I do not think that we would have had a hard time if we desired to find alarming market signals. However, the message from the markets seems to be a resilient one. This past week new record highs were achieved, while the arch-enemy of fiat money (gold) reached its lowest level since July 2011, officially entering bear territory. How could we explain such discrepancy?

As we have documented in this commentaries over the last several months, a momentum is being built (artificially in our opinion) that seeks to advance the return on capital investments and the overall economic growth. As a result of that effort, the markets also advance, increasing the paper-wealth of investors. We anticipate this process to continue this year, unless an unforeseen reversal takes place.

At the same time, we observe EU officials taking hard lines regarding the “sinners” in their midst, while openly talk about bailing-in depositors (a.k.a. confiscation of deposits) if banks start becoming shaky again. The fact that our own FDIC and the Bank of England have agreed on this line of defense simply affirms that times are changing (see section 34 of the following link)

(http://www.bankofengland.co.uk/publications/Documents/

news/2012/nr156.pdf)

In a nutshell, I would say four things:

- First, I anticipate capital flight from the EU to the US.

- Second, we should not be surprised if the trillions of swaps between our own Fed and the ECB start experiencing diminishing returns (that incompatible affection did not make sense to begin with).

- Third, the buildup of the momentum that is taking place (via QEs) could lead to a major blow up in three-four years (maybe sooner) at which point the real money a.k.a. gold will increase at a geometric rate (however we still expect gold prices to decline even further this year), unless an out-of-the-box solution is implemented.

- Fourth, while the markets make a hard effort to set aside the Cypriot case and its impact on them, the latter due to the questionable ELA (emergency liquidity assistance) and the impeding depression in the Cypriot economy (we project GDP decline of 22-24% during the next 12 months, while the unemployment rate will explode to over 45% by 2015) will make any austerity program ineffective. The result might be that Cyprus may be left with the only viable choice that is to drop the Euro. Once the glass (Euro) is broken we better avoid drinking from that cup.

Let’s now review some basic facts:

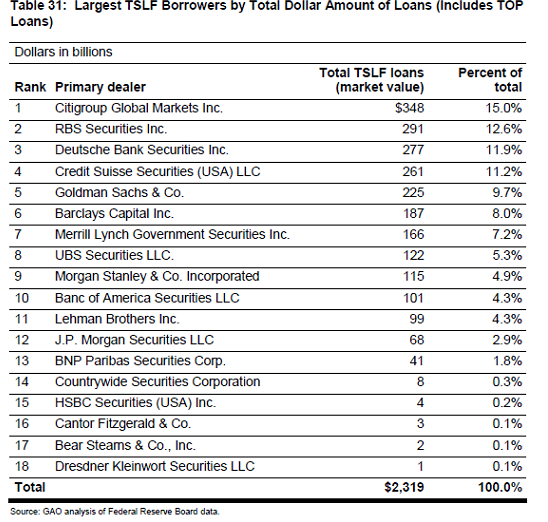

- As we have documented before, the EU banks could have survived only through the liquidity provided by the Fed to the ECB. We present below another table from the Fed’s audit which shows the hundreds of billions of dollars that banks like Deutsche Bank, UBS, RBS, etc. received form just one of the credit facilities that the Fed opened for them. When we add up all the money they borrowed from the different credit facilities, we will discover that trillions of dollars were distributed to EU banks. This is what I call an incompatible affection that needs to be stopped.

