As previously noted from this page, I believe that we are entering into a period where the forces of market risk, volatility, liquidity, and credit risk encompass a cycle whose velocity may change much more frequently than during any other period in financial history. This is due to three main reasons, namely: the lack of an anchor in the global credit creation system; the frequency of crises since 1971; and the explosion of debt instruments that has destabilized the global economic and financial system which moves from a state of unstable equilibrium to a state of stable disequilibrium. It is the argument of this commentary that the frequency of those moves will be exacerbated in the near future (however, this is not the same as arguing that volatility will increase). We do not anticipate any particular trend and thus we echo von Mises phrase “It is impossible to discover any rhythmical fluctuation in the general trend itself”.

It is essential that we cannot understate the role that credit plays in today’s financial and real economy. Credit is like oxygen in today’s economy. Tightening credit standards at the wrong point in the macro-cycle could asphyxiate an economy. Similarly, loosening credit standards at the wrong turn in the macro-cycle could drunken the economy and create financial dislocations that eventually will hit the real economy.

In the last several weeks, prominent analysts have been focusing on the sharp selloff in US corporate credit, which in turn has pushed spreads higher. Their conclusion is that the credit cycle is approaching its end and a downturn in the economy could be imminent. In the last commentary I wrote about the rising spreads (http://stage.blacksummitfg.com/3236); however, the emphasis was on the macro-assessment. The difference between those analysts and our analysis is threefold: First, it is our opinion that the trillions of bank reserves generated through the QEs – and which never became money supply – is a tool that dwarfs any historical similarities. Second, the high yield credit contraction is necessary for refinancing existing deals, and, as we wrote in the last commentary, such a healthy retreat is essential for what it is argued in this commentary i.e. that upswing and downturn cycles will interchange more frequently in the future.

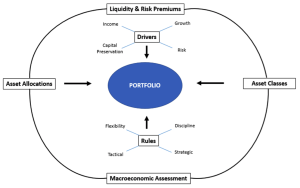

What does that mean for portfolio structure? It is our belief that a macroeconomic assessment should drive portfolio construction, which in turn should incorporate risk and liquidity preferences, before the asset classes are selected. The schematic below shows that process (click to enlarge).

The portfolio construction should be guided by rules and drivers as shown above. The former should discipline investors in their chosen strategies, while should retain enough flexibility so that tactical rebalances could take place based upon judgment whose compass will also be rules-based. The latter (drivers) depend upon the profile of the investor and are mostly guided by the appetite for risk.

The overall construction cannot be but macro-based. The judgment of the managers would be called into a question if the macro assessment is wrong. If that were to be the case, that would imply that managers cannot understand the direction of the price of money whose regime shifts determines the credit cycle. To give an example: if in the 1970s the manager misjudged the direction of the regime of the price of money that would mean that s/he would have stayed in bonds when the bond market was getting killed. Or, would mean that s/he would have stayed in equities in 2007 when the market was screaming of malinvestments.

Passivity in investment style is becoming passé, as we are entering the era where the regime of the price of money may experience short-lived cycles. Credit cycles shift as the regime of the price of money changes direction, and we cannot exclude the possibility that regime change may need to be short lived for the inverted credit pyramid to remain in a state of stable disequilibrium.

As the macro assessment is completed, the asset allocation cannot be done independently from risk premium and liquidity analysis. No matter whether the allocation is a classic one (like 60% in equities and 40% in bonds) or follows a risk parity approach, the required risk premium and how liquid the investment would be should be the compasses that allocate the assets. As for the asset classes chosen, diversification with conviction (and not diversification for the sake of diversification) is needed in order to achieve portfolio alpha and the excess returns required in order to grow the portfolio and face the challenges of tomorrow.

What should then guide our judgment calls? Let me answer that by quoting Robert Zimmerman (a.k.a. Bob Dylan in his song “Shelter from the Storm”:

Now there’s a wall between us something there’s been lost

I took too much for granted, I got my signals crossed

Just to think that it all began on an uneventful morn

“Come in,” she said,

“I’ll give you shelter from the storm.”

Well the deputy walks on hard nails and the preacher rides a mount

But nothing really matters much it’s doom alone that counts

And the one-eyed undertaker he blows a futile horn

“Come in,” she said,

“I’ll give you shelter from the storm.”

I’ve heard newborn babies wailing like a mourning dove

And old men with broken teeth stranded without love

Do I understand your question man, is it hopeless and forlorn?

“Come in,” she said,

“I’ll give you shelter from the storm.”

