From last weekend’s IMF meetings we learned that its “firepower” had increased substantially by over $400 billion to be used as needed in light of the deteriorating situation in Europe. That seems a bit contradictory given that it was the IMF that warned earlier last week that is afraid of a balance sheet contraction in the EU-wide banking sector and that contraction could reach as high as $2.6 trillion.

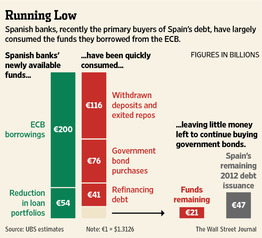

With all due respect, we do not think that the newly committed – and yet to be materialized – funds will be adequate to avoid what seems to be an accident waiting to happen. For comparison let’s review what has happened to the “firepower” absorbed by Spanish banks using the LTROs funds borrowed from the ECB. The graph below tells the story.

The WSJ reported last week: “Europe’s bold program to defuse its financial crisis by injecting cash into the banking system is running out of steam”. The cash of over $1.3 trillion has been used primarily by banks in Spain, Italy, and France and there is little left. Needless to say that very little – if any –was utilized as loans to the private sector for business purposes and thus it is no wonder that the EU is falling back into recession. Carry trading and playing with margins can provide temporary relief and an illusion that the crisis has been addressed, until the effects of the dosage slipped away. At the same time Greek banks reported last Friday that their losses totaled over $36 billion, about 10 times their capitalization!

The EU-wide banking sector problems may lead to a movement of nationalizing the most troubled banks unless the ECB commits to targeting the rates of member-states bonds and provide unlimited liquidity, something that does not seem very realistic. The signs of the Euro’s disintegration will keep multiplying.

This nationalization trajectory seems to follow the paradigm shift that we have been observing in the last few days in the developing and emerging world. Argentina announced the nationalization of its most important energy company YPF SA, which was a subsidiary of the Spanish Repsol (actually 25% of Repsol’s operating income was earned by its Argentinean subsidiary). At the same time, the Mongolian government threatened to suspend the mining license of SouthGobi Resources, a Toronto-listed company (its majority shares are controlled by Ivanhoe Mines), because it is in the process of being bought by Chalco, a Chinese company. Moreover, at the same time, Indonesia is threatening to impose punitive export taxes on commodities from copper to thermal coal, suspending in that sense trading in those commodities. And let’s not forget Premier’s Wen Jiabao’s message that he will break up the largest Chinese banks.

On the US front, the rejection of Citibank’s capital plan by the Fed might be a signal that the US might finally start cleaning up the banking sector in anticipation of its takeoff within a short period of time.

Resources’ Nationalization in the Midst of Disintegration: A Paradigm Shift?

Author : John E. Charalambakis

Date : April 25, 2012

From last weekend’s IMF meetings we learned that its “firepower” had increased substantially by over $400 billion to be used as needed in light of the deteriorating situation in Europe. That seems a bit contradictory given that it was the IMF that warned earlier last week that is afraid of a balance sheet contraction in the EU-wide banking sector and that contraction could reach as high as $2.6 trillion.

With all due respect, we do not think that the newly committed – and yet to be materialized – funds will be adequate to avoid what seems to be an accident waiting to happen. For comparison let’s review what has happened to the “firepower” absorbed by Spanish banks using the LTROs funds borrowed from the ECB. The graph below tells the story.

The WSJ reported last week: “Europe’s bold program to defuse its financial crisis by injecting cash into the banking system is running out of steam”. The cash of over $1.3 trillion has been used primarily by banks in Spain, Italy, and France and there is little left. Needless to say that very little – if any –was utilized as loans to the private sector for business purposes and thus it is no wonder that the EU is falling back into recession. Carry trading and playing with margins can provide temporary relief and an illusion that the crisis has been addressed, until the effects of the dosage slipped away. At the same time Greek banks reported last Friday that their losses totaled over $36 billion, about 10 times their capitalization!

The EU-wide banking sector problems may lead to a movement of nationalizing the most troubled banks unless the ECB commits to targeting the rates of member-states bonds and provide unlimited liquidity, something that does not seem very realistic. The signs of the Euro’s disintegration will keep multiplying.

This nationalization trajectory seems to follow the paradigm shift that we have been observing in the last few days in the developing and emerging world. Argentina announced the nationalization of its most important energy company YPF SA, which was a subsidiary of the Spanish Repsol (actually 25% of Repsol’s operating income was earned by its Argentinean subsidiary). At the same time, the Mongolian government threatened to suspend the mining license of SouthGobi Resources, a Toronto-listed company (its majority shares are controlled by Ivanhoe Mines), because it is in the process of being bought by Chalco, a Chinese company. Moreover, at the same time, Indonesia is threatening to impose punitive export taxes on commodities from copper to thermal coal, suspending in that sense trading in those commodities. And let’s not forget Premier’s Wen Jiabao’s message that he will break up the largest Chinese banks.

On the US front, the rejection of Citibank’s capital plan by the Fed might be a signal that the US might finally start cleaning up the banking sector in anticipation of its takeoff within a short period of time.