We have entered an era where currency values may move markets into uncharted territory. At the same time complacency and the fact that investments are driven by central banks’ moves, has created an atmosphere where investment activity is more reactive rather than anticipatory. As I wrote in the November 7th commentary I believe that the strength of the greenback will continue and that the gains seen so far in the last five-six months represent a prelude to future advances. Historically speaking currency swings are sustained for a period of at least 18-24 months, hence as the prospects for growth in the US strengthen (vis-a-vis the EU’s growth prospects), the US greenback is expected to strengthen further. However, this trend will be supplemented by moves already underway. Specifically, the determination of the ECB and the central bank of Japan for significant rounds of quantitative easing – while the Chinese reduce their interest rates – will only give wings to the greenback.

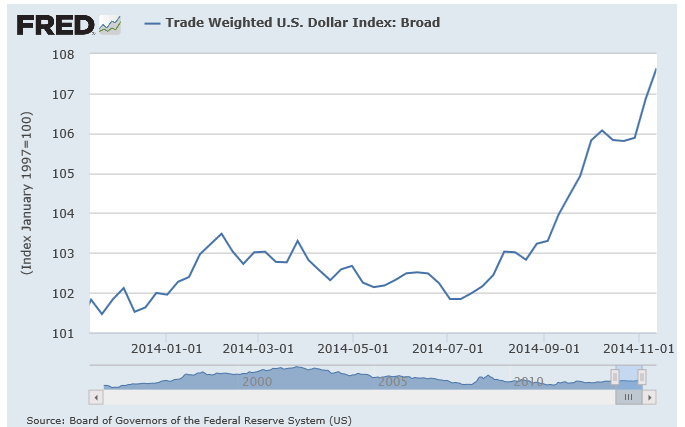

As the graph below shows the USD trade-weighted index has taken off, which has three immediate effects (among others): First, it reduces the purchasing power of multinationals’ cash sitting overseas; second, it attracts capital in the US; and third, tends to be negatively correlated with prices of commodities.

Again, as I wrote previously, I believe that while this negative correlation may be sustained for a number of commodities it will be not sustained for precious metals. The prices of the latter are susceptible to some fundamental changes underway, such as higher demand from China and India, the fact that Russia’s central bank can buy local miners’ production in rubles simply by printing them, institutional changes in the way that those prices are settled, sought-after alternative investments, low prices , and low yields (among others), all of which could start the rising tide for precious metals in 2015 and stronger wings in 2016.

The US equity markets seem to trade lately within a narrow range and to some extent they also seem over-stretched seeking some breathing room. If that breathing room is extended, we anticipate that 2015 will start on a healthier basis. If not, we may have a bumpy ride in the beginning.

