Over the course of the last several months a sense of market stability has prevailed. This can be seen in the low yields of government securities around the globe, signifying that for even risky countries the country-related risk is declining, and prospects constantly keep improving. However, this past Thursday’s mini market turmoil was primarily blamed on the Portuguese bank Banco Espirito whose shares dropped by 17% in one day, triggering a wider selloff of equities throughout Europe and causing some minor tremors in US markets too. In addition, companies and banks from Span, Italy, and France as well as countries like France and Greece slashed their debt offerings or cancelled them completely, signifying that clogs remain in the financial system of Europe.

The main issue however that underline this past week’s mini turmoil may have more to do with the financial system’s overall plumbing rather than with the capital shortfalls of particular banks. Specifically, the dependence of the health of the economy on its financialization and rehypothecation and more particularly on the lubricants made up of the repo trading has inserted a dimension in the overall equation that may contain seeds of turbulence and instability.

The way that the system works nowadays is that the entity that needs cash puts up collateral (Treasuries) which in turn are hypothecated by the lender of the cash in order to close his own holes. The fact that the central banks (mainly the Fed) has bought a good chunk of the available Treasuries over the last three years has created an awkward situation where the shortfall of good collateral forces the lenders of cash to pay high prices for good collateral with the result being the declining of yields, and more recently of negative rates.

The shortfall of good collateral has resulted in clogging the repo market, where trades fail and remain unfulfilled. Since the beginning of the year, more than $250 billion of such failed trades are being reported, every month. However, lately the failure rate reached the level of almost $200 billion per week, signifying a malfunctioning repo market that encompasses tail risks that have not been counted for. If those conditions prevail in the future, then liquidity constraints will add pressures on equity markets, while the hunt for safe havens will be on again, raising lending spreads and adding risks in the valuation exercises.

The Fed’s reverse repo agreements may loosen up some of the shortfall, however the fact is that while the outstanding amount of Treasuries has tripled in the last four years the trading volume has been declining, indicating an inability to create collateral which inevitably will lead to a liquidity crisis, which may not only disrupt operations like in Banco Espirito, but also result in fire sales of securities which undermine stability and exacerbate risks.

The low market volatility (as measured e.g. by VIX) may correlate with low volatility expected in bond yields (as measured by MOVE). However, that calmness does not necessarily imply stability. On the contrary may signify nervousness in the absence of collateral creation which will undermine all markets and will become a major disruptor, because repo fails could dry up leverage capacity which in turn will undermine the global derivatives structure.

