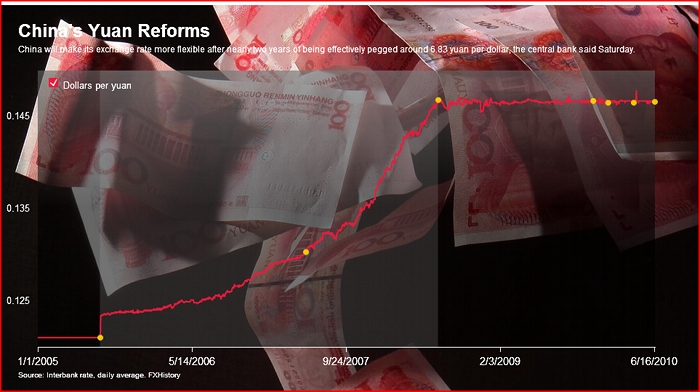

The recent announcement that the Chinese will allow their currency (RMB a.k.a. Yuan) to be more flexible against the greenback was welcomed by US and other monetary authorities. The RMB was fixed during the last two years at 6.83 to the greenback. That helped the Chinese Authorities in their semi-controlled economic regime to plan for their targets. However, as we wrote in the June newsletter, the first signs are already present that the Chinese growth is slowing down. The expected appreciation of the RMB will boost domestic spending and thus production and employment will also experience positive side-effects, with the hope that any slowdown will not be significant.

As the following figure shows, the RMB was allowed to appreciate against the USD two years ago, and since then has been fixed. We view the new exchange rate regime with twin glasses: First, with the glasses of upcoming domestic challenges in China. Second, with the glasses of an alliance in international monetary affairs where the Russian efforts to re-assert themselves are coupled with efforts to control assets and thus contracts and the bond markets around the world. We are very cautious of the reported meetings among Russian officials and investment bankers who commit to advance Russian financial capital markets. We are of the opinion that nothing short of the USD as the international Reserve Currency is at stake.

President Medvedev announced during a conference last weekend, that he desires the Russian Ruble to play the role of an international reserve currency. Russia controls major hard assets that could be collateralized and thus securitized. In that case, the development of major Russian capital markets would be the venue of controlling the international bond/debt market. In the case of a major Chinese collapse, and given the projected alliance between China and Russia, the latter would be able to control major Chinese assets around the world. Thus, they would be also able to control a good portion of the US bond market. Is this something desirable? What would happen to the greenback and the bond market under such a scenario? Could the US afford that?

We believe that such a scenario could only advance precious metals and the asset classes related to hard assets. The recent record set for gold, could only be the beginning of an exponential rise in the prices of gold, platinum, and to some extent set silver as an investment class itself.

It promises to be an interesting ride. Please enjoy it!

On the Verge of Major Monetary Changes

Author : John E. Charalambakis

Date : June 21, 2010

The recent announcement that the Chinese will allow their currency (RMB a.k.a. Yuan) to be more flexible against the greenback was welcomed by US and other monetary authorities. The RMB was fixed during the last two years at 6.83 to the greenback. That helped the Chinese Authorities in their semi-controlled economic regime to plan for their targets. However, as we wrote in the June newsletter, the first signs are already present that the Chinese growth is slowing down. The expected appreciation of the RMB will boost domestic spending and thus production and employment will also experience positive side-effects, with the hope that any slowdown will not be significant.

As the following figure shows, the RMB was allowed to appreciate against the USD two years ago, and since then has been fixed. We view the new exchange rate regime with twin glasses: First, with the glasses of upcoming domestic challenges in China. Second, with the glasses of an alliance in international monetary affairs where the Russian efforts to re-assert themselves are coupled with efforts to control assets and thus contracts and the bond markets around the world. We are very cautious of the reported meetings among Russian officials and investment bankers who commit to advance Russian financial capital markets. We are of the opinion that nothing short of the USD as the international Reserve Currency is at stake.

President Medvedev announced during a conference last weekend, that he desires the Russian Ruble to play the role of an international reserve currency. Russia controls major hard assets that could be collateralized and thus securitized. In that case, the development of major Russian capital markets would be the venue of controlling the international bond/debt market. In the case of a major Chinese collapse, and given the projected alliance between China and Russia, the latter would be able to control major Chinese assets around the world. Thus, they would be also able to control a good portion of the US bond market. Is this something desirable? What would happen to the greenback and the bond market under such a scenario? Could the US afford that?

We believe that such a scenario could only advance precious metals and the asset classes related to hard assets. The recent record set for gold, could only be the beginning of an exponential rise in the prices of gold, platinum, and to some extent set silver as an investment class itself.

It promises to be an interesting ride. Please enjoy it!