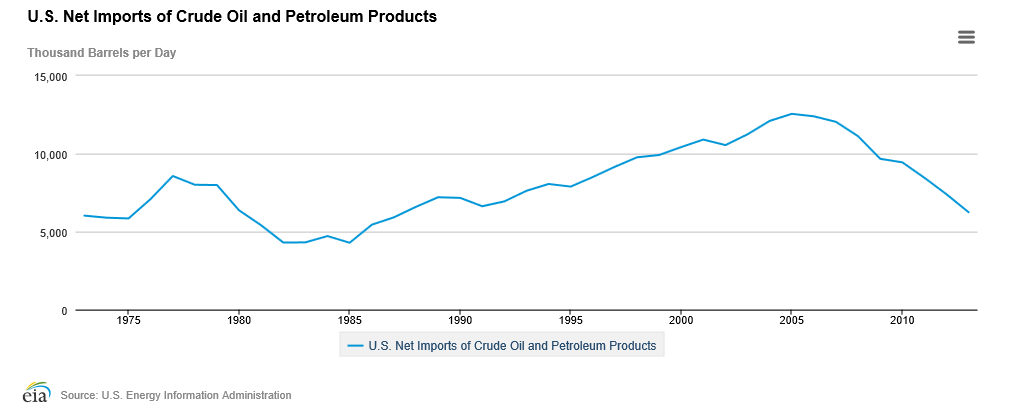

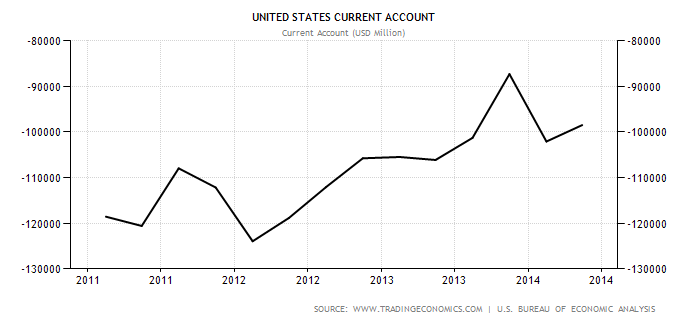

Overall however, the US equity markets seem to be preparing themselves for another decent year in which the EU and possibly the Chinese and the Japanese markets will also demonstrate good performances. The EU markets will be supported not only by the ECB’s actions that may advance liquidity, but also by higher exports and corporate earnings (a 10% drop in the Euro is anticipated to raise corporate profits in the EU by 7%). The locomotive is expected to be the US which as the following two graphs show, is experiencing an energy renaissance with declining energy imports and improving current account balances.

What then should we expect of emerging markets? Traditionally, their revenue from exporting primary materials and commodities declines due to the rising dollar and lower commodities prices. However, in the unfolding era we may see that the US locomotive may not only increase volumes but also foreign direct investments.

Someone may say, “All these sound wonderful”. This might be true until the next crisis hits at which point – as this past week’s revelations showed – all major players and the global financial system may be “toasted”. We shall return in the forthcoming weeks with commentaries related to the threats forming in the horizon of the global economy, but for now I will only mention that complacency that leads to crowded trades is dangerous simply because at the time of crisis the liquidity will not be there to support the exit that everybody would want.

Happy Thanksgiving!

On the Rising Dollar, Crowded Trades, and Market Prospects: The Background to the 2015 Season

Author : John E. Charalambakis

Date : November 24, 2014

We have entered an era where currency values may move markets into uncharted territory. At the same time complacency and the fact that investments are driven by central banks’ moves, has created an atmosphere where investment activity is more reactive rather than anticipatory. As I wrote in the November 7th commentary I believe that the strength of the greenback will continue and that the gains seen so far in the last five-six months represent a prelude to future advances. Historically speaking currency swings are sustained for a period of at least 18-24 months, hence as the prospects for growth in the US strengthen (vis-a-vis the EU’s growth prospects), the US greenback is expected to strengthen further. However, this trend will be supplemented by moves already underway. Specifically, the determination of the ECB and the central bank of Japan for significant rounds of quantitative easing – while the Chinese reduce their interest rates – will only give wings to the greenback.

As the graph below shows the USD trade-weighted index has taken off, which has three immediate effects (among others): First, it reduces the purchasing power of multinationals’ cash sitting overseas; second, it attracts capital in the US; and third, tends to be negatively correlated with prices of commodities.

Again, as I wrote previously, I believe that while this negative correlation may be sustained for a number of commodities it will be not sustained for precious metals. The prices of the latter are susceptible to some fundamental changes underway, such as higher demand from China and India, the fact that Russia’s central bank can buy local miners’ production in rubles simply by printing them, institutional changes in the way that those prices are settled, sought-after alternative investments, low prices , and low yields (among others), all of which could start the rising tide for precious metals in 2015 and stronger wings in 2016.

The US equity markets seem to trade lately within a narrow range and to some extent they also seem over-stretched seeking some breathing room. If that breathing room is extended, we anticipate that 2015 will start on a healthier basis. If not, we may have a bumpy ride in the beginning.

Overall however, the US equity markets seem to be preparing themselves for another decent year in which the EU and possibly the Chinese and the Japanese markets will also demonstrate good performances. The EU markets will be supported not only by the ECB’s actions that may advance liquidity, but also by higher exports and corporate earnings (a 10% drop in the Euro is anticipated to raise corporate profits in the EU by 7%). The locomotive is expected to be the US which as the following two graphs show, is experiencing an energy renaissance with declining energy imports and improving current account balances.

What then should we expect of emerging markets? Traditionally, their revenue from exporting primary materials and commodities declines due to the rising dollar and lower commodities prices. However, in the unfolding era we may see that the US locomotive may not only increase volumes but also foreign direct investments.

Someone may say, “All these sound wonderful”. This might be true until the next crisis hits at which point – as this past week’s revelations showed – all major players and the global financial system may be “toasted”. We shall return in the forthcoming weeks with commentaries related to the threats forming in the horizon of the global economy, but for now I will only mention that complacency that leads to crowded trades is dangerous simply because at the time of crisis the liquidity will not be there to support the exit that everybody would want.

Happy Thanksgiving!