A major Chinese conference related to the New Silk Road ended two days ago. The conference centered on the theme of “One Belt, One Road”, which is the Chinese equivalent of a Marshall Plan to dominate world trade via controls of railways, shipping routes, power plants, pipelines, and roads. The project involves more than 60 countries and over $1 trillion in infrastructure spending. China is reshaping global trade, and the fear is that the abandonment by the US of the Trans-Pacific Partnership has converted the pathway to global influence into a superhighway for Chinese interests.

The project advances China’s economic, financial, military, technology, and diplomatic interests. China is planting seeds for fruits to be enjoyed down the road, in a manner similar to the United States following WWII. At the same time, China is also tightening credit standards at home due to the unsustainable debt levels along with the inherent dangers of the Wealth Management Products (WMP) (which now exceed $4.5 trillion and could become a financial bomb that undermines Chinese growth prospects). Certainly the project has inherent weaknesses (significant domestic problems in the countries involved, underestimated costs and overestimated benefits, credit restraints, physical hurdles, motives that are questionable by friends and foes, etc.). However, if a counter-weight to those ambitious plans is not set in action, then we are in for a major power shift that will change the balance of power and alter geoeconomics and geopolitics for many decades to come.

We anticipate that the hubs as shown above have a very good chance of attracting additional investments and experiencing good growth, so from an macro-investment perspective a cautious look at them – where possible and feasible – may be warranted, in the same sense that someone who had invested early on in China may have enjoyed significant returns.

Thinking of macro-trends under current conditions (i.e. taking into account today’s valuations), we could say that given the earnings season (with double digit gains) and the prospects of sales, margins, and low interest rates, the US market may still have some room to grow, especially if policy execution is on the right direction. To this we would add that, as we have pointed out for several months, European markets may have more room to enjoy gains than the US markets, at least for the foreseeable future. Among other things, the expected Return on Investment Capital (ROIC) looks promising – even more for European markets – and given consumer and investors’ sentiment in both continents our opinion is that room for some gains still exists.

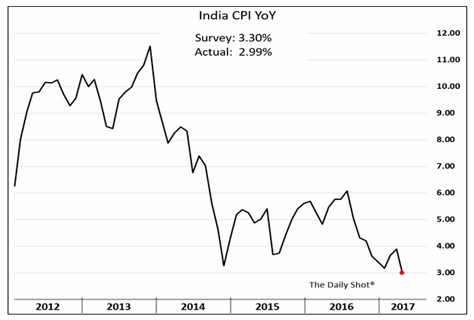

Before we close this week’s commentary, let’s look at three recent developments around the world. We will start with India where consumer inflation has fallen below 3% – see below – which may allow for some credit expansion and higher growth, implying gains and better prospects for the Indian economy and the Indian market.

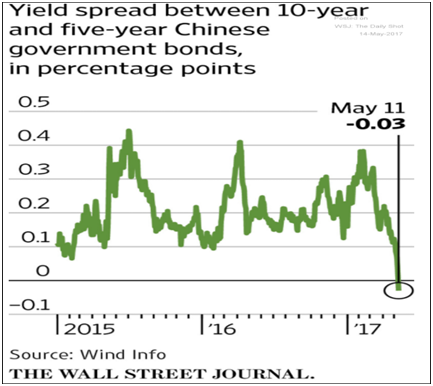

Then, and as reported by the WSJ, the inversion of the yield difference between 10- and 5-year old Chinese bonds (meaning that 5-year bonds yield more than 10-year bonds) as shown below, might have implied trouble for the Chinese markets, but we consider that an aberration, at least for now.

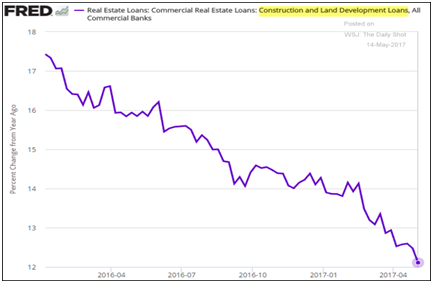

Finally, some measure of softness (from rentals, to telecommunications, to car prices, and inventories) has started appearing in the US, and as shown below, real estate loans’ deceleration is becoming a reality.

In conclusion, we would say that diligent caution is warranted under promising conditions.

The Reshaping of Global Trade and Recent Economic Trends

Author : John E. Charalambakis

Date : May 17, 2017

A major Chinese conference related to the New Silk Road ended two days ago. The conference centered on the theme of “One Belt, One Road”, which is the Chinese equivalent of a Marshall Plan to dominate world trade via controls of railways, shipping routes, power plants, pipelines, and roads. The project involves more than 60 countries and over $1 trillion in infrastructure spending. China is reshaping global trade, and the fear is that the abandonment by the US of the Trans-Pacific Partnership has converted the pathway to global influence into a superhighway for Chinese interests.

The project advances China’s economic, financial, military, technology, and diplomatic interests. China is planting seeds for fruits to be enjoyed down the road, in a manner similar to the United States following WWII. At the same time, China is also tightening credit standards at home due to the unsustainable debt levels along with the inherent dangers of the Wealth Management Products (WMP) (which now exceed $4.5 trillion and could become a financial bomb that undermines Chinese growth prospects). Certainly the project has inherent weaknesses (significant domestic problems in the countries involved, underestimated costs and overestimated benefits, credit restraints, physical hurdles, motives that are questionable by friends and foes, etc.). However, if a counter-weight to those ambitious plans is not set in action, then we are in for a major power shift that will change the balance of power and alter geoeconomics and geopolitics for many decades to come.

We anticipate that the hubs as shown above have a very good chance of attracting additional investments and experiencing good growth, so from an macro-investment perspective a cautious look at them – where possible and feasible – may be warranted, in the same sense that someone who had invested early on in China may have enjoyed significant returns.

Thinking of macro-trends under current conditions (i.e. taking into account today’s valuations), we could say that given the earnings season (with double digit gains) and the prospects of sales, margins, and low interest rates, the US market may still have some room to grow, especially if policy execution is on the right direction. To this we would add that, as we have pointed out for several months, European markets may have more room to enjoy gains than the US markets, at least for the foreseeable future. Among other things, the expected Return on Investment Capital (ROIC) looks promising – even more for European markets – and given consumer and investors’ sentiment in both continents our opinion is that room for some gains still exists.

Before we close this week’s commentary, let’s look at three recent developments around the world. We will start with India where consumer inflation has fallen below 3% – see below – which may allow for some credit expansion and higher growth, implying gains and better prospects for the Indian economy and the Indian market.

Then, and as reported by the WSJ, the inversion of the yield difference between 10- and 5-year old Chinese bonds (meaning that 5-year bonds yield more than 10-year bonds) as shown below, might have implied trouble for the Chinese markets, but we consider that an aberration, at least for now.

Finally, some measure of softness (from rentals, to telecommunications, to car prices, and inventories) has started appearing in the US, and as shown below, real estate loans’ deceleration is becoming a reality.

In conclusion, we would say that diligent caution is warranted under promising conditions.