out in the introduction of that post, we believe that we are again at such pivotal moment and the time is ripe for another strategic disintegration that will allow the seed to die in the ground for the fruit to come in the foreseeable future. We will dedicate this and possible one-two more future postings to this idea. Please note that this and any future postings on the subject are nothing but a prelude to such an idea where opposite forces of interdependence and autonomy clash, and where such a clash might be helpful in explaining market movements and moods.

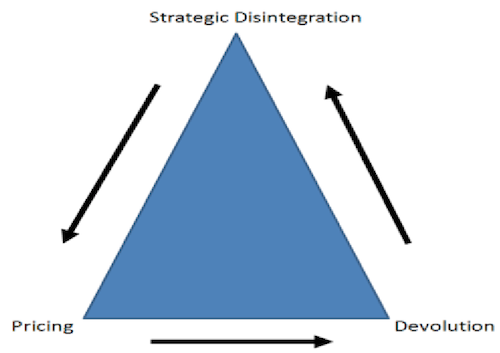

Definition: Strategic disintegration is a process of controlled triangulation that involves two mechanisms, namely pricing and devolution. The former assigns values to assets and the latter dissolves mature states of affair. (e.g. blocks and states of being) The process of strategic disintegration will develop dormant assets to be used in the pricing mechanism for the purpose of turning the triangle upside down (triangle inversion) in order for the latter to support the functions of the society via sustainable credit creation.

The idea behind this framework of thought is that the economy/society arrives from time-to-time at an inflection point. Either the system collapses or has to go through disintegration. Strategic power shifts, energy infusions and transitions (from firewood to coal, from coal to petroleum, and from petroleum to renewable energy via the natgas bridge), policy mistakes, bubbles produced via credit over-extension, misallocation of resources, asymmetrical risks, incompetence and the loss of vision all contribute to that inflection point.

If a responsible global power desires to continue playing a leading role for its sake as well as for the sake of global stability and growth, then it has to foresee that point and initiate – rather than allow catastrophic forces to do so – a process of controlled disintegration. This power must develop and implement viable and sustainable realistic forces of integration rather than utopian dreams. Chairman Volcker in the midst of global chaotic disequilibrium did it with the USD (late 1970s-early 1980s), reversed the trends, allowed the US to continue playing its leading role for another 30 years, set the foundations for a credible fiscal and monetary policy that advanced stability & growth, while it also allowed geopolitical tectonic plates to move in such a manner as to reset the button of global relationships where the unthinkable could materialize for the sake of freedom and prosperity. This was the Chairman’s rallying cry, i.e. to manage the integration rather than allow destructive forces to unravel catastrophe and chaos.

At this stage, it wouldn’t hurt if we start thinking in terms of waves. The latter could be roughly thought as long periods (70-100 years, that some may call them Kondratieff waves) made up of shorter ones (30-40 years) where creative destruction or as we prefer to call it in this framework constructive clearance takes place. Hence we could think of the late 1890s and the beginning of the 20th century as the long wave accompanied by an energy shift (from coal to petroleum) and the beginning of US’s strategic role in global affairs that necessitated the establishment of a central bank. Lack of leadership, lack of disintegration vision, as well as the over-circulation of pounds had undermined the system’s anchor (gold) and hence it was only in the US (that offered the investment/asset opportunities that could be supported by the pricing mechanism) where the credit pyramid could have been inverted to support expansion. The leadership, vision, and anchor’s vacuum allowed credit over-extension in the US. The system disintegrated (uncontrollably) in the 1930s and early 1940s due to depression and war, in order to emerge stronger with the US’s leadership and the dollar-gold standard (Bretton Woods I).

The latter rode its short wave based on strong collateral (US gold reserves) but started its disintegration due to policy mistakes that necessitated its controlled dissolution by the 1970s. The controlled disintegration of the 1970s, allowed Bretton Woods to live for a few decades more, on a different standard (floating exchange rates), that permitted the credit pyramid to stay inverted and support expansion based on assets created whose value had a hard basis rather than a soft one such as an algorithm or paper-assets that are nothing but third-party liabilities.

During the stage where the seed of disintegration had started producing its fruits (vividly seen in the faith that markets exercised because of paper currencies as well as in the markets’ overall performance) a devolution was taking place in the former USSR, while another block was being formed and setting the stage for economic unification (EU). Assets were being freed that could support credit creation while others were pulled together that allowed the foundation of credit creation to perform what has been performed through the ages.

The global monetary system had started running out of hard assets and the prudence was absent to foresee that a controlled disintegration was needed in order to extend life and purpose to the system. The derivatives deregulation disaster shook the inverted pyramid and made it unstable. It was only a matter of time until disaster hit. The boiling point had been reached and no plans to bury the seeds had been made. The system had outlived its life– the symptom was the crisis that started in 2007 – over the course of the long wave, at the point when the global economy is getting ready to move into new energy sources.

