“The world was all before them

where to choose their place of rest

and Providence their guide.

They hand in hand with wandering steps and slow

through Eden took,

their solitaire way.”

John Milton, Book XII (that’s how the poem ends)

In the most recent issue of Institutional Investor, Ian Bremmer and Nouriel Roubini published an article that became the magazine’s cover story, titled “Paradise Lost: Why Fallen Markets Will Never Be the Same”. Thus, almost 350 years after John Milton’s famous poem on the fall of humanity, and of the eternal conflicts, the two famous authors and analysts follow the steps of Francis Fukuyama by predicting another end of history, due to the most recent financial collapse.

The reasons they cite for such a pessimistic view are deleveraging, subpar growth, rising unemployment, instability, and uncertainty, among others. The latter two can be attributed to the fact that the new era will be characterized by nonpolarity vs. what most analysts claim will be a multipolar world. Of course, the unipolarity that characterized the last twenty years, according to the authors, is history since unfunded liabilities, debt, and institutional factors prevent the US from continuing to play the role that allowed her to dominate in the last quarter century.

The authors continue their nonpolarity claim by advocating that the G-20 group is incapable of leading the global order due to divergent views on democracy, transparency, institutional reform, and the role of state in the new era. Without a doubt the role of the state in economic affairs has been advancing since the financial crisis surfaced. State-owned oil companies control over 75% of oil reserves around the world. Moreover, Sovereign Wealth Funds are perceived as the liberators of markets and the ultimate refuge of cash-strapped companies and nations that need to unload debt instruments.

We may revert back to this very important theme, however we choose to divert from this view and claim that a strategic position of the US and of individual investors has a lot to gain in the new unfolding era. Allow us to review some (and certainly not all) of our positions:

First, an economic structure that is not based on hard assets, is doomed to fail.

Second, paper-assets represent liabilities of somebody else and contain significant counter-party risks.

Third, valuations that exceed historical averages – adjusted for productivity and anchored projections – represent bubbles.

Fourth, financial interests separated from industrial interests and production cannot advance wealth creation.

Finally, as history unfolds herself along with technology, geostrategic moves, institutional forces, and demographic factors, nations and individuals need to position themselves according to those unfolding changes.

From our writings over the past few months, we would like to review three calls we have made (besides our classic gold) and which if followed by investors, a lot of gains could have been made. The numbers speak for themselves.

The implications for the US and other countries follow the graphs.

In the beginning of the year we published in our monthly newsletter our strong position regarding Rare Earth Elements (RRE). Since then the performance of funds that track conditions in the REE market have done very well. We show two of them below. The first one is the Solactive Rare Earth Index which tracks the performance of the15 largest listed companies, whose main business operations are exploration, mining, investing in Rare Earth and/or direct investments in Rare Earth mines.

Solactive Rare Earth Total Return Index

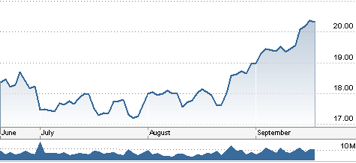

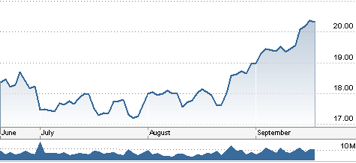

The next one is the company called Avalon which is also in the business of REE mining and exploration.

Avalon, 60%+ return since the beginning of the Year

In addition, last June we published in our newsletter our views about Africa and its promising trajectory. The following ETF shows the returns of our call since June.

Africa ETF, 3-month Return, of over 10%

Finally, in our July issue, we made the call regarding silver. Since then silver has gained more than 15% and we believe its best days are ahead.

Silver ETF and its 15%+ return in 3 months

Good solid returns have not been expelled from the financial paradise. We simply believe that an investment strategy should follow – among others – the five characteristics outlined earlier.

Closing this commentary, allow us to state that nations that need to advance themselves also need to anchor their strategies in those five – among others – characteristics.

REE exploration, mining and trading represents both hard assets and production possibilities. At the same time it advances new technologies and thus educational and research opportunities. Credit creation that is also anchored to hard assets, avoids the creation of bubbles and the cheapening of currencies and standards. Finally, investing in a promising market like Africa produces two positive results. First, it advances the chances of development for a poor continent that is resource-rich but cash and institutions-poor. And second, it creates frontier opportunities for investors and addresses the growth potential/need of portfolios.

