Last Friday’s evening downgrade by the S&P was ill-timed and ill-advised. We wrote a week ago that we would not be surprised if it took place. We will reiterate our position that August again will prove to be a pivotal month in the financial markets. No need to repeat what we wrote in August 2010 and also in the last few commentaries. On August 15, 1971 the global financial system lost its anchor and on August 5, 2011 the vessel started moving into uncharted waters. Where the next destination-port (if there is one in the foreseeable future) will be determined by several factors, probably over the course of a few years.

We are not compelled to elaborate on why it was ill-timed and ill-advised, because the reasons are probably obvious. However, we will site a few examples: Most other countries that still have AAA rating are in a worse position than the US; the credibility of the rating agencies is not stellar; political dysfunctions cannot carry that much weight in the probability of default, especially when the assets are real; the banking system is much more toxic than the macroeconomy of the US, and hence if anything should have been downgraded it should have been the shaky balance sheets of banks that count toxic assets as real collateral and capital; the instability that the downgrade could evoke has the potential of pushing the global economy into dangerous waters completely unknown to the financial system. The number of instruments tied to the US Treasuries is enormous. The number of financial transactions tied to the US dollar is infinite. S&P admitted its error of $2 trillion and quickly changed its rationale for the downgrade to the political dysfunctions, given the failure to agree on a $4 trillion deficit reduction program. If their ill-timed downgrade pushes interest rates higher by just 1%, the deficit will increase by approximately $1.5 trillion, and will eliminate even the benefits of the dismal deal reached. The confinement of the port started to be demolished on Friday, and the vessel is being pushed into uncharted waters without an anchor.

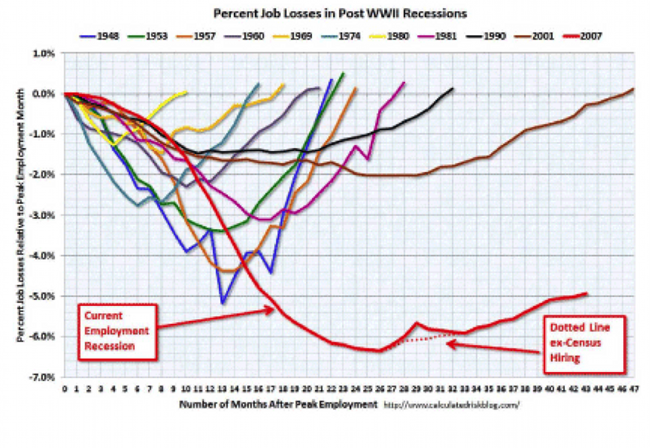

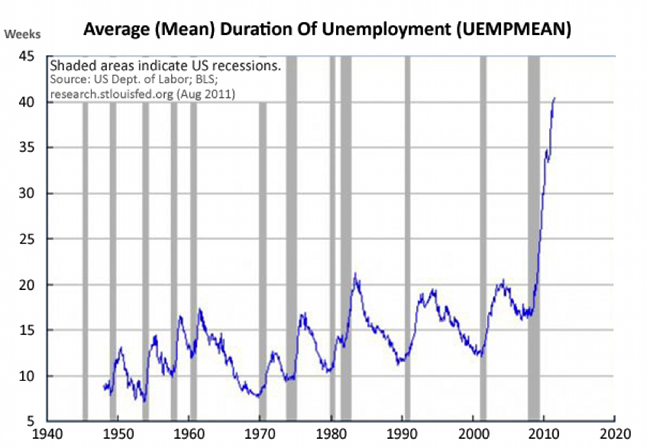

The US and global economy is fragile no doubt, as the following two graphs show. The first graph shows that the job losses are the worst in the last 65 years. Even worse is that the average duration in unemployment is also the worst since World War II. We may be entering a period of sluggish growth with permanently unemployed persons who will be experiencing a downgrade of their physical, financial, and human capital. All these at a time when the educational system has assassinated Homer, has lowered standards, and has produced pupils who may know the price of everything and the value of nothing, incapable of connecting the dots and seeing that the physical infrastructure – which enables the private sector to do business – of the US is crumpling in a state of disrepair. It’s not so much that cyclically-adjusted deficits matter, as that the car engine is dying and needs major work.

