One of the main issues debated at the Davos conference this week is the possibility of a new trade regime, as President Trump takes office. Discontent with globalization and the talk – over a number of years – by the President himself, as well as by his designated officials (Wilbur Ross, Peter Navarro, and Robert Lighthizer) on matters related to trade, leave little doubt that a new trade policy will be unfolded. It seems that the strategy that the US has followed since the end of WWII is coming to an end.

No one can deny that free trade can cost jobs, since those who can offer better prices and services prevail at the expense of those who are offering uncompetitive prices and fewer services. A protectionist policy which may coincide with nationalist politics and a misinformed industrial policy may not be the best prescription for long term growth. It could produce some headlines and temporarily uplift growth, but in the long term it always backfires and creates a myriad of problems.

If such change were to happen, then in the medium term capital will be misallocated. As capital is misallocated, distortions take place in the markets (including financial and real-economy markets). As distortions are being materialized, long term productivity suffers, and as the latter is unfolded profits decline and with them in the medium and long term growth suffers and unemployment increases, while goods and services may end up costing more. All in all, the tail wind may end up becoming a headwind if desired regime change is not done using commercial diplomacy.

It is one thing to use commercial diplomacy (e.g. tactical moves on tariffs in order to open foreign markets) and completely another thing to pursue a protectionist policy with targeted punitive tariffs that could lead to trade conflicts and changing alliances. Hence the risk is that this trade regime change may create turbulence and issues not only in the commercial sphere but also in the geopolitical one, as alliances change.

As global investment strategies (including foreign investments) are called into question, supply chains will be affected and as the latter try to adjust in the new era, prices get affected, including exchange rates. The forthcoming changes in the trade regime may become the seeds of market and exchange rate volatility. This is due to the fact that protection for vulnerable industries and workers cannot be found in trade walls which lower standards and efficiency, but rather in open seas.

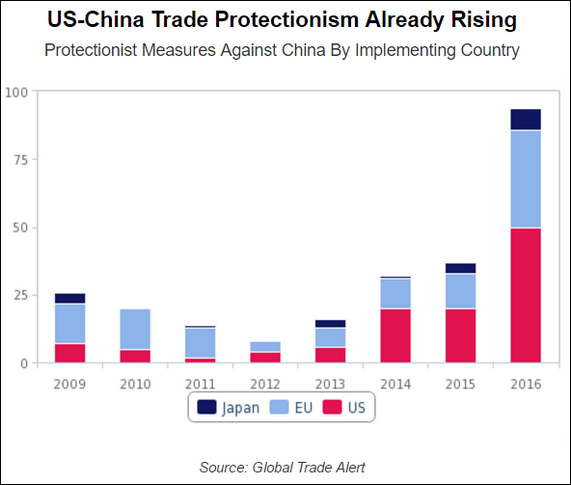

It is quite troubling that as the graph below shows, trade protectionism is already on the rise.

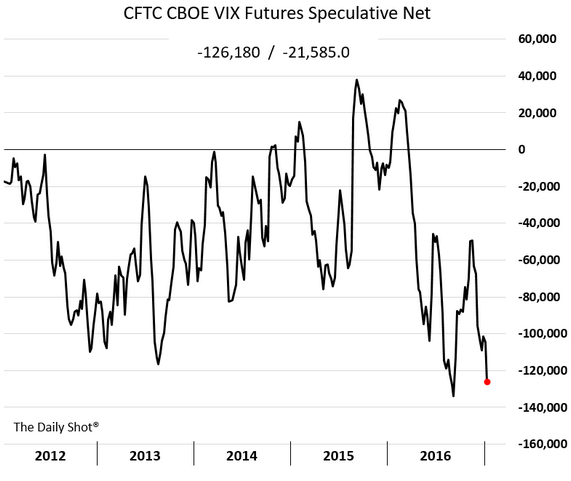

Here are two possible implications for the markets if the shifting regime produces unpleasant surprises: First, market volatility will reverse its downward trend as exhibited below. Such reversal, may lead to a market correction.

Second, if the shifting regime is accompanied by currency volatility, then a market correction could turn into a secular bear which would necessitate hedging measures beyond the normal ones.

Allow me to close this commentary by quoting Charles Montesquieu who in his work titled “The Spirit of Laws” he declares that, “commerce is a cure for the most destructive prejudices.” Later in the same book Montesquieu will declare “peace is the natural effect of trade. Two nations who traffic with each other become reciprocally dependent for, if one has an interest in buying, the other has an interest in selling and thus their union is founded on their mutual necessities.”

Montesquieu teaches us that trade among nations advances justice. I hope we will be wise to heed his voice.

Shifting Regimes and Changing Winds: Reflections on Trade and Market Implications at the Dawn of a New Era

Author : John E. Charalambakis

Date : January 19, 2017

One of the main issues debated at the Davos conference this week is the possibility of a new trade regime, as President Trump takes office. Discontent with globalization and the talk – over a number of years – by the President himself, as well as by his designated officials (Wilbur Ross, Peter Navarro, and Robert Lighthizer) on matters related to trade, leave little doubt that a new trade policy will be unfolded. It seems that the strategy that the US has followed since the end of WWII is coming to an end.

No one can deny that free trade can cost jobs, since those who can offer better prices and services prevail at the expense of those who are offering uncompetitive prices and fewer services. A protectionist policy which may coincide with nationalist politics and a misinformed industrial policy may not be the best prescription for long term growth. It could produce some headlines and temporarily uplift growth, but in the long term it always backfires and creates a myriad of problems.

If such change were to happen, then in the medium term capital will be misallocated. As capital is misallocated, distortions take place in the markets (including financial and real-economy markets). As distortions are being materialized, long term productivity suffers, and as the latter is unfolded profits decline and with them in the medium and long term growth suffers and unemployment increases, while goods and services may end up costing more. All in all, the tail wind may end up becoming a headwind if desired regime change is not done using commercial diplomacy.

It is one thing to use commercial diplomacy (e.g. tactical moves on tariffs in order to open foreign markets) and completely another thing to pursue a protectionist policy with targeted punitive tariffs that could lead to trade conflicts and changing alliances. Hence the risk is that this trade regime change may create turbulence and issues not only in the commercial sphere but also in the geopolitical one, as alliances change.

As global investment strategies (including foreign investments) are called into question, supply chains will be affected and as the latter try to adjust in the new era, prices get affected, including exchange rates. The forthcoming changes in the trade regime may become the seeds of market and exchange rate volatility. This is due to the fact that protection for vulnerable industries and workers cannot be found in trade walls which lower standards and efficiency, but rather in open seas.

It is quite troubling that as the graph below shows, trade protectionism is already on the rise.

Here are two possible implications for the markets if the shifting regime produces unpleasant surprises: First, market volatility will reverse its downward trend as exhibited below. Such reversal, may lead to a market correction.

Second, if the shifting regime is accompanied by currency volatility, then a market correction could turn into a secular bear which would necessitate hedging measures beyond the normal ones.

Allow me to close this commentary by quoting Charles Montesquieu who in his work titled “The Spirit of Laws” he declares that, “commerce is a cure for the most destructive prejudices.” Later in the same book Montesquieu will declare “peace is the natural effect of trade. Two nations who traffic with each other become reciprocally dependent for, if one has an interest in buying, the other has an interest in selling and thus their union is founded on their mutual necessities.”

Montesquieu teaches us that trade among nations advances justice. I hope we will be wise to heed his voice.