Searching for Escape in the Middle of Black Holes: On the Balkanization of the Markets

Let’s start with defining the terms used in this commentary. A black hole is created when massive stars collapse. Once it is formed it keeps growing by absorbing mass from its surrounding. Its gravitational forces are so powerful that everything around it goes in but nothing comes out (not even light, and hence the name black hole). The term balkanization refers to constant conflict among heterogeneous as well as homogeneous entities within a particular region to the extent that solid prosperity cannot be built due to fragmentation (it derived its name from the historical conflicts in southeastern Europe a.k.a. the Balkans). The similarities with current market conditions are plentiful, but it will suffice to name just three: the black hole created by the financial collapse of 2008; the black hole that non-conventional monetary measures have been creating; and the black hole created by the dysfunctional European Union.

The first one (due to a financial collapse) revealed that a financial system operating without an anchor is susceptible to ongoing crises (oil crises in the 1970s, Latin America in the early 1980s, currencies in the mid 1980s, trade imbalances in the mid 1980s too, equities and banks’ crises in the late 1980s, housing in the early 1990s, Tequila crisis in mid 1990s, Southeast Asian crisis in 1997-’98; Russian crisis in 1998, stock market crisis in 2000-’01, bubbles in the mid 2000s, financial collapse in 2008, fiscal crises in 2009-’10).

The second one of unorthodox monetary measures since 2009 created expectations that central banks are here to bail out investors, subsidize securities, and play the role of the big daddy. It has created moral hazards left and right, while proclaiming that all is well as long as we have central bankers willing to sugar-coat placebos for a cancerous tumor. In the meantime a system born for capital and real wealth generation based on production and not on consumption financed by debts gets killed.

The third one centers on the monster created by EU bureaucrats and their vested interests. Instead of focusing on free trade, free movement of capital, people, ideas, technology, etc., the Brussels bureaucrats thought that by issuing regulations upon regulations, by creating pyramids upon pyramids of paper-pushers, and by having a common currency they will create the United States of Europe! It reminds me of those who believe that by boarding a boat they become ship-owners. It was interesting to read the comments made by some of the heads of the EU in the last two days. Here is an anthology of them:

The new president of the European Commission Mr. Juncker, accused the prime ministers of England and Italy that they are deceiving their citizens! Mr. Juncker also accused Mr. Cameron (Britain’s prime minister) that he has serious issues with the other heads of states. Italy’s prime minister responded that the Brussels Eurocrats only care for themselves while dictating policies for the nation-states which are losing their autonomy and independence. This made Mr. Juncker so defensive that he proclaimed that he is “not the head of a bureaucrats’ mob!”

At the same time, Ms. Merkel implied that the EU would not lose much if Britain exits the union. And while this Balkanization takes place in the political sphere, Mr. Draghi – the president of EU’s central bank – is in a constant fight with the head of Bundesbank (Germany’s central bank) over his plans to endeavor into providing placebos to the market. Welcome to the harmonious United States of Europe, a monster that has lost direction, purpose, leadership, vision, and mission. How could this dysfunctional body create jobs, advance growth, and look after the prosperity of the people of the EU?

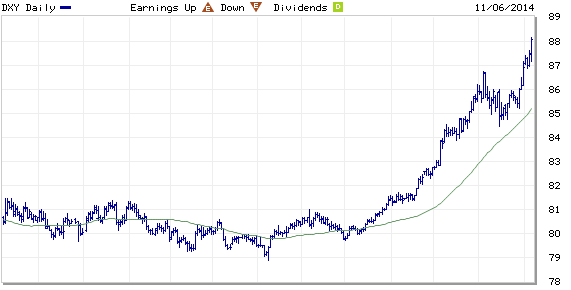

Let’s now look into the major market developments of the last few days. As we expected – see previous commentaries – markets not only recovered but also reached new record levels. We have little doubt that the subsidies provided by the non-conventional monetary measures have been the main cause of this. At the same time real assets such as gold and oil have been experiencing significant losses, reaching such low levels not seen since mid 2010. There should be little doubt that the significant gains of the US dollar (the supreme king of fiat money) is one of the main causes of the losses experienced in those two asset classes. Here is a graph that portrays the gains of the USD in the last six months.

On October 13th from these pages I wrote:

”At the same time, a smoothing in the Fed’s reverse repo operations, coupled with easy credit policies in the EU (where the ECB will cease being a day late and a Euro short), China and Japan (with the latter three benefitting from lower oil prices) could form a tail on the right side of the abnormal curve, which will become the culprit of the paradigm shift whose flag – like in the early 1980s – will be the rising value of the dollar while China experiences another awakening due to market liberalizations.”

Most analysts believe that the inverse relationship between gold and USD will hold and even predict gold prices below $1000/troy ounce. Here is my take: the black holes described above may have such gravitational forces to swallow everything around them but the collapse of the stars that creates black holes has intrinsic powers which may create escape velocities due to the disintegration/entropy observed in the “stars”. Why should we exclude a scenario where the USD and gold rise together starting in the next few months, while moving towards greater market entropy? After all it is the surprising relationships that define new eras.