Source: Bureau of Labor Statistics, Agora Financial

Source: Bureau of Labor Statistics, St. Louis Federal Reserve Bank

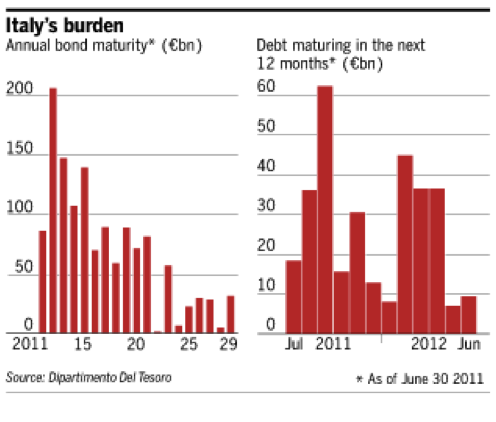

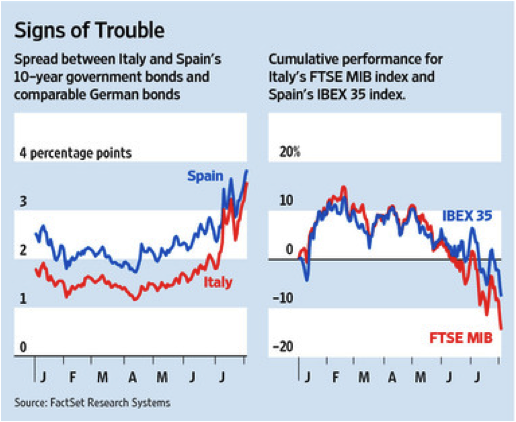

We have been saying for years that the camouflages used – top among them the infamous derivatives – as “assets” and pledged as collateral for credit over-extension, have had the result of creating an unstable debt pyramid that now not only is it shaky but also dangerous for the well-being of the real economy. The dramatic situation in Europe is an example of that unstable situation. The high debt costs of refinancing EU debt are rising, and the concerns over EU’s stamina to strengthen their rescue facility (EFSF) are spreading over the possible need to bailout major economies in the EU (see our previous commentaries on the issue). If that were to be the case, then Spain and Italy would need at least $1 trillion, as the following graph shows, and assuming that there will be no collateral damages for Belgium, Netherlands, France, to name just a few other EU countries.

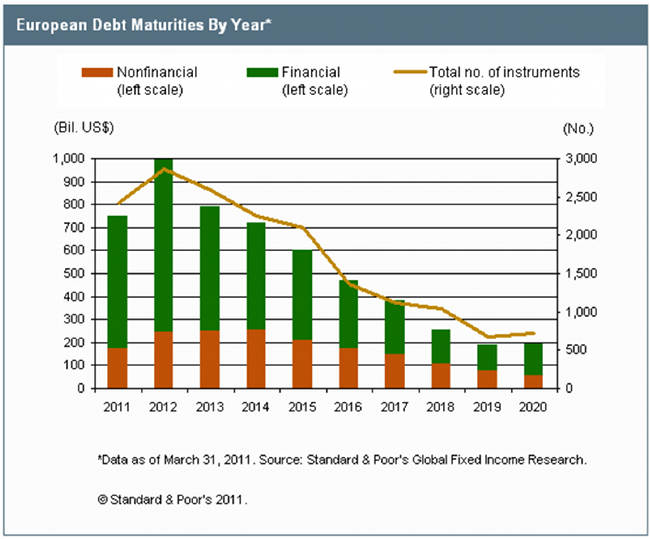

The rising costs of refinancing and insuring EU debt will have significant effects on equities and most importantly in refinancing private debt. The need for the latter is estimated to be at least $4 trillion. The recent downgrade of the US paper/anchor for the debt markets will lead to the balkanization of the bond markets, especially for paper that is unsecured and that is rated below A+. As the following two figures show between 2011 and 2015 there are trillions of dollars in bonds – especially in the banking sector – that require refinancing. The rising costs of financing government paper will squeeze liquidity, raise risks, will create crowded markets, will force corporate downgrades, may dry up financing for startups, may even increase defaults, all at a time when central banks contemplate issuing massive amount of cash and purchasing paper assets.

