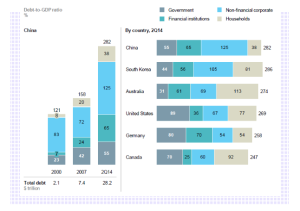

In a recent study by the McKinsey Institute total credit market debt in China is shown as the largest in the world, and that is only what we know of. The dangers are not limited just to China but are extended to the global financial system. In a world where financial institutions are interconnected and where credit flows create a maze, the overextension of credit in an economy endanger the global financial architecture with a hard landing that could quickly unravel the real economies due to the size of leverage that all leading countries have accumulated in the last 15 years.

Here is a picture of the debt-to-GDP ratio for the leading countries around the world, according to the McKinsey Institute.

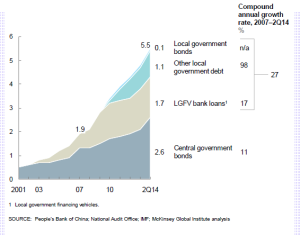

Over the course of the last seven years, credit growth in China averaged 27%, as the graph below shows.

Non-performing loans – especially among SPVs created for real estate projects – are rising. Loosening monetary policy (as we witnessed lately) does not solve the problem, since corporate borrowing seems to have been tapped out. In addition, municipalities face difficulties in repaying the loans they have guaranteed, giving a push to the central government to spend more money. Hence, while consumers – and possibly the central government – may still have room to take on more debt, the overblown stock market endangers a landing that could restrain the households to take on more debt.

The murky local shadow banking system and the bubble in the stock market endanger China’s financial stability, which in turn could shake up the finances of all developing countries and negatively affect most developed economies too. The reason for such danger is the fact that margin lending has more than tripled in the past year, giving frenzy to speculation among uninformed investors. The fact that the margin debt exceeds 8% of the free float is indicative of the bubble that has been created. At the very least the bursting of this bubble (the Shanghai market rose 53% last year and another 36% this year) will intensify volatility in global markets.

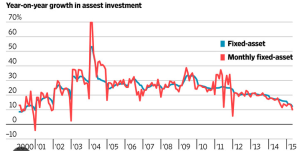

The Chinese slowdown could be seen in its fixed-asset investment spending which reached record low levels since the beginning of the century, as the graph below shows.

It was this slowdown among other significant drops in equal important indicators that forced the Chinese authorities just a few days ago to announce the launching of another round of urgent stimulus, in order to assist local governments in overcoming difficulties in repaying hundreds of billions of overdue loans, while encouraging lenders to loosen credit standards. In addition, the cheapening of collateral standards is in full swing which demonstrates the magnitude of the problems.

China’s overcapacity in several industries is seeking an exit venue. This could be the new Silk Road (which envisions connecting 65 countries and 4.4 billion people and is officially called One Belt One Road) that Xi Jinping is announcing throughout Asia. The dream of connecting Asia to the Middle East, Russia, and Europe and eventually the maritime road goal of linking South China Sea to the Indian Ocean, The Red Sea, the Mediterranean and East Africa, is ambitious but it also has its own problems. Such an exit may also advance China’s dreams of making its currency a reserve currency for the world. The Asian Infrastructure and Development Bank (AIIB) is another initiative it is trying to let air and fumes out of the many bubbles it faces.

However, such big dreams are destined to meet the reality that political liberalization is required across nations and that projecting a naval power may conflict with existing geostrategic structures. After all, it could not be a coincidence that in the last few days harsh words have been exchanged between the Pentagon and Chinese authorities due to the fact that the US is determined to send aircraft and Navy ships in disputed waters in the South China Sea.

Could some of the above serve as a prelude to a forthcoming feature presentation?

On the Chinese Wall of Steroids: Imbalances and Asymmetries

Author : John E. Charalambakis

Date : May 19, 2015

In a recent study by the McKinsey Institute total credit market debt in China is shown as the largest in the world, and that is only what we know of. The dangers are not limited just to China but are extended to the global financial system. In a world where financial institutions are interconnected and where credit flows create a maze, the overextension of credit in an economy endanger the global financial architecture with a hard landing that could quickly unravel the real economies due to the size of leverage that all leading countries have accumulated in the last 15 years.

Here is a picture of the debt-to-GDP ratio for the leading countries around the world, according to the McKinsey Institute.

Over the course of the last seven years, credit growth in China averaged 27%, as the graph below shows.

Non-performing loans – especially among SPVs created for real estate projects – are rising. Loosening monetary policy (as we witnessed lately) does not solve the problem, since corporate borrowing seems to have been tapped out. In addition, municipalities face difficulties in repaying the loans they have guaranteed, giving a push to the central government to spend more money. Hence, while consumers – and possibly the central government – may still have room to take on more debt, the overblown stock market endangers a landing that could restrain the households to take on more debt.

The murky local shadow banking system and the bubble in the stock market endanger China’s financial stability, which in turn could shake up the finances of all developing countries and negatively affect most developed economies too. The reason for such danger is the fact that margin lending has more than tripled in the past year, giving frenzy to speculation among uninformed investors. The fact that the margin debt exceeds 8% of the free float is indicative of the bubble that has been created. At the very least the bursting of this bubble (the Shanghai market rose 53% last year and another 36% this year) will intensify volatility in global markets.

The Chinese slowdown could be seen in its fixed-asset investment spending which reached record low levels since the beginning of the century, as the graph below shows.

It was this slowdown among other significant drops in equal important indicators that forced the Chinese authorities just a few days ago to announce the launching of another round of urgent stimulus, in order to assist local governments in overcoming difficulties in repaying hundreds of billions of overdue loans, while encouraging lenders to loosen credit standards. In addition, the cheapening of collateral standards is in full swing which demonstrates the magnitude of the problems.

China’s overcapacity in several industries is seeking an exit venue. This could be the new Silk Road (which envisions connecting 65 countries and 4.4 billion people and is officially called One Belt One Road) that Xi Jinping is announcing throughout Asia. The dream of connecting Asia to the Middle East, Russia, and Europe and eventually the maritime road goal of linking South China Sea to the Indian Ocean, The Red Sea, the Mediterranean and East Africa, is ambitious but it also has its own problems. Such an exit may also advance China’s dreams of making its currency a reserve currency for the world. The Asian Infrastructure and Development Bank (AIIB) is another initiative it is trying to let air and fumes out of the many bubbles it faces.

However, such big dreams are destined to meet the reality that political liberalization is required across nations and that projecting a naval power may conflict with existing geostrategic structures. After all, it could not be a coincidence that in the last few days harsh words have been exchanged between the Pentagon and Chinese authorities due to the fact that the US is determined to send aircraft and Navy ships in disputed waters in the South China Sea.

Could some of the above serve as a prelude to a forthcoming feature presentation?