Where next? How about Vietnam, the subject of our October newsletter.

Paradise Lost: A Contrarian View Based on Our Most Recent Calls

Author : John E. Charalambakis

Date : October 5, 2010

“The world was all before them

where to choose their place of rest

and Providence their guide.

They hand in hand with wandering steps and slow

through Eden took,

their solitaire way.”

John Milton, Book XII (that’s how the poem ends)

In the most recent issue of Institutional Investor, Ian Bremmer and Nouriel Roubini published an article that became the magazine’s cover story, titled “Paradise Lost: Why Fallen Markets Will Never Be the Same”. Thus, almost 350 years after John Milton’s famous poem on the fall of humanity, and of the eternal conflicts, the two famous authors and analysts follow the steps of Francis Fukuyama by predicting another end of history, due to the most recent financial collapse.

The reasons they cite for such a pessimistic view are deleveraging, subpar growth, rising unemployment, instability, and uncertainty, among others. The latter two can be attributed to the fact that the new era will be characterized by nonpolarity vs. what most analysts claim will be a multipolar world. Of course, the unipolarity that characterized the last twenty years, according to the authors, is history since unfunded liabilities, debt, and institutional factors prevent the US from continuing to play the role that allowed her to dominate in the last quarter century.

The authors continue their nonpolarity claim by advocating that the G-20 group is incapable of leading the global order due to divergent views on democracy, transparency, institutional reform, and the role of state in the new era. Without a doubt the role of the state in economic affairs has been advancing since the financial crisis surfaced. State-owned oil companies control over 75% of oil reserves around the world. Moreover, Sovereign Wealth Funds are perceived as the liberators of markets and the ultimate refuge of cash-strapped companies and nations that need to unload debt instruments.

We may revert back to this very important theme, however we choose to divert from this view and claim that a strategic position of the US and of individual investors has a lot to gain in the new unfolding era. Allow us to review some (and certainly not all) of our positions:

First, an economic structure that is not based on hard assets, is doomed to fail.

Second, paper-assets represent liabilities of somebody else and contain significant counter-party risks.

Third, valuations that exceed historical averages – adjusted for productivity and anchored projections – represent bubbles.

Fourth, financial interests separated from industrial interests and production cannot advance wealth creation.

Finally, as history unfolds herself along with technology, geostrategic moves, institutional forces, and demographic factors, nations and individuals need to position themselves according to those unfolding changes.

From our writings over the past few months, we would like to review three calls we have made (besides our classic gold) and which if followed by investors, a lot of gains could have been made. The numbers speak for themselves.

The implications for the US and other countries follow the graphs.

In the beginning of the year we published in our monthly newsletter our strong position regarding Rare Earth Elements (RRE). Since then the performance of funds that track conditions in the REE market have done very well. We show two of them below. The first one is the Solactive Rare Earth Index which tracks the performance of the15 largest listed companies, whose main business operations are exploration, mining, investing in Rare Earth and/or direct investments in Rare Earth mines.

Solactive Rare Earth Total Return Index

The next one is the company called Avalon which is also in the business of REE mining and exploration.

Avalon, 60%+ return since the beginning of the Year

In addition, last June we published in our newsletter our views about Africa and its promising trajectory. The following ETF shows the returns of our call since June.

Africa ETF, 3-month Return, of over 10%

Finally, in our July issue, we made the call regarding silver. Since then silver has gained more than 15% and we believe its best days are ahead.

Silver ETF and its 15%+ return in 3 months

Good solid returns have not been expelled from the financial paradise. We simply believe that an investment strategy should follow – among others – the five characteristics outlined earlier.

Closing this commentary, allow us to state that nations that need to advance themselves also need to anchor their strategies in those five – among others – characteristics.

REE exploration, mining and trading represents both hard assets and production possibilities. At the same time it advances new technologies and thus educational and research opportunities. Credit creation that is also anchored to hard assets, avoids the creation of bubbles and the cheapening of currencies and standards. Finally, investing in a promising market like Africa produces two positive results. First, it advances the chances of development for a poor continent that is resource-rich but cash and institutions-poor. And second, it creates frontier opportunities for investors and addresses the growth potential/need of portfolios.

Where next? How about Vietnam, the subject of our October newsletter.