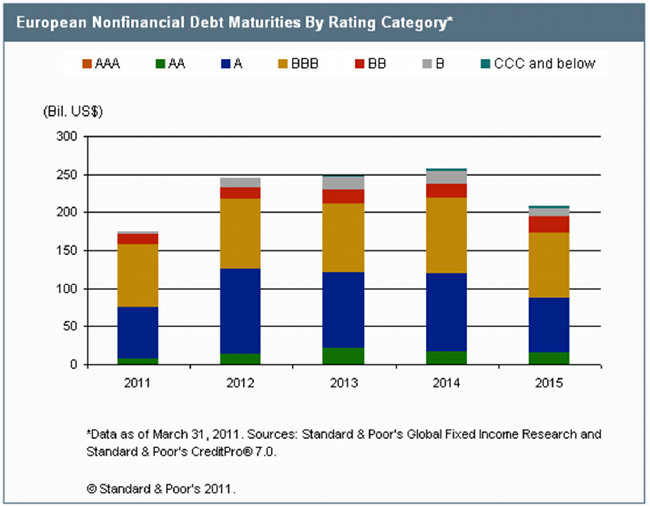

Of course, the non-financial debt that is maturing will face equal pressures, and as the following figure shows, the great majority of it is rated below A+.

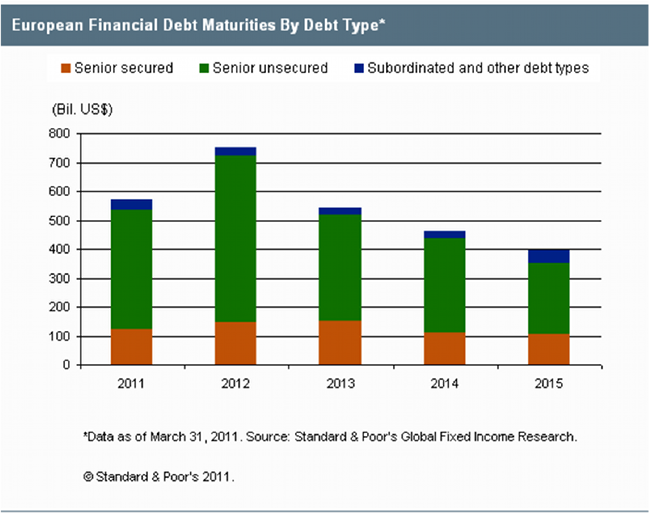

The fact that the financial debt is mostly unsecured, as the following graph shows, may create havoc in the markets since absent a sound collateral base, the institutions may turn out to be too big to save.

Once the balkanization/devolution of the bond markets starts the firefighter role of the central banks may be limited by its own restrictions. The Fedwire market for repos, interbank loans, and swaps might be affected, if we take literally the Fed’s collateral guidelines below:

Unless otherwise indicated, securities must be rated investment grade and in some cases must be rated “AAA” (where indicated). If more than one rating is available, the most conservative (lowest) rating will determine whether the requirement is met

Of course, such guidelines can change in the presence of extraordinary circumstances, which will make us shout again:

Ode to real, hard assets that are no one else’s liabilities.

On the Balkanization of the Markets: Part II

Author : John E. Charalambakis

Date : August 8, 2011

Last Friday’s evening downgrade by the S&P was ill-timed and ill-advised. We wrote a week ago that we would not be surprised if it took place. We will reiterate our position that August again will prove to be a pivotal month in the financial markets. No need to repeat what we wrote in August 2010 and also in the last few commentaries. On August 15, 1971 the global financial system lost its anchor and on August 5, 2011 the vessel started moving into uncharted waters. Where the next destination-port (if there is one in the foreseeable future) will be determined by several factors, probably over the course of a few years.

