It seems that analysts around the world are singing from the same chorus book, called Reflation. If we could define the latter we would say that it refers to a cycle when incomes and spending are rising which in turn boost growth. It’s interesting to note that such reflation arguments are echoed even in regions that have been in a state of stagnation for a long time such as Europe and Japan.

Business surveys that come out signify robust projections and as long as promising prospects are kept alive, the reflation dynamism retains its momentum. If this is maintained, then we would not be surprised if the beneficiaries in the second half of the year are found outside the US, where valuations are lower and hence the investment prospects bigger. This could be especially true for European markets, assuming that the political risks due to forthcoming elections are subsided.

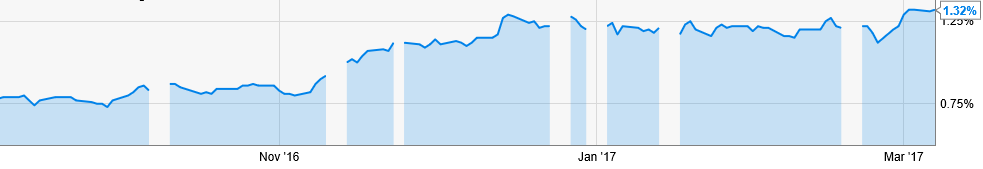

When the Dow Jones Industrial Average crossed the 21,000 line and the Fed indicated a possible rate increase next week, reflation sentiment was uplifted, and that was combined by news that the deflationary fears in Japan, China, and Europe may be dying. Here in the US we observe that the policy-sensitive two-year Treasury has been reaching record highs since 2009, indicating that the rate normalization process may be underway which in turn uplifts momentum.

At the same time we observe that during 2017 oil has been mostly fluctuating in a range between $52-$56, assuming that the drop in price in the last two days is an aberration. By historical standards this is a tight range, which in turn could signify oil price stabilization. Furthermore, the oil volatility index is around 26 when the ten-year average is about 37. In addition, data show that speculators are holding the biggest net long positions in Brent futures and options since 2001. If indeed oil prices are stabilizing, then we could argue that capital expenditures would be uplifted which will also uplift economic growth and future earnings.

As economies around the world pick up steam, equity markets could fan expectations further, giving a boost to cyclical sectors. Markets outside the US whose currencies are being depreciated against the greenback will also enjoy higher profit margins, boosting their earnings and in turn the local equity markets.

As rates and yields rise, capital expenditures increase and momentum is built up, the equities market for the short term could obtain greater operational leverage which will allow them to extend their gains between now and the end of the year (without excluding some corrective moves between). As stated above, this could be especially true for some overseas markets given their lower valuations and their depreciated currencies.

If that is the case then, where are the risks? We could say that they can be found in three broad categories: First, political uncertainty including places that we may be discounting; second, policy derailment; and third unexpected bad economic news that could turn the picture bleaker and make investors wonder if the valuations are sustainable. In the midst of those risks, we maintain our position that building up a small cushion in precious metals might be a good hedge.

Reflation Trades and Upbeat Sentiment: Rates, Oil, and the Containment of Risks

Author : John E. Charalambakis

Date : March 9, 2017

It seems that analysts around the world are singing from the same chorus book, called Reflation. If we could define the latter we would say that it refers to a cycle when incomes and spending are rising which in turn boost growth. It’s interesting to note that such reflation arguments are echoed even in regions that have been in a state of stagnation for a long time such as Europe and Japan.

Business surveys that come out signify robust projections and as long as promising prospects are kept alive, the reflation dynamism retains its momentum. If this is maintained, then we would not be surprised if the beneficiaries in the second half of the year are found outside the US, where valuations are lower and hence the investment prospects bigger. This could be especially true for European markets, assuming that the political risks due to forthcoming elections are subsided.

When the Dow Jones Industrial Average crossed the 21,000 line and the Fed indicated a possible rate increase next week, reflation sentiment was uplifted, and that was combined by news that the deflationary fears in Japan, China, and Europe may be dying. Here in the US we observe that the policy-sensitive two-year Treasury has been reaching record highs since 2009, indicating that the rate normalization process may be underway which in turn uplifts momentum.

At the same time we observe that during 2017 oil has been mostly fluctuating in a range between $52-$56, assuming that the drop in price in the last two days is an aberration. By historical standards this is a tight range, which in turn could signify oil price stabilization. Furthermore, the oil volatility index is around 26 when the ten-year average is about 37. In addition, data show that speculators are holding the biggest net long positions in Brent futures and options since 2001. If indeed oil prices are stabilizing, then we could argue that capital expenditures would be uplifted which will also uplift economic growth and future earnings.

As economies around the world pick up steam, equity markets could fan expectations further, giving a boost to cyclical sectors. Markets outside the US whose currencies are being depreciated against the greenback will also enjoy higher profit margins, boosting their earnings and in turn the local equity markets.

As rates and yields rise, capital expenditures increase and momentum is built up, the equities market for the short term could obtain greater operational leverage which will allow them to extend their gains between now and the end of the year (without excluding some corrective moves between). As stated above, this could be especially true for some overseas markets given their lower valuations and their depreciated currencies.

If that is the case then, where are the risks? We could say that they can be found in three broad categories: First, political uncertainty including places that we may be discounting; second, policy derailment; and third unexpected bad economic news that could turn the picture bleaker and make investors wonder if the valuations are sustainable. In the midst of those risks, we maintain our position that building up a small cushion in precious metals might be a good hedge.