Shifting Cycles and Portfolio Structures: Hand Me Another Brick to Build a Shelter From the Storm

Author : John E. Charalambakis

Date : October 25, 2015

As previously noted from this page, I believe that we are entering into a period where the forces of market risk, volatility, liquidity, and credit risk encompass a cycle whose velocity may change much more frequently than during any other period in financial history. This is due to three main reasons, namely: the lack of an anchor in the global credit creation system; the frequency of crises since 1971; and the explosion of debt instruments that has destabilized the global economic and financial system which moves from a state of unstable equilibrium to a state of stable disequilibrium. It is the argument of this commentary that the frequency of those moves will be exacerbated in the near future (however, this is not the same as arguing that volatility will increase). We do not anticipate any particular trend and thus we echo von Mises phrase “It is impossible to discover any rhythmical fluctuation in the general trend itself”.

It is essential that we cannot understate the role that credit plays in today’s financial and real economy. Credit is like oxygen in today’s economy. Tightening credit standards at the wrong point in the macro-cycle could asphyxiate an economy. Similarly, loosening credit standards at the wrong turn in the macro-cycle could drunken the economy and create financial dislocations that eventually will hit the real economy.

In the last several weeks, prominent analysts have been focusing on the sharp selloff in US corporate credit, which in turn has pushed spreads higher. Their conclusion is that the credit cycle is approaching its end and a downturn in the economy could be imminent. In the last commentary I wrote about the rising spreads (http://stage.blacksummitfg.com/3236); however, the emphasis was on the macro-assessment. The difference between those analysts and our analysis is threefold: First, it is our opinion that the trillions of bank reserves generated through the QEs – and which never became money supply – is a tool that dwarfs any historical similarities. Second, the high yield credit contraction is necessary for refinancing existing deals, and, as we wrote in the last commentary, such a healthy retreat is essential for what it is argued in this commentary i.e. that upswing and downturn cycles will interchange more frequently in the future.

What does that mean for portfolio structure? It is our belief that a macroeconomic assessment should drive portfolio construction, which in turn should incorporate risk and liquidity preferences, before the asset classes are selected. The schematic below shows that process (click to enlarge).

The portfolio construction should be guided by rules and drivers as shown above. The former should discipline investors in their chosen strategies, while should retain enough flexibility so that tactical rebalances could take place based upon judgment whose compass will also be rules-based. The latter (drivers) depend upon the profile of the investor and are mostly guided by the appetite for risk.

The overall construction cannot be but macro-based. The judgment of the managers would be called into a question if the macro assessment is wrong. If that were to be the case, that would imply that managers cannot understand the direction of the price of money whose regime shifts determines the credit cycle. To give an example: if in the 1970s the manager misjudged the direction of the regime of the price of money that would mean that s/he would have stayed in bonds when the bond market was getting killed. Or, would mean that s/he would have stayed in equities in 2007 when the market was screaming of malinvestments.

Passivity in investment style is becoming passé, as we are entering the era where the regime of the price of money may experience short-lived cycles. Credit cycles shift as the regime of the price of money changes direction, and we cannot exclude the possibility that regime change may need to be short lived for the inverted credit pyramid to remain in a state of stable disequilibrium.

As the macro assessment is completed, the asset allocation cannot be done independently from risk premium and liquidity analysis. No matter whether the allocation is a classic one (like 60% in equities and 40% in bonds) or follows a risk parity approach, the required risk premium and how liquid the investment would be should be the compasses that allocate the assets. As for the asset classes chosen, diversification with conviction (and not diversification for the sake of diversification) is needed in order to achieve portfolio alpha and the excess returns required in order to grow the portfolio and face the challenges of tomorrow.

What should then guide our judgment calls? Let me answer that by quoting Robert Zimmerman (a.k.a. Bob Dylan in his song “Shelter from the Storm”:

Now there’s a wall between us something there’s been lost

I took too much for granted, I got my signals crossed

Just to think that it all began on an uneventful morn

“Come in,” she said,

“I’ll give you shelter from the storm.”

Well the deputy walks on hard nails and the preacher rides a mount

But nothing really matters much it’s doom alone that counts

And the one-eyed undertaker he blows a futile horn

“Come in,” she said,

“I’ll give you shelter from the storm.”

I’ve heard newborn babies wailing like a mourning dove

And old men with broken teeth stranded without love

Do I understand your question man, is it hopeless and forlorn?

“Come in,” she said,

“I’ll give you shelter from the storm.”