We are not compelled to elaborate on why it was ill-timed and ill-advised, because the reasons are probably obvious. However, we will site a few examples: Most other countries that still have AAA rating are in a worse position than the US; the credibility of the rating agencies is not stellar; political dysfunctions cannot carry that much weight in the probability of default, especially when the assets are real; the banking system is much more toxic than the macroeconomy of the US, and hence if anything should have been downgraded it should have been the shaky balance sheets of banks that count toxic assets as real collateral and capital; the instability that the downgrade could evoke has the potential of pushing the global economy into dangerous waters completely unknown to the financial system. The number of instruments tied to the US Treasuries is enormous. The number of financial transactions tied to the US dollar is infinite. S&P admitted its error of $2 trillion and quickly changed its rationale for the downgrade to the political dysfunctions, given the failure to agree on a $4 trillion deficit reduction program. If their ill-timed downgrade pushes interest rates higher by just 1%, the deficit will increase by approximately $1.5 trillion, and will eliminate even the benefits of the dismal deal reached. The confinement of the port started to be demolished on Friday, and the vessel is being pushed into uncharted waters without an anchor.

The US and global economy is fragile no doubt, as the following two graphs show. The first graph shows that the job losses are the worst in the last 65 years. Even worse is that the average duration in unemployment is also the worst since World War II. We may be entering a period of sluggish growth with permanently unemployed persons who will be experiencing a downgrade of their physical, financial, and human capital. All these at a time when the educational system has assassinated Homer, has lowered standards, and has produced pupils who may know the price of everything and the value of nothing, incapable of connecting the dots and seeing that the physical infrastructure – which enables the private sector to do business – of the US is crumpling in a state of disrepair. It’s not so much that cyclically-adjusted deficits matter, as that the car engine is dying and needs major work.

Source: Bureau of Labor Statistics, Agora Financial

Source: Bureau of Labor Statistics, St. Louis Federal Reserve Bank

We have been saying for years that the camouflages used – top among them the infamous derivatives – as “assets” and pledged as collateral for credit over-extension, have had the result of creating an unstable debt pyramid that now not only is it shaky but also dangerous for the well-being of the real economy. The dramatic situation in Europe is an example of that unstable situation. The high debt costs of refinancing EU debt are rising, and the concerns over EU’s stamina to strengthen their rescue facility (EFSF) are spreading over the possible need to bailout major economies in the EU (see our previous commentaries on the issue). If that were to be the case, then Spain and Italy would need at least $1 trillion, as the following graph shows, and assuming that there will be no collateral damages for Belgium, Netherlands, France, to name just a few other EU countries.

The rising costs of refinancing and insuring EU debt will have significant effects on equities and most importantly in refinancing private debt. The need for the latter is estimated to be at least $4 trillion. The recent downgrade of the US paper/anchor for the debt markets will lead to the balkanization of the bond markets, especially for paper that is unsecured and that is rated below A+. As the following two figures show between 2011 and 2015 there are trillions of dollars in bonds – especially in the banking sector – that require refinancing. The rising costs of financing government paper will squeeze liquidity, raise risks, will create crowded markets, will force corporate downgrades, may dry up financing for startups, may even increase defaults, all at a time when central banks contemplate issuing massive amount of cash and purchasing paper assets.

Of course, the non-financial debt that is maturing will face equal pressures, and as the following figure shows, the great majority of it is rated below A+.

The fact that the financial debt is mostly unsecured, as the following graph shows, may create havoc in the markets since absent a sound collateral base, the institutions may turn out to be too big to save.

Once the balkanization/devolution of the bond markets starts the firefighter role of the central banks may be limited by its own restrictions. The Fedwire market for repos, interbank loans, and swaps might be affected, if we take literally the Fed’s collateral guidelines below:

Of course, such guidelines can change in the presence of extraordinary circumstances, which will make us shout again:

Ode to real, hard assets that are no one else’s liabilities.