Sector Focus: Semiconductors

Sector Focus: Semiconductors

-

Author : Ken Rietz

Date : December 6, 2017

Over the course of the next several weeks, we will be discussing our views on particular sectors which in our opinion may present some challenges and opportunities. This week we present an overview of the semiconductor sector in the context of their applications. Several topics that will greatly influence this sector but which are far enough away to have little impact in 2018, such as quantum computing, are not covered here.

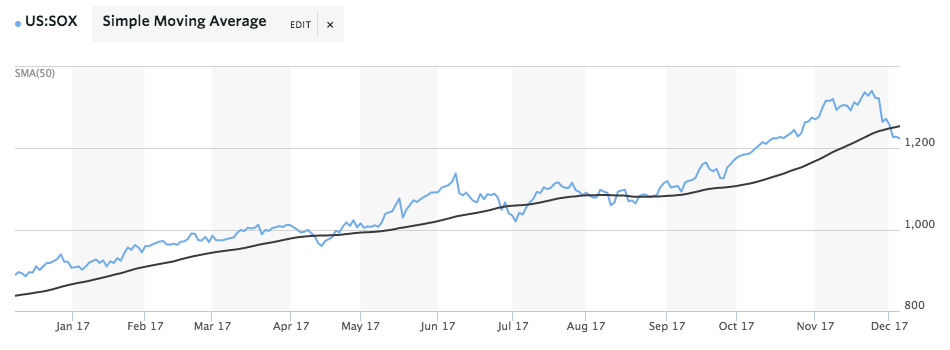

The semiconductor sector is a sector that has shown enormous growth over the course of the last year, as shown by the graph below of the Philadelphia Semiconductor Index, and is expected to do well in the medium- and long-term based on the sector’s trajectory as discussed below.

Source: MarketWatch; PHLX Semiconductor Index

We begin with the field that used to dominate semiconductor sales. Global personal computer sales are dropping, as people find that their tablets are capable of doing most of what used to be done on their desktop systems or laptops. Similarly, people typically have their smartphones with them and find that their phones can duplicate many of the functions of tablets. Additionally, people are becoming more reluctant to upgrade laptops and desktops given the number of other devices that they already have. Thus, personal computers and tablets are going to reduce into niches where they are superior to smaller alternatives. For personal computers, that will include areas where extended work using high-resolution video or large amounts of memory or high performance are important, such as office work or gaming. For tablets, that will include areas where portability and extensive mobile use are critical, such as on-site evaluations and portable note-taking.

While traditional analysis might conclude that the drop in the PC market spells trouble for semiconductor sales, the opposite is, in fact, more probable. Tablet and phones all require their own semiconductors. Furthermore, all systems (including computers) benefit from the superior performance and resistance to shock given by solid state drives, which need a multitude of memory chips (semiconductors).

One of the most significant areas, large and growing rapidly, is for servers. Big Data is not an isolated phenomenon, and server farms require an enormous number of semiconductors. And processing all that data requires High-Performance Computing, or industrial-sized computers, all of which need enormous amounts of memory and many processors. Similarly, cloud-based servers and the routers that coordinate them are rapidly expanding; consider applications like Facebook, YouTube, and Google that each need rapid access to an enormous amount of data.

The Internet of Things (often abbreviated IoT) represents a nascent, but eventually dominating, application area for semiconductors. IoT is the effort to embed sensors in many diverse items ranging from temperature sensors in home appliances to pressure sensors in roads to stress sensors in bridges. The sensors communicate wirelessly with the rest of the world, allowing them to connect to monitoring systems. The sensors in large IoT applications can also form networks which allow them to interact. It would be difficult to overstate the potential here. Handling all that information will only drive the need for data storage even higher. While this will have quite an effect in 2018, the longer-term outlook is far greater.

Somewhat related to the Internet of Things is the rise in artificial intelligence (AI) and with that, demand for custom chips specialized to work well in an algorithm-based world. Early implementations of machine learning and artificial intelligence relied on graphics processing units (GPUs)—originally developed for computer gaming—which were simply repurposed for use in neural network processing and the other types of computation-intensive algorithms underpinning artificial intelligence. Now mega-customers such as Amazon, Apple, Facebook, Google, and Microsoft are creating a market for custom-designed chips that are specifically optimized for AI and machine learning purposes. And although core markets for traditional chips – for personal computers, servers, smartphones, and tablets – are beginning to grow more slowly than in the past, the market for custom AI chips is set to grow exponentially as artificial intelligence continues to be increasingly incorporated into smartphones, autos, drones, industrial applications and other systems.

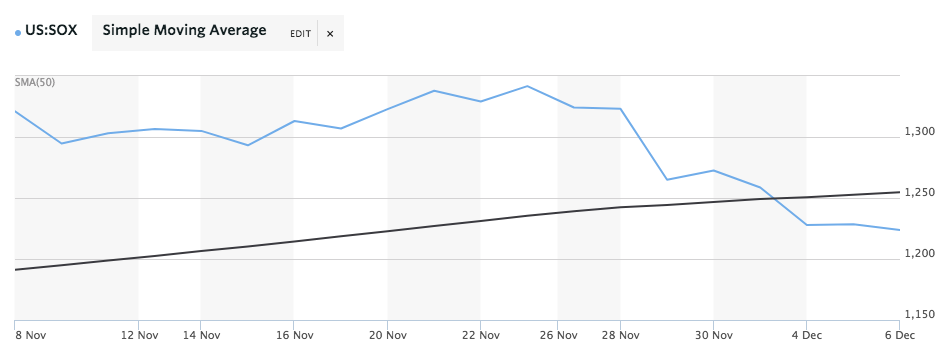

At the moment, one of the heaviest commercial usages of traditional computational power globally is “mining” cryptocurrencies. Due to the intense competition to be the first to complete blockchain computations—which is necessary to receive payments—miners started with general computers, then moved to computers based on graphics cards since those are designed to run many operations in parallel. Now the processor of choice has become ASIC (Application-Specific Integrated Circuit) chips, since they can be optimized for the computations needed. In fact, the recent brief market decline which has occurred in the semiconductor sector — shown in the graph below — followed reports in mid-November that the market for GPU chips will likely be cut in half in 2018 as it becomes less profitable to use GPUs in cryptocurrency mining (some profit-taking also contributed to that decline). So the incredible growth of cryptocurrencies has created its own demand for specialized semiconductors.

Source: MarketWatch; PHLX Semiconductor Index

Consumer electronics, apart from tablets and smartphones, is the final field to be addressed here. High-definition televisions, especially those with 4K resolution, use several computer boards with a very large number of semiconductors; and that market is growing rapidly. People who are installing smart home devices, ranging from thermostats to security systems to wireless lighting controls to smoke and CO2 detectors, will drive more semiconductor demand. The same is true as drones become cheaper, more functional, regulated and accepted. And many entertainment items such as Blu-Ray devices are forecast to grow. We should also mention wearable items, health and fitness trackers, hearing aids, and voice-activated digital assistants. The troop of gamers, who now will insist on things like Virtual Reality or Augmented Reality systems, have always pushed the markets. The list is growing constantly. All of these use semiconductors extensively.

In summary, the semiconductor sector is an exciting arena and is expected to grow handsomely in 2018 and beyond. Any downside that might exist is not due to technology. However, care will need to be taken when choosing which companies to invest in. There will be an immense amount of competition, and rapid shifts could potentially occur: the leaders in any given subfield can shift as soon as an upstart company introduces a new, superior technology. So it is prudent to choose companies that are major suppliers in several different areas to avoid that risk and to diversify accordingly. This could be achieved if an investor chose an index rather than particular stocks.