Fifteen years ago the global markets were getting ready to “welcome” the Asian financial crisis. The cause of that crisis? Declining multifactor productivity from Thailand and Taiwan, to Indonesia and S. Korea. The symptoms of that crisis? Trade deficits, overvalued currencies, declining foreign reserves, among others.

Where is the EU today? Needless to say that it is in exactly the same position as SE Asia back then! The symptoms of deficits, uncontrollable public debts, unfunded liabilities (in major countries like Germany, Austria, France and the Netherlands), bankrupt banks, high unemployment (to name just a few), are nothing but the natural consequences of a “Union” that lost the two basic messages of a market economy, namely that prosperity does not depend upon the ability to consume and manufacture credit out of nothing, but rather upon the ability to produce and have a stable monetary anchor that cannot be printed.

Based on the above, the Euro project was nothing but a parasitic structure. It is time to save the trade openness of the EU by allowing the controlled disintegration of the dream that made us scream. The fact of entropy teaches us that a system moves from order to disorder and disintegration. Why is it so difficult for the EU leaders to follow the natural order of things and prepare for a controlled disintegration, rather than masochistically torture the people and the markets with “solutions” that cannot work such as more debt, bank union, etc?

As monetary entropy accumulates into the economic system in the form of credit extensions via rehypothecation of paper assets (including unfortunately derivative “assets” a.k.a. weapons of mass deception) it necessarily leads to greater imbalances in trade, capital flows, employment, and liabilities.

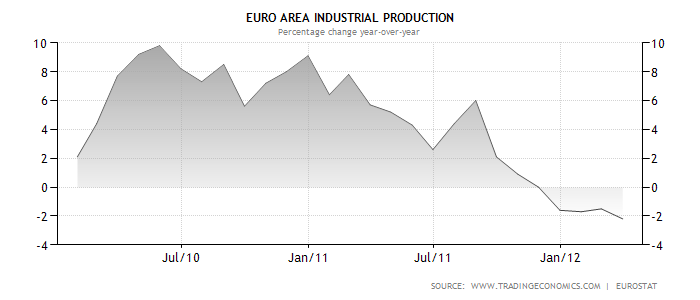

The graphs below are indicative of the trends described above.

The declining industrial production is a symptom of a system that is unstable due to wasteful monetary entropy that needs to be released due to the fact that credit was extended without the necessary hard asset backing. As the system disintegrates, liabilities cannot be met and internal devaluations are forced that lead to higher unemployment rates as shown below.

Of course, as countries fall deeper into recessions and silent depressions, stock markets dive since no viable solution can be found to a system that inherently is unstable and which is based on a banking sector that perpetuates the idea that liabilities ranging from the ECB cash to all the EU banks’ IOUs can be considered assets.

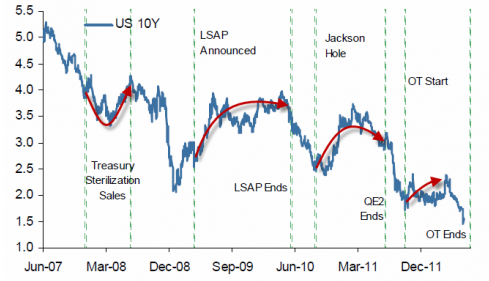

Among the “solutions” proposed again is the two-speed Euro where the northern countries would have a different kind of Euro from the “problematic” southern states. With all due respect, fiat money will always be fiat money that sooner or later will lose all credibility and store of value function. Of course, through financial repression the yields of US and Germany are pushed downwards as the figure below demonstrates, but this is another symptom of the current global monetary system’s non sustainability.

What could be simpler than scratching the debunk system and start a new one based on hard assets and precious metals rather than on the collateralization of worthless liabilities which when securitized make endogenous money demand claims that destabilize the system?

Until this is done, here are basic instructions at a time of disintegration: Hold a significant percentage of your portfolio in precious metals, because if all the cash that sits around – in the trillions of dollars – seeks a true safe haven such as gold, then given that there is not enough of gold available for purchase, the trajectory of precious metals’ pricing is very promising, especially if the disintegration happens to be in an uncontrolled form.

Parasitic Structures and Monetary Entropy: Basic Instructions Before Disintegration

Author : John E. Charalambakis

Date : June 7, 2012

Fifteen years ago the global markets were getting ready to “welcome” the Asian financial crisis. The cause of that crisis? Declining multifactor productivity from Thailand and Taiwan, to Indonesia and S. Korea. The symptoms of that crisis? Trade deficits, overvalued currencies, declining foreign reserves, among others.

Where is the EU today? Needless to say that it is in exactly the same position as SE Asia back then! The symptoms of deficits, uncontrollable public debts, unfunded liabilities (in major countries like Germany, Austria, France and the Netherlands), bankrupt banks, high unemployment (to name just a few), are nothing but the natural consequences of a “Union” that lost the two basic messages of a market economy, namely that prosperity does not depend upon the ability to consume and manufacture credit out of nothing, but rather upon the ability to produce and have a stable monetary anchor that cannot be printed.

Based on the above, the Euro project was nothing but a parasitic structure. It is time to save the trade openness of the EU by allowing the controlled disintegration of the dream that made us scream. The fact of entropy teaches us that a system moves from order to disorder and disintegration. Why is it so difficult for the EU leaders to follow the natural order of things and prepare for a controlled disintegration, rather than masochistically torture the people and the markets with “solutions” that cannot work such as more debt, bank union, etc?

As monetary entropy accumulates into the economic system in the form of credit extensions via rehypothecation of paper assets (including unfortunately derivative “assets” a.k.a. weapons of mass deception) it necessarily leads to greater imbalances in trade, capital flows, employment, and liabilities.

The graphs below are indicative of the trends described above.

The declining industrial production is a symptom of a system that is unstable due to wasteful monetary entropy that needs to be released due to the fact that credit was extended without the necessary hard asset backing. As the system disintegrates, liabilities cannot be met and internal devaluations are forced that lead to higher unemployment rates as shown below.

Of course, as countries fall deeper into recessions and silent depressions, stock markets dive since no viable solution can be found to a system that inherently is unstable and which is based on a banking sector that perpetuates the idea that liabilities ranging from the ECB cash to all the EU banks’ IOUs can be considered assets.

Among the “solutions” proposed again is the two-speed Euro where the northern countries would have a different kind of Euro from the “problematic” southern states. With all due respect, fiat money will always be fiat money that sooner or later will lose all credibility and store of value function. Of course, through financial repression the yields of US and Germany are pushed downwards as the figure below demonstrates, but this is another symptom of the current global monetary system’s non sustainability.

What could be simpler than scratching the debunk system and start a new one based on hard assets and precious metals rather than on the collateralization of worthless liabilities which when securitized make endogenous money demand claims that destabilize the system?

Until this is done, here are basic instructions at a time of disintegration: Hold a significant percentage of your portfolio in precious metals, because if all the cash that sits around – in the trillions of dollars – seeks a true safe haven such as gold, then given that there is not enough of gold available for purchase, the trajectory of precious metals’ pricing is very promising, especially if the disintegration happens to be in an uncontrolled form.