It is an undisputed fact that the over-collateralization of assets (including toxic ones prior to 2008) and the securitization explosion that took place between 2000-2007, created the seeds of the financial crisis via credit-overextension. The response to that was an overextension of the monetary base, which in turn has seeded the ground for a new credit cycle which, like a restless wrestler, is seeking to defeat catharsis- that is, the detoxification of the economy of too much debt and leverage.

Credit is the oxygen of the economy. Abnormal quantities (whether small or large) are harmful. The inability to assess its vital role, leads to capital misallocation and distorted prices. The latter misconfigures the price discovery mechanism and from there on the birth pains of economic and financial disequilibrium start their destabilization process.

The hunger for the centralization of power and the usage of credit as the vehicle for that accomplishment has created a triple problem: First, it has morphed a loophole, where credit feeds assets prices that tend to move according to expectations of financial variables (e.g. interest rates) rather than real variables (such as productivity), and which in turn of course distort the whole economic and financial environment. Second, it is the source of new shocks (e.g. volatility) in the economic and financial spheres where credit extension or contraction amplifies the expected outcome/result and hence leads to faulty policy decisions (e.g. postponing the normalization of interest rates). Third, it builds up financial entropy, which necessitates either a disintegration or a deus ex machina, with the latter leading to potential geostrategic conflicts.

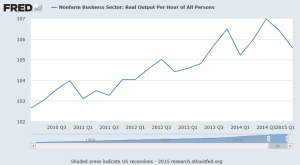

The graph below signifies the essence of the first distortion discussed above. Despite credit overextension the growth rate of productivity (the most important economic variable) is declining, and with that decline several other distractions and disruptions follow.

As the debt saturation level deteriorates (defined as the change in GDP divided by the change in total debt), it takes more and more debt to generate one extra dollar of GDP (nowadays it takes about $4.6 vs. 2.1 in 2000). As this trend continues the disruption required by the market forces in order to correct imbalances becomes a distraction for policymakers who choose to centralize power in the midst of market shocks that feed upon themselves. As the shocks are amplified, volatility rises, and geostrategic dislocations take place (e.g. commodity prices decline).

Case in point is the developments in the Chinese markets. The graphs below demonstrate that the Chinese central authorities in an effort to control the markets that were seeking reason and balance in an unreasonable and imbalanced market (and in their eternal hunger for more power), have caused concerns that led to Monday’s worst-day shock in the last ten years. Of course, their response to the shock was more central government intervention with the hope that they can control what in the medium term we all know is uncontrollable. (Same thing could have been said of any central authority that tries to manipulate the markets).

What I have said so far point to the first two problems explained earlier, namely the distortion of prices and wrong-headed policy. The combination of those two problems exacerbate financial entropy which in turn may lead to the third problem mentioned of disintegration via geostrategic tensions that potentially could lead to conflicts.

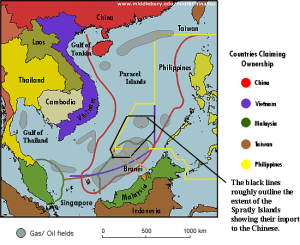

The rise in geostrategic dislocations in turn becomes the seed of a global crisis whose hunger may require resolution by force. The two maps below are indicative of geographic areas in Asia that are susceptible for this kind of conflict and disintegration that could jump out due to the other two problems explained above. The first graph shows the disputed areas and the countries involved in those territorial disputes centered around energy claims and sources. Again, the cause may be the price distortions (caused by credit overextensions) that have led to wrong-headed policies, but the symptom will be the territorial disputes which may erupt and used as disguise for the cover-up of the wrongs made. The disintegration that could take place will reverse many years of progress and will wipe out trillions worth of paper wealth around the globe.

There are other places where the geo-uncertainty may erupt (Middle East, India-Pakistan, Ukraine, etc.). It might be time that investors start taking that into account and pertinent strategies are developed to hedge against that possibility.

Searching in the Shadows of a Restless Credit Cycle: The Street called Geo-Uncertainty

Author : John E. Charalambakis

Date : July 29, 2015

It is an undisputed fact that the over-collateralization of assets (including toxic ones prior to 2008) and the securitization explosion that took place between 2000-2007, created the seeds of the financial crisis via credit-overextension. The response to that was an overextension of the monetary base, which in turn has seeded the ground for a new credit cycle which, like a restless wrestler, is seeking to defeat catharsis- that is, the detoxification of the economy of too much debt and leverage.

Credit is the oxygen of the economy. Abnormal quantities (whether small or large) are harmful. The inability to assess its vital role, leads to capital misallocation and distorted prices. The latter misconfigures the price discovery mechanism and from there on the birth pains of economic and financial disequilibrium start their destabilization process.

The hunger for the centralization of power and the usage of credit as the vehicle for that accomplishment has created a triple problem: First, it has morphed a loophole, where credit feeds assets prices that tend to move according to expectations of financial variables (e.g. interest rates) rather than real variables (such as productivity), and which in turn of course distort the whole economic and financial environment. Second, it is the source of new shocks (e.g. volatility) in the economic and financial spheres where credit extension or contraction amplifies the expected outcome/result and hence leads to faulty policy decisions (e.g. postponing the normalization of interest rates). Third, it builds up financial entropy, which necessitates either a disintegration or a deus ex machina, with the latter leading to potential geostrategic conflicts.

The graph below signifies the essence of the first distortion discussed above. Despite credit overextension the growth rate of productivity (the most important economic variable) is declining, and with that decline several other distractions and disruptions follow.

As the debt saturation level deteriorates (defined as the change in GDP divided by the change in total debt), it takes more and more debt to generate one extra dollar of GDP (nowadays it takes about $4.6 vs. 2.1 in 2000). As this trend continues the disruption required by the market forces in order to correct imbalances becomes a distraction for policymakers who choose to centralize power in the midst of market shocks that feed upon themselves. As the shocks are amplified, volatility rises, and geostrategic dislocations take place (e.g. commodity prices decline).

Case in point is the developments in the Chinese markets. The graphs below demonstrate that the Chinese central authorities in an effort to control the markets that were seeking reason and balance in an unreasonable and imbalanced market (and in their eternal hunger for more power), have caused concerns that led to Monday’s worst-day shock in the last ten years. Of course, their response to the shock was more central government intervention with the hope that they can control what in the medium term we all know is uncontrollable. (Same thing could have been said of any central authority that tries to manipulate the markets).

What I have said so far point to the first two problems explained earlier, namely the distortion of prices and wrong-headed policy. The combination of those two problems exacerbate financial entropy which in turn may lead to the third problem mentioned of disintegration via geostrategic tensions that potentially could lead to conflicts.

The rise in geostrategic dislocations in turn becomes the seed of a global crisis whose hunger may require resolution by force. The two maps below are indicative of geographic areas in Asia that are susceptible for this kind of conflict and disintegration that could jump out due to the other two problems explained above. The first graph shows the disputed areas and the countries involved in those territorial disputes centered around energy claims and sources. Again, the cause may be the price distortions (caused by credit overextensions) that have led to wrong-headed policies, but the symptom will be the territorial disputes which may erupt and used as disguise for the cover-up of the wrongs made. The disintegration that could take place will reverse many years of progress and will wipe out trillions worth of paper wealth around the globe.

There are other places where the geo-uncertainty may erupt (Middle East, India-Pakistan, Ukraine, etc.). It might be time that investors start taking that into account and pertinent strategies are developed to hedge against that possibility.