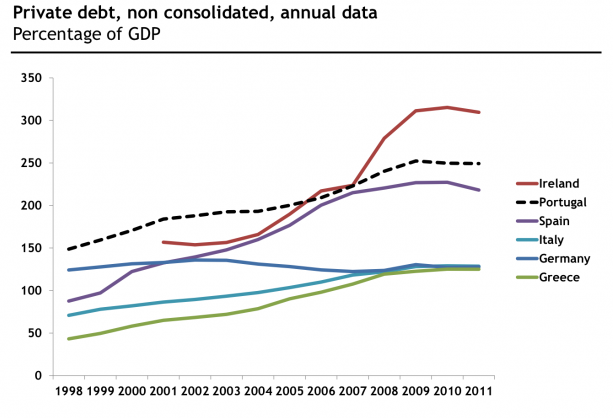

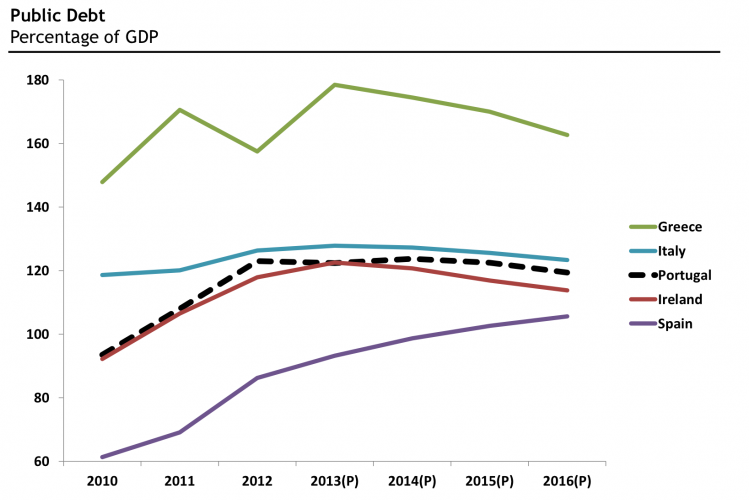

- The reasons that those EU banks needed the funding was that they had over-extended credit to the private and public sectors, and among the recipients where the least qualifying countries that could not afford it. The result was that in those countries debts exploded – see graphs below – and unless those EU banks had been bailed out by the ECB – via Fed’s funds – the dream that became the nightmare (Euro) would have ceased to exist since 2009.

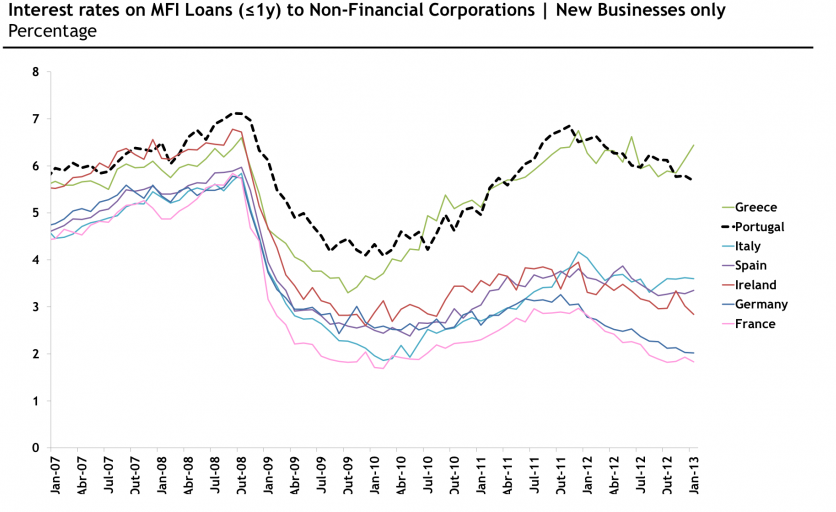

- The interest rates on loans in those “sinner” countries remain very high, a fact that feeds negative growth given their environment of depression. The graph below shows that for Greece and Portugal (which in the last few days has been in the news given the renewed troubles there) the high borrowing costs – let alone the dry liquidity – cannot allow capital to be invested and thus growth seeds to be planted.

