First of all, a special note of thanks to a good friend (IKM) who recently reminded me of the concept of Seisachtheia. Thus, a historical reference is needed first (please note that this is not a diatribe on the concept, and I am only using the pertinent clauses of that legislation).

Solon, was the most famous of the Athenian lawmakers. By the 6th century BC, the debts had enslaved many Athenians with severe consequences for social and economic stability. Solon, proposed and the Athenian democracy adopted the concept of debt relief a.k.a. Seisachtheia for those whose collateral assets fell below the amounts due/loans. At the same time personal enslavement was forbidden and excessive capital (land) accumulation was prevented by institutional means, including taxes. Of course, about 1000 years prior to Seisachtheia, Moses had proposed the concept of Jubilee, according to which land was supposed to be returned to the original owners and all debts to be cancelled every fifty years. Thus, we could say that Seisachtheia was the elevated form of debt relief originally proposed by Moses in order to sustain stability and smooth the business cycles.

While we have been somehow skeptical of the Fed’s new move (QE2 as recent commentaries have articulated, in this commentary we will come to the defense of the Fed, contingent upon a counterfactual assumption discussed below.

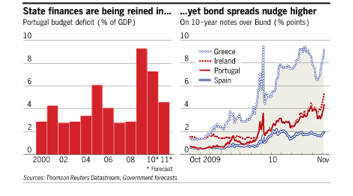

Our assumption is as follows: The Fed – without having a “magic wand” – has to take into account the possibility of haircuts in financial instruments. Please recall that as our November newsletter discusses (and as we have been on record regarding those for some years now) these financial instruments project liabilities in the hundreds of trillions of dollars, making the credit structure unsustainable. An unsustainable credit structure will either collapse or will look like the tower of Pisa. Therefore, the possibility – if not the necessity – for haircuts in those instruments is viable and real. Such haircuts in the face value of those instruments could trigger financial tremors, shake confidence in markets that are trying to recover, reduce liquidity, and lower paper “wealth”, hence risking another global recession. The graph below with the rising spreads between German bonds and peripheral countries’ bonds is only indicative of the possible haircuts (please note that we are not necessarily referring to sovereign nations bonds’ haircuts, and we only use the graph as indicative of those risks).

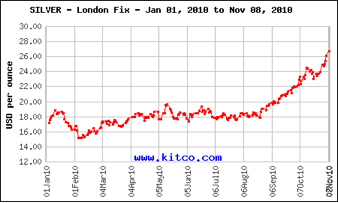

The Fed in its QE2 actions is taking pre-cautionary/pre-emptive measures against such risks. If haircuts materialize in the next few months and/or during the first half of 2011, the Fed via its QE2 will have built a fence against drains of liquidity while fending the largest economy on earth to stand on its feet when the haircuts are taken. Thus, while Germany, China, Japan, Russia, and Brazil are complaining, if that were the Fed’s thinking, then they should be happy that such measures were taken now. Therefore, we are of the opinion that hard assets are appreciating significantly in the last several days, not because they are afraid of inflation and/or the dollar’s depreciation, but rather because they have come to appreciate what a real asset is. It is a demand-driven appreciation out of an awakening that paper assets cannot sustain a complex global trade and monetary system.

In our terminology, an asset is a claim on a stream of income generated by capital. The latter is defined as the ability to extract value out of existing or newly created or awaken resources. In our framework of thinking, bare land that is used to produce products/leases etc. is capital that generates streams of incomes. The latter may be used for consumption, capital investments, and business opportunities which in turn will create new sources/awakenings of capital. In the process of this capital formation mechanism wealth is created which will become the collateral base for a functional monetary system.

However, if the latter is without an anchor (as is our current system since August 15, 1971 when the dollar delinked from gold, starting what is known as Bretton Woods II, BWII) the system is vulnerable to crises (oil, debt, bond, stock, banking, derivatives, housing, etc). We believe that the era of BWII is coming to an end. A new era is emerging, and this is evident by the prominent role of the G-20. We call this new era the “New Silk Road”. We briefly wrote and introduced the concept in the last few months. At this point we will only add what emerged as a surprise in the market; that is, the call by Robert Zoellick, President of the World Bank, that the new era will have an anchor based on some form of gold standard (See Financial Times’ main article on Nov. 8).

The new basis of the system will have four currencies (dollar, yuan, euro, yen) used as international reserves currencies (with the dollar most prominent among them). In our commentaries in the last few weeks we have discussed these developments and the November newsletter articulated on that possibility too, cautioning of course that such a development without an anchor may prove to be too problematic and possibly catastrophic. We were delighted to see that what is contemplated will be based on a hard anchor. Gold and/or a basket of hard assets would be what could bring stability, create capital, awaken assets, achieve growth, and advance prosperity around the globe. In the new system hard assets that form the elements of capital and wealth creation (the basket of hard assets that will anchor currencies and monetary values) will be the basis of intrinsic value, therefore, the demand for such hard assets is not out of fear of inflation but rather should be viewed as a healthy reawakening of the global monetary system.