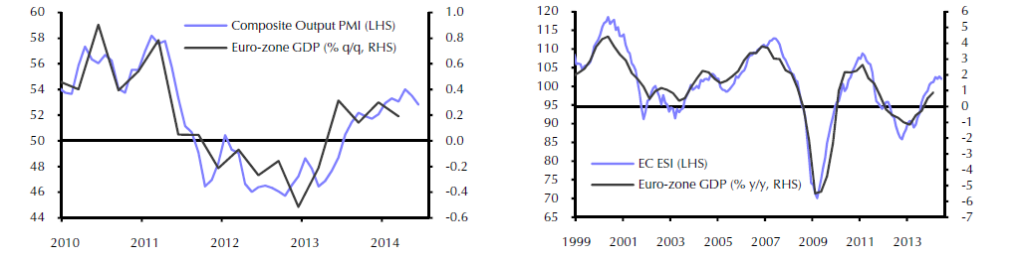

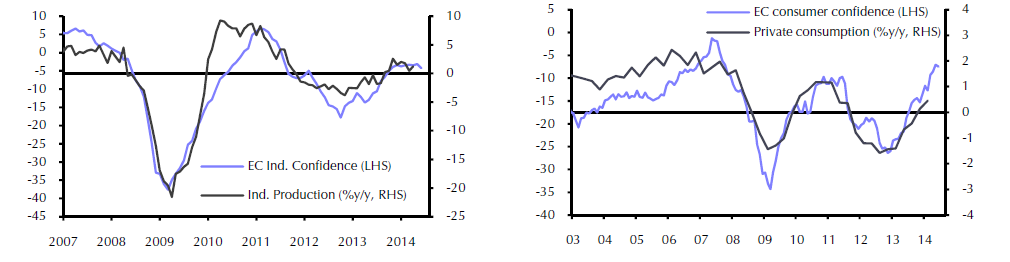

We are not as concerned of the Fed losing control of the interest rate game. The prudential engineering of the rates may have resulted in losing focus of collateral considerations, thus while the Fed and Fed- watchers are focusing on interest rates, the game is being played in another stadium; therefore interest rate normalization may well be in an execution phase and the markets may be following along in a rejoicing chorus. However, the dismal prospects on production, consumption, sentiment, and spending as shown below for the Eurozone may not so much signify deflationary concerns as much as declining velocity of collateral and inability to create bases of wealth that will in turn become collateral generators.

Unless collateral velocity increases, deflationary pressures will remain and uncertainty will undermine in the medium term any efforts to sustain an economy whose lifeline has become the trading of instruments rather than the production of hard assets that become the anchor of growth.

Plumbers Wanted: Financial Clogs and Market Engineering

Author : John E. Charalambakis

Date : July 12, 2014

Over the course of the last several months a sense of market stability has prevailed. This can be seen in the low yields of government securities around the globe, signifying that for even risky countries the country-related risk is declining, and prospects constantly keep improving. However, this past Thursday’s mini market turmoil was primarily blamed on the Portuguese bank Banco Espirito whose shares dropped by 17% in one day, triggering a wider selloff of equities throughout Europe and causing some minor tremors in US markets too. In addition, companies and banks from Span, Italy, and France as well as countries like France and Greece slashed their debt offerings or cancelled them completely, signifying that clogs remain in the financial system of Europe.

The main issue however that underline this past week’s mini turmoil may have more to do with the financial system’s overall plumbing rather than with the capital shortfalls of particular banks. Specifically, the dependence of the health of the economy on its financialization and rehypothecation and more particularly on the lubricants made up of the repo trading has inserted a dimension in the overall equation that may contain seeds of turbulence and instability.

The way that the system works nowadays is that the entity that needs cash puts up collateral (Treasuries) which in turn are hypothecated by the lender of the cash in order to close his own holes. The fact that the central banks (mainly the Fed) has bought a good chunk of the available Treasuries over the last three years has created an awkward situation where the shortfall of good collateral forces the lenders of cash to pay high prices for good collateral with the result being the declining of yields, and more recently of negative rates.

The shortfall of good collateral has resulted in clogging the repo market, where trades fail and remain unfulfilled. Since the beginning of the year, more than $250 billion of such failed trades are being reported, every month. However, lately the failure rate reached the level of almost $200 billion per week, signifying a malfunctioning repo market that encompasses tail risks that have not been counted for. If those conditions prevail in the future, then liquidity constraints will add pressures on equity markets, while the hunt for safe havens will be on again, raising lending spreads and adding risks in the valuation exercises.

The Fed’s reverse repo agreements may loosen up some of the shortfall, however the fact is that while the outstanding amount of Treasuries has tripled in the last four years the trading volume has been declining, indicating an inability to create collateral which inevitably will lead to a liquidity crisis, which may not only disrupt operations like in Banco Espirito, but also result in fire sales of securities which undermine stability and exacerbate risks.

The low market volatility (as measured e.g. by VIX) may correlate with low volatility expected in bond yields (as measured by MOVE). However, that calmness does not necessarily imply stability. On the contrary may signify nervousness in the absence of collateral creation which will undermine all markets and will become a major disruptor, because repo fails could dry up leverage capacity which in turn will undermine the global derivatives structure.

We are not as concerned of the Fed losing control of the interest rate game. The prudential engineering of the rates may have resulted in losing focus of collateral considerations, thus while the Fed and Fed- watchers are focusing on interest rates, the game is being played in another stadium; therefore interest rate normalization may well be in an execution phase and the markets may be following along in a rejoicing chorus. However, the dismal prospects on production, consumption, sentiment, and spending as shown below for the Eurozone may not so much signify deflationary concerns as much as declining velocity of collateral and inability to create bases of wealth that will in turn become collateral generators.

Unless collateral velocity increases, deflationary pressures will remain and uncertainty will undermine in the medium term any efforts to sustain an economy whose lifeline has become the trading of instruments rather than the production of hard assets that become the anchor of growth.