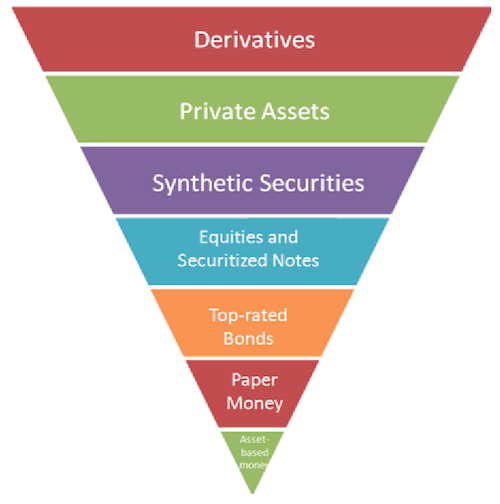

Hence, the inverted pyramid as shown below became unstable, because its base became thinner, while the upper parts became larger and fatter. For the credit creation to keep working, a solid basis is needed of hard real assets. By 2005 the paper-assets dominated the pyramid and the synthetic IOUs were nothing but toxic assets that were in turn collateralized and securitized, creating a monster of $700 trillion worth of derivatives. It was only a time before the cheapening of the collateral standards would awake forces of destruction.

At the current stage the shift of power from the West to the East requires a pricing mechanism that will assign values, while existing structures are dissolved. The market may be anticipating that unstable structures and blocks will be dissolved despite the massive infusion of credit into EU banks. The anticipation of the birth of something new foretells the story of capital flight that will strengthen US structures as the latter are getting ready to greet the new partner in power in the East. In the process of disintegration – which may still seem uncontrolled – new forms of median powers could unfold and emerge in the median terrain of the Middle East and Africa. Such unfolding will allow the awakening of dormant assets that can act as stabilizers in the process of the pyramid’s inversion, while creating wealth mechanisms and mobility ladders for middle class sustainability in those areas.

Speaking of the pricing mechanism (primarily for those things that play a crucial role in credit creation), we need to take into account that prices reflect three fundamental forces, namely: demand and supply; collateral prospects; and speculative premium. The more the commodity/asset is used in the credit creation mechanism the higher its price will be. At the same time, the higher the speculation is (e.g. fear of war with Iran) the higher the price fluctuation will be.

When the system collapses credit freezes and the pyramid turns into its normal position unable to feed the system at large. The collapse of the system implies that the process of deleveraging is injecting deflationary pressures which if sustained could lead to depression and the uncontrolled disintegration of the economy and the society at large. The system may still be susceptible to controlled disintegration as long as the strategic moves that will be implemented allow devolution and prices to do their job.

We only hope that the new phase of managing integration will unveil strategic forces of clearance and capital formation.

Strategic Disintegration: Part II

Author : John E. Charalambakis

Date : March 8, 2012

Last week we posted the presentation that Chairman Volcker gave at Warwick University approximately thirty-three years ago. We believe that speech set the foundation for a great economic reversal that revitalized the global economy. As we pointed out in the introduction of that post, we believe that we are again at such pivotal moment and the time is ripe for another strategic disintegration that will allow the seed to die in the ground for the fruit to come in the foreseeable future. We will dedicate this and possible one-two more future postings to this idea. Please note that this and any future postings on the subject are nothing but a prelude to such an idea where opposite forces of interdependence and autonomy clash, and where such a clash might be helpful in explaining market movements and moods.

Definition: Strategic disintegration is a process of controlled triangulation that involves two mechanisms, namely pricing and devolution. The former assigns values to assets and the latter dissolves mature states of affair. (e.g. blocks and states of being) The process of strategic disintegration will develop dormant assets to be used in the pricing mechanism for the purpose of turning the triangle upside down (triangle inversion) in order for the latter to support the functions of the society via sustainable credit creation.

The idea behind this framework of thought is that the economy/society arrives from time-to-time at an inflection point. Either the system collapses or has to go through disintegration. Strategic power shifts, energy infusions and transitions (from firewood to coal, from coal to petroleum, and from petroleum to renewable energy via the natgas bridge), policy mistakes, bubbles produced via credit over-extension, misallocation of resources, asymmetrical risks, incompetence and the loss of vision all contribute to that inflection point.