In the process we anticipate the yuan to appreciate significantly and the strategic alliance that is emerging between the US and India to advance the interests of both; therefore, becoming the cornerstone of the emerging morning.

Ode to hard assets!

Seisachtheia Meets the Markets: The Fed, the Yuan, and India

Author : John E. Charalambakis

Date : November 10, 2010

First of all, a special note of thanks to a good friend (IKM) who recently reminded me of the concept of Seisachtheia. Thus, a historical reference is needed first (please note that this is not a diatribe on the concept, and I am only using the pertinent clauses of that legislation).

Solon, was the most famous of the Athenian lawmakers. By the 6th century BC, the debts had enslaved many Athenians with severe consequences for social and economic stability. Solon, proposed and the Athenian democracy adopted the concept of debt relief a.k.a. Seisachtheia for those whose collateral assets fell below the amounts due/loans. At the same time personal enslavement was forbidden and excessive capital (land) accumulation was prevented by institutional means, including taxes. Of course, about 1000 years prior to Seisachtheia, Moses had proposed the concept of Jubilee, according to which land was supposed to be returned to the original owners and all debts to be cancelled every fifty years. Thus, we could say that Seisachtheia was the elevated form of debt relief originally proposed by Moses in order to sustain stability and smooth the business cycles.

While we have been somehow skeptical of the Fed’s new move (QE2 as recent commentaries have articulated, in this commentary we will come to the defense of the Fed, contingent upon a counterfactual assumption discussed below.

Our assumption is as follows: The Fed – without having a “magic wand” – has to take into account the possibility of haircuts in financial instruments. Please recall that as our November newsletter discusses (and as we have been on record regarding those for some years now) these financial instruments project liabilities in the hundreds of trillions of dollars, making the credit structure unsustainable. An unsustainable credit structure will either collapse or will look like the tower of Pisa. Therefore, the possibility – if not the necessity – for haircuts in those instruments is viable and real. Such haircuts in the face value of those instruments could trigger financial tremors, shake confidence in markets that are trying to recover, reduce liquidity, and lower paper “wealth”, hence risking another global recession. The graph below with the rising spreads between German bonds and peripheral countries’ bonds is only indicative of the possible haircuts (please note that we are not necessarily referring to sovereign nations bonds’ haircuts, and we only use the graph as indicative of those risks).

The Fed in its QE2 actions is taking pre-cautionary/pre-emptive measures against such risks. If haircuts materialize in the next few months and/or during the first half of 2011, the Fed via its QE2 will have built a fence against drains of liquidity while fending the largest economy on earth to stand on its feet when the haircuts are taken. Thus, while Germany, China, Japan, Russia, and Brazil are complaining, if that were the Fed’s thinking, then they should be happy that such measures were taken now. Therefore, we are of the opinion that hard assets are appreciating significantly in the last several days, not because they are afraid of inflation and/or the dollar’s depreciation, but rather because they have come to appreciate what a real asset is. It is a demand-driven appreciation out of an awakening that paper assets cannot sustain a complex global trade and monetary system.

In our terminology, an asset is a claim on a stream of income generated by capital. The latter is defined as the ability to extract value out of existing or newly created or awaken resources. In our framework of thinking, bare land that is used to produce products/leases etc. is capital that generates streams of incomes. The latter may be used for consumption, capital investments, and business opportunities which in turn will create new sources/awakenings of capital. In the process of this capital formation mechanism wealth is created which will become the collateral base for a functional monetary system.

However, if the latter is without an anchor (as is our current system since August 15, 1971 when the dollar delinked from gold, starting what is known as Bretton Woods II, BWII) the system is vulnerable to crises (oil, debt, bond, stock, banking, derivatives, housing, etc). We believe that the era of BWII is coming to an end. A new era is emerging, and this is evident by the prominent role of the G-20. We call this new era the “New Silk Road”. We briefly wrote and introduced the concept in the last few months. At this point we will only add what emerged as a surprise in the market; that is, the call by Robert Zoellick, President of the World Bank, that the new era will have an anchor based on some form of gold standard (See Financial Times’ main article on Nov. 8).

The new basis of the system will have four currencies (dollar, yuan, euro, yen) used as international reserves currencies (with the dollar most prominent among them). In our commentaries in the last few weeks we have discussed these developments and the November newsletter articulated on that possibility too, cautioning of course that such a development without an anchor may prove to be too problematic and possibly catastrophic. We were delighted to see that what is contemplated will be based on a hard anchor. Gold and/or a basket of hard assets would be what could bring stability, create capital, awaken assets, achieve growth, and advance prosperity around the globe. In the new system hard assets that form the elements of capital and wealth creation (the basket of hard assets that will anchor currencies and monetary values) will be the basis of intrinsic value, therefore, the demand for such hard assets is not out of fear of inflation but rather should be viewed as a healthy reawakening of the global monetary system.

In the process we anticipate the yuan to appreciate significantly and the strategic alliance that is emerging between the US and India to advance the interests of both; therefore, becoming the cornerstone of the emerging morning.

Ode to hard assets!