It has been a week now since the Japanese markets have been exhibiting significant volatility. What we have been observing is that both equities and bonds show signs of turmoil. This may continue, however we anticipate that the Japanese stock market will end up the year higher than where it stands now. What the Japanese markets prognosticate is the end of an era marked with the bond market halleluiahs and the beginning of a period which we can call the demarcation period, where bonds will be seen for what they truly are, i.e. third-party liabilities.

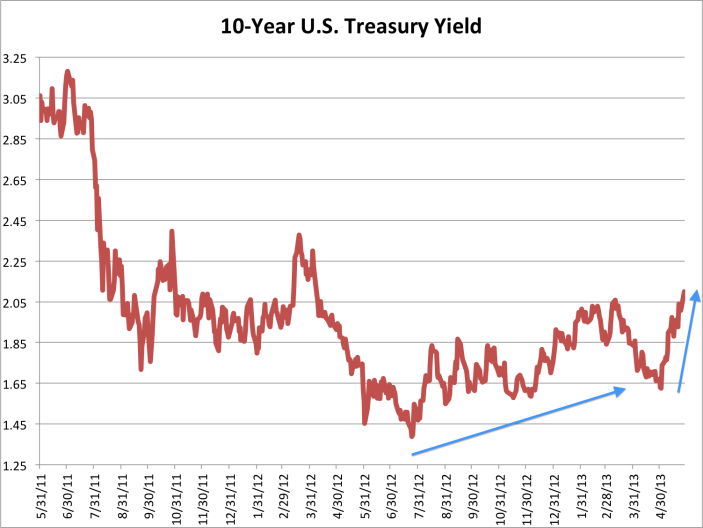

Central bankers and the market overall have started sending signals that the debt absorption capacity has been reaching an inflection point. To that we also need to add the fact that the fear premium is declining, which facts lead us to conclude that the flow of funds from bonds to equities will sustain the global rally in stocks, at least until year’s end. The spikes in government bond yields (see graphs below) may taper temporarily in the next few weeks, but we anticipate them to continue in the foreseeable future. As they rise, the spread between the LIBOR rate and that of the three-month Treasuries will remain flat (it may even drop below its current level) given that liquidity will be rising rather than dropping, and the flatness of this difference (a.k.a. the TED curve) will keep boosting equities’ prospects.

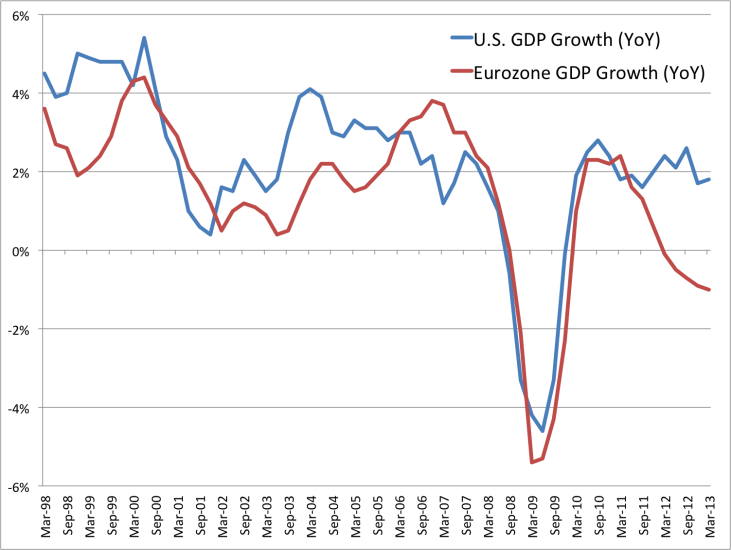

Such increases in the yield curves are expected to boost confidence in the global economy even more, which boosts will advance spending and hopefully capital creation while closing the growth gap between the US and the EU as shown below. The fiscal drag from lower government spending and higher taxes do not seem to be affecting the current trajectory. The rising interest rates may be viewed as healthy signs and that will contribute to higher levels of bank lending activity, increasing the money multiplier and allowing higher profit margins in the financial sector (as it seeks to build up its capital and collateral base).

If such demarcation is done without taking into account the potential losses in the bond portfolios, then one-percentage point increases in the yields can potentially wipe out between 8-10% of Tier-One capital in big banks. It is our belief that unless those “too big-to-save” institutions are broken up, the undergoing demarcation plants the seeds of the next systemic crisis which might hit the global markets within 24-36 months, especially when we take into account the debt and other macro-fundamentals, the global unfunded liabilities, the already shaky balance sheets of the EU banking sector, and the EU unemployment rates.

For a long time now, we have been stating that the collateralization of paper assets and the re-hypothecation of dubious “assets” along with the derivatives time-bomb and the shadow banking monetization schemes are undermining true wealth creation. It is very sad to observe that no steps have been taken yet to stop this massive inversion of the collateralization process. It seems that speculating in the void is now taking a new phase.

Speculating into the Void: The Demarcation of Absorption Capacity

Author : John E. Charalambakis

Date : May 30, 2013

It has been a week now since the Japanese markets have been exhibiting significant volatility. What we have been observing is that both equities and bonds show signs of turmoil. This may continue, however we anticipate that the Japanese stock market will end up the year higher than where it stands now. What the Japanese markets prognosticate is the end of an era marked with the bond market halleluiahs and the beginning of a period which we can call the demarcation period, where bonds will be seen for what they truly are, i.e. third-party liabilities.

Central bankers and the market overall have started sending signals that the debt absorption capacity has been reaching an inflection point. To that we also need to add the fact that the fear premium is declining, which facts lead us to conclude that the flow of funds from bonds to equities will sustain the global rally in stocks, at least until year’s end. The spikes in government bond yields (see graphs below) may taper temporarily in the next few weeks, but we anticipate them to continue in the foreseeable future. As they rise, the spread between the LIBOR rate and that of the three-month Treasuries will remain flat (it may even drop below its current level) given that liquidity will be rising rather than dropping, and the flatness of this difference (a.k.a. the TED curve) will keep boosting equities’ prospects.

Such increases in the yield curves are expected to boost confidence in the global economy even more, which boosts will advance spending and hopefully capital creation while closing the growth gap between the US and the EU as shown below. The fiscal drag from lower government spending and higher taxes do not seem to be affecting the current trajectory. The rising interest rates may be viewed as healthy signs and that will contribute to higher levels of bank lending activity, increasing the money multiplier and allowing higher profit margins in the financial sector (as it seeks to build up its capital and collateral base).

If such demarcation is done without taking into account the potential losses in the bond portfolios, then one-percentage point increases in the yields can potentially wipe out between 8-10% of Tier-One capital in big banks. It is our belief that unless those “too big-to-save” institutions are broken up, the undergoing demarcation plants the seeds of the next systemic crisis which might hit the global markets within 24-36 months, especially when we take into account the debt and other macro-fundamentals, the global unfunded liabilities, the already shaky balance sheets of the EU banking sector, and the EU unemployment rates.

For a long time now, we have been stating that the collateralization of paper assets and the re-hypothecation of dubious “assets” along with the derivatives time-bomb and the shadow banking monetization schemes are undermining true wealth creation. It is very sad to observe that no steps have been taken yet to stop this massive inversion of the collateralization process. It seems that speculating in the void is now taking a new phase.