Over the course of the last few days we have been hearing renewed concerns in the real estate sector. We would like to take this opportunity to outline a few thoughts regarding those concerns, as well as continue with our thoughts about taking measures to waterproof a portfolio in the current economic environment (see our related comments of 08/23/2010 on hybrid measures related to commodities in a portfolio).

In an article published in the Wall Street Journal last Tuesday August 24th we read that developers chose to default on their commercial real estate loans. Let us just state that we think that we have not seen any serious quakes in the commercial real estate sector yet. Thus, when the developers choose to default and turn in the keys because their assets are worth less than their debts in this mild commercial real estate correction, what would happen when a real financial quake hits that industry? Some estimates put the size of potential losses at over $150 billion dollars. If that were even close, then the banking sector is in for another shock.

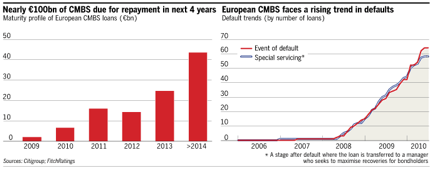

Now, on the other side of the Atlantic, we observe similar problems in that sector. The European Commercial Mortgage Backed Securities (CMBS) market faces a rising trend of defaults, as the following graph shows.

Given the number of loans maturing in the next few years, the declining money supply, the liquidity squeeze, and the inability to re-finance and rollover debt, our concerns are that the commercial real estate sector might be in for a major shock if the markets in general experience major turmoil in the next 6-8 months. Of course, any shock creates opportunities, and thus, as we wrote earlier, we believe and hope (Dum Spiro Spero), that the eventual shock will act as the catharthis to cleanse the system’s arteries.

Now, on the residential front, it was also reported in the last couple of days, that existing home sales dropped in July the most they have in the last 15 years, and also that new home sales dropped an unexpected 32.4% (year-on-year). In addition, median home prices fell by 4.8%, taking value out of the collateral base equation. If we add to that the declining manufacturing index, the declining durable goods purchasing activity, and the stubbornly high unemployment rate, we have a dangerous cocktail.

The above real estate concerns are the symptoms of the greater cause, called over-inflated assets that fed the frenzy of the credit mechanism and extrapolated leverage into the stratosphere, causing the financial crisis and economic turmoil. Those symptoms will continue as long as we do not address the main cause of the problem.

However, we would like to finish this commentary where we started this week, i.e. examine measures that protect and also advance portfolio structures. We talked about hybrid commodities in our previous commentary. In this one, we would like to suggest that floors need to be established in every portfolio, where a price is set for every holding. By doing so, an investor minimizes his/her losses and at the same time establishes a maximum risk tolerance level. In addition, the portfolio could be protected through the purchase of puts for the holdings it has. Of course, if those puts expire without being exercised, then their cost is an out of pocket insurance cost that cannot be recovered. Other measures could be taken that could equally protect the floor-tolerance level, and we would be happy to discuss those with you, if you would like to call or email us.

At the same time, and understanding that we may be entering in the next few months into another phase of a fat-tail market exercise where significant quakes may take place, an offensive measure would be to exploit leverage by investing into inverse indexes, shorting particular holdings, buying puts and also buying calls of asset-classes that you anticipate gaining in the midst of the turmoil.

We believe that thoughtful investors should discern the times and take defensive, offensive, and hybrid measures to waterproof their portfolios.

The times they are a changing…, and for this, Dum Spiro Spero!

Recent Real Estate Concerns and Waterproofing a Portfolio

Author : John E. Charalambakis

Date : August 27, 2010

Over the course of the last few days we have been hearing renewed concerns in the real estate sector. We would like to take this opportunity to outline a few thoughts regarding those concerns, as well as continue with our thoughts about taking measures to waterproof a portfolio in the current economic environment (see our related comments of 08/23/2010 on hybrid measures related to commodities in a portfolio).

In an article published in the Wall Street Journal last Tuesday August 24th we read that developers chose to default on their commercial real estate loans. Let us just state that we think that we have not seen any serious quakes in the commercial real estate sector yet. Thus, when the developers choose to default and turn in the keys because their assets are worth less than their debts in this mild commercial real estate correction, what would happen when a real financial quake hits that industry? Some estimates put the size of potential losses at over $150 billion dollars. If that were even close, then the banking sector is in for another shock.

Now, on the other side of the Atlantic, we observe similar problems in that sector. The European Commercial Mortgage Backed Securities (CMBS) market faces a rising trend of defaults, as the following graph shows.

Given the number of loans maturing in the next few years, the declining money supply, the liquidity squeeze, and the inability to re-finance and rollover debt, our concerns are that the commercial real estate sector might be in for a major shock if the markets in general experience major turmoil in the next 6-8 months. Of course, any shock creates opportunities, and thus, as we wrote earlier, we believe and hope (Dum Spiro Spero), that the eventual shock will act as the catharthis to cleanse the system’s arteries.

Now, on the residential front, it was also reported in the last couple of days, that existing home sales dropped in July the most they have in the last 15 years, and also that new home sales dropped an unexpected 32.4% (year-on-year). In addition, median home prices fell by 4.8%, taking value out of the collateral base equation. If we add to that the declining manufacturing index, the declining durable goods purchasing activity, and the stubbornly high unemployment rate, we have a dangerous cocktail.

The above real estate concerns are the symptoms of the greater cause, called over-inflated assets that fed the frenzy of the credit mechanism and extrapolated leverage into the stratosphere, causing the financial crisis and economic turmoil. Those symptoms will continue as long as we do not address the main cause of the problem.

However, we would like to finish this commentary where we started this week, i.e. examine measures that protect and also advance portfolio structures. We talked about hybrid commodities in our previous commentary. In this one, we would like to suggest that floors need to be established in every portfolio, where a price is set for every holding. By doing so, an investor minimizes his/her losses and at the same time establishes a maximum risk tolerance level. In addition, the portfolio could be protected through the purchase of puts for the holdings it has. Of course, if those puts expire without being exercised, then their cost is an out of pocket insurance cost that cannot be recovered. Other measures could be taken that could equally protect the floor-tolerance level, and we would be happy to discuss those with you, if you would like to call or email us.

At the same time, and understanding that we may be entering in the next few months into another phase of a fat-tail market exercise where significant quakes may take place, an offensive measure would be to exploit leverage by investing into inverse indexes, shorting particular holdings, buying puts and also buying calls of asset-classes that you anticipate gaining in the midst of the turmoil.

We believe that thoughtful investors should discern the times and take defensive, offensive, and hybrid measures to waterproof their portfolios.

The times they are a changing…, and for this, Dum Spiro Spero!