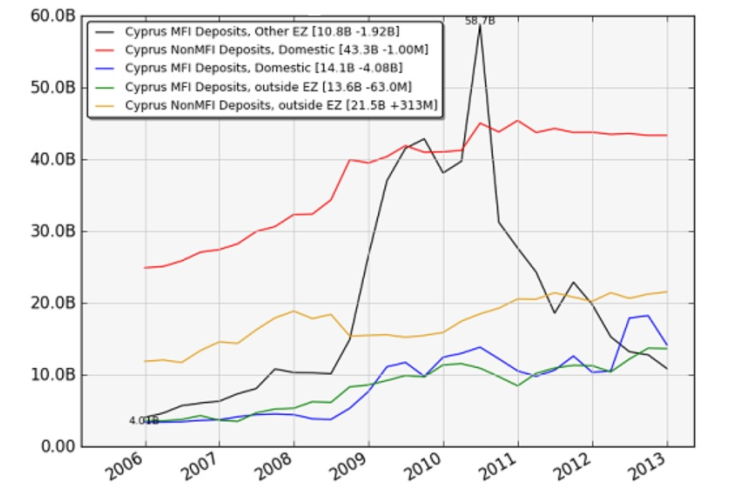

- Let me close with a comment on Cyprus. I believe the graph below tells us a death foretold since mid 2010. The black line below shows the deposits of German and French banks in Cypriot banks (mainly Bank of Cyprus and Laiki). (The red line shows Russian deposits and the rest are local or EU deposits other than German and French). As the graph clearly shows, prior to mid 2010 banks from Germany and France kept depositing their funds into the Cypriot banks, in order to take advantage of high deposit rates in Cyprus (in their own countries they paid the depositors less than half of one percent, while their own deposits were earning ten times more in Cyprus). Then, in mid 2010 they withdrew their deposits from Cyprus causing significant problems to the two main Cypriot banks. By all measures those two Cypriot banks became problematic since mid 2010. The haircut on Greek bonds (which constituted a good chunk of their assets) which was initiated and forced on Cyprus by the EU, shook their asset base, which in combination with the recession in the EU and the depression of their borrowers turned them into insolvent institutions.

Where was the ECB in the midst of a crisis borne in mid 2010? Where was its fiduciary responsibility to financial stability? How in the world did they authorize ELA funding of more than €11 billion when the rules of ELA provide clear guidelines as to when it could be dispatched?

Are we facing an inept detachment of Cyprus from the rest of the Euro zone which in combination with the diminishing incompatible affection between the Fed and the ECB could signal the beginning of the end of one of the most important fiat currencies?

Resilient Markets Searching for Vitality: Incompatible Affections and Inept Detachments

Author : John E. Charalambakis

Date : April 13, 2013

I do not think that we would have had a hard time if we desired to find alarming market signals. However, the message from the markets seems to be a resilient one. This past week new record highs were achieved, while the arch-enemy of fiat money (gold) reached its lowest level since July 2011, officially entering bear territory. How could we explain such discrepancy?

As we have documented in this commentaries over the last several months, a momentum is being built (artificially in our opinion) that seeks to advance the return on capital investments and the overall economic growth. As a result of that effort, the markets also advance, increasing the paper-wealth of investors. We anticipate this process to continue this year, unless an unforeseen reversal takes place.

At the same time, we observe EU officials taking hard lines regarding the “sinners” in their midst, while openly talk about bailing-in depositors (a.k.a. confiscation of deposits) if banks start becoming shaky again. The fact that our own FDIC and the Bank of England have agreed on this line of defense simply affirms that times are changing (see section 34 of the following link)

(http://www.bankofengland.co.uk/publications/Documents/

news/2012/nr156.pdf)

In a nutshell, I would say four things:

Let’s now review some basic facts:

Where was the ECB in the midst of a crisis borne in mid 2010? Where was its fiduciary responsibility to financial stability? How in the world did they authorize ELA funding of more than €11 billion when the rules of ELA provide clear guidelines as to when it could be dispatched?

Are we facing an inept detachment of Cyprus from the rest of the Euro zone which in combination with the diminishing incompatible affection between the Fed and the ECB could signal the beginning of the end of one of the most important fiat currencies?