Searching for Escape in the Middle of Black Holes: On the Balkanization of the Markets

Author : John E. Charalambakis

Date : November 6, 2014

Searching for Escape in the Middle of Black Holes: On the Balkanization of the Markets

Let’s start with defining the terms used in this commentary. A black hole is created when massive stars collapse. Once it is formed it keeps growing by absorbing mass from its surrounding. Its gravitational forces are so powerful that everything around it goes in but nothing comes out (not even light, and hence the name black hole). The term balkanization refers to constant conflict among heterogeneous as well as homogeneous entities within a particular region to the extent that solid prosperity cannot be built due to fragmentation (it derived its name from the historical conflicts in southeastern Europe a.k.a. the Balkans). The similarities with current market conditions are plentiful, but it will suffice to name just three: the black hole created by the financial collapse of 2008; the black hole that non-conventional monetary measures have been creating; and the black hole created by the dysfunctional European Union.

The first one (due to a financial collapse) revealed that a financial system operating without an anchor is susceptible to ongoing crises (oil crises in the 1970s, Latin America in the early 1980s, currencies in the mid 1980s, trade imbalances in the mid 1980s too, equities and banks’ crises in the late 1980s, housing in the early 1990s, Tequila crisis in mid 1990s, Southeast Asian crisis in 1997-’98; Russian crisis in 1998, stock market crisis in 2000-’01, bubbles in the mid 2000s, financial collapse in 2008, fiscal crises in 2009-’10).

The second one of unorthodox monetary measures since 2009 created expectations that central banks are here to bail out investors, subsidize securities, and play the role of the big daddy. It has created moral hazards left and right, while proclaiming that all is well as long as we have central bankers willing to sugar-coat placebos for a cancerous tumor. In the meantime a system born for capital and real wealth generation based on production and not on consumption financed by debts gets killed.

The third one centers on the monster created by EU bureaucrats and their vested interests. Instead of focusing on free trade, free movement of capital, people, ideas, technology, etc., the Brussels bureaucrats thought that by issuing regulations upon regulations, by creating pyramids upon pyramids of paper-pushers, and by having a common currency they will create the United States of Europe! It reminds me of those who believe that by boarding a boat they become ship-owners. It was interesting to read the comments made by some of the heads of the EU in the last two days. Here is an anthology of them:

The new president of the European Commission Mr. Juncker, accused the prime ministers of England and Italy that they are deceiving their citizens! Mr. Juncker also accused Mr. Cameron (Britain’s prime minister) that he has serious issues with the other heads of states. Italy’s prime minister responded that the Brussels Eurocrats only care for themselves while dictating policies for the nation-states which are losing their autonomy and independence. This made Mr. Juncker so defensive that he proclaimed that he is “not the head of a bureaucrats’ mob!”

At the same time, Ms. Merkel implied that the EU would not lose much if Britain exits the union. And while this Balkanization takes place in the political sphere, Mr. Draghi – the president of EU’s central bank – is in a constant fight with the head of Bundesbank (Germany’s central bank) over his plans to endeavor into providing placebos to the market. Welcome to the harmonious United States of Europe, a monster that has lost direction, purpose, leadership, vision, and mission. How could this dysfunctional body create jobs, advance growth, and look after the prosperity of the people of the EU?

Let’s now look into the major market developments of the last few days. As we expected – see previous commentaries – markets not only recovered but also reached new record levels. We have little doubt that the subsidies provided by the non-conventional monetary measures have been the main cause of this. At the same time real assets such as gold and oil have been experiencing significant losses, reaching such low levels not seen since mid 2010. There should be little doubt that the significant gains of the US dollar (the supreme king of fiat money) is one of the main causes of the losses experienced in those two asset classes. Here is a graph that portrays the gains of the USD in the last six months.

On October 13th from these pages I wrote:

”At the same time, a smoothing in the Fed’s reverse repo operations, coupled with easy credit policies in the EU (where the ECB will cease being a day late and a Euro short), China and Japan (with the latter three benefitting from lower oil prices) could form a tail on the right side of the abnormal curve, which will become the culprit of the paradigm shift whose flag – like in the early 1980s – will be the rising value of the dollar while China experiences another awakening due to market liberalizations.”

Most analysts believe that the inverse relationship between gold and USD will hold and even predict gold prices below $1000/troy ounce. Here is my take: the black holes described above may have such gravitational forces to swallow everything around them but the collapse of the stars that creates black holes has intrinsic powers which may create escape velocities due to the disintegration/entropy observed in the “stars”. Why should we exclude a scenario where the USD and gold rise together starting in the next few months, while moving towards greater market entropy? After all it is the surprising relationships that define new eras.