If a responsible global power desires to continue playing a leading role for its sake as well as for the sake of global stability and growth, then it has to foresee that point and initiate – rather than allow catastrophic forces to do so – a process of controlled disintegration. This power must develop and implement viable and sustainable realistic forces of integration rather than utopian dreams. Chairman Volcker in the midst of global chaotic disequilibrium did it with the USD (late 1970s-early 1980s), reversed the trends, allowed the US to continue playing its leading role for another 30 years, set the foundations for a credible fiscal and monetary policy that advanced stability & growth, while it also allowed geopolitical tectonic plates to move in such a manner as to reset the button of global relationships where the unthinkable could materialize for the sake of freedom and prosperity. This was the Chairman’s rallying cry, i.e. to manage the integration rather than allow destructive forces to unravel catastrophe and chaos.

At this stage, it wouldn’t hurt if we start thinking in terms of waves. The latter could be roughly thought as long periods (70-100 years, that some may call them Kondratieff waves) made up of shorter ones (30-40 years) where creative destruction or as we prefer to call it in this framework constructive clearance takes place. Hence we could think of the late 1890s and the beginning of the 20th century as the long wave accompanied by an energy shift (from coal to petroleum) and the beginning of US’s strategic role in global affairs that necessitated the establishment of a central bank. Lack of leadership, lack of disintegration vision, as well as the over-circulation of pounds had undermined the system’s anchor (gold) and hence it was only in the US (that offered the investment/asset opportunities that could be supported by the pricing mechanism) where the credit pyramid could have been inverted to support expansion. The leadership, vision, and anchor’s vacuum allowed credit over-extension in the US. The system disintegrated (uncontrollably) in the 1930s and early 1940s due to depression and war, in order to emerge stronger with the US’s leadership and the dollar-gold standard (Bretton Woods I).

The latter rode its short wave based on strong collateral (US gold reserves) but started its disintegration due to policy mistakes that necessitated its controlled dissolution by the 1970s. The controlled disintegration of the 1970s, allowed Bretton Woods to live for a few decades more, on a different standard (floating exchange rates), that permitted the credit pyramid to stay inverted and support expansion based on assets created whose value had a hard basis rather than a soft one such as an algorithm or paper-assets that are nothing but third-party liabilities.

During the stage where the seed of disintegration had started producing its fruits (vividly seen in the faith that markets exercised because of paper currencies as well as in the markets’ overall performance) a devolution was taking place in the former USSR, while another block was being formed and setting the stage for economic unification (EU). Assets were being freed that could support credit creation while others were pulled together that allowed the foundation of credit creation to perform what has been performed through the ages.

The global monetary system had started running out of hard assets and the prudence was absent to foresee that a controlled disintegration was needed in order to extend life and purpose to the system. The derivatives deregulation disaster shook the inverted pyramid and made it unstable. It was only a matter of time until disaster hit. The boiling point had been reached and no plans to bury the seeds had been made. The system had outlived its life– the symptom was the crisis that started in 2007 – over the course of the long wave, at the point when the global economy is getting ready to move into new energy sources.

Hence, the inverted pyramid as shown below became unstable, because its base became thinner, while the upper parts became larger and fatter. For the credit creation to keep working, a solid basis is needed of hard real assets. By 2005 the paper-assets dominated the pyramid and the synthetic IOUs were nothing but toxic assets that were in turn collateralized and securitized, creating a monster of $700 trillion worth of derivatives. It was only a time before the cheapening of the collateral standards would awake forces of destruction.

At the current stage the shift of power from the West to the East requires a pricing mechanism that will assign values, while existing structures are dissolved. The market may be anticipating that unstable structures and blocks will be dissolved despite the massive infusion of credit into EU banks. The anticipation of the birth of something new foretells the story of capital flight that will strengthen US structures as the latter are getting ready to greet the new partner in power in the East. In the process of disintegration – which may still seem uncontrolled – new forms of median powers could unfold and emerge in the median terrain of the Middle East and Africa. Such unfolding will allow the awakening of dormant assets that can act as stabilizers in the process of the pyramid’s inversion, while creating wealth mechanisms and mobility ladders for middle class sustainability in those areas.

Speaking of the pricing mechanism (primarily for those things that play a crucial role in credit creation), we need to take into account that prices reflect three fundamental forces, namely: demand and supply; collateral prospects; and speculative premium. The more the commodity/asset is used in the credit creation mechanism the higher its price will be. At the same time, the higher the speculation is (e.g. fear of war with Iran) the higher the price fluctuation will be.

When the system collapses credit freezes and the pyramid turns into its normal position unable to feed the system at large. The collapse of the system implies that the process of deleveraging is injecting deflationary pressures which if sustained could lead to depression and the uncontrolled disintegration of the economy and the society at large. The system may still be susceptible to controlled disintegration as long as the strategic moves that will be implemented allow devolution and prices to do their job.

We only hope that the new phase of managing integration will unveil strategic forces of clearance and capital formation.