Over the last few weeks, we have argued that we are entering a watershed moment in economic and financial history, when significant decisions have to be made, since kicking the can down the road has its limits. The risks associated with those decisions are not negligible. We could outline some of the more important ones, namely: sovereign defaults (controlled & uncontrolled); currency earthquakes; skyrocketing unemployment; severe recession; contagion; shaky balance sheets, inflation via the monetization route; depressed asset values; political & social instability; war; just to name a few ones.

When we observe the almost euphoric markets (which we do not consider necessarily rational) our analysis says that they are underestimating those risks, and thus the risk premiums associated with securities (both equities, but especially debt/bond securities) are not properly priced. The valuation of stocks these days cannot justify growth beyond 7% (of which on average 2.5% is derived through dividends), while the negative (in most cases) real returns of bonds (i.e. when we subtract inflation) are classic cases of financial repression, neglecting the inflation and currency risks (such as the possibility of a Euro breakup). Speaking of earnings growth potential, one does not need to go very far. Just by looking at incomes growth we can understand that consumer spending around the globe (but especially in the EU) is slowing down significantly, and hence earnings potential will follow the same route. When we take into account the Chinese slowdown (which could see GDP growth rate as low as 4.5% by year’s end, a level that will signify recession for China) and the EU banks’ shaky balance sheets (where “assets” are made up of questionable paper and several non-financial companies have debts that exceed 10 times net cash flow), then we can understand that risk premiums affiliated with such sluggish growth potential are well underestimated, given the fiscal restraints that government are operating under.

The great wall of steroids a.k.a. Chinese fathom is getting ready to create a currency fatigue in Asia, similar to the one it created in the mid 1990s. We anticipate that this will put downward pressure on the Japanese Yen vs. the US dollar. At the same time, the drums of conflict in that region of the world, but most importantly in the Middle East will keep oil premium high, at least for a few more weeks.

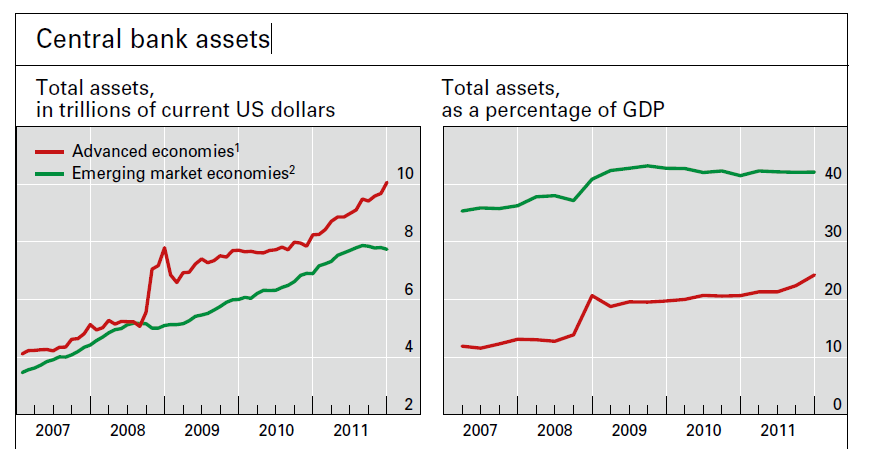

It is our position that the central banks are developing a new measure of action that is based on two fundamental targets, namely: central banks’ “assets” as a percentage of GDP; and a bifurcated (in the sense of primary such as US and Germany vs. secondary bond markets such as those of Spain and Italy) “acceptable” yield rate on government bonds. The first target will allow them to infuse QE measures as long as the “assets” in their balance sheets do not exceed a pre-determined level e.g. 40%. The result of those QE actions would be to achieve the targeted yields on government bonds and indirectly achieve financial “stability”. (Needless to say that such “stability” is only an illusion in the medium and long term given the inflationary pressures that will develop, and the trillions in unfunded liabilities around the world). The graph below (taken from the latest report of the Bank of International Settlements, BIS) shows that there is room to grow the balance sheets of central banks until they reach the level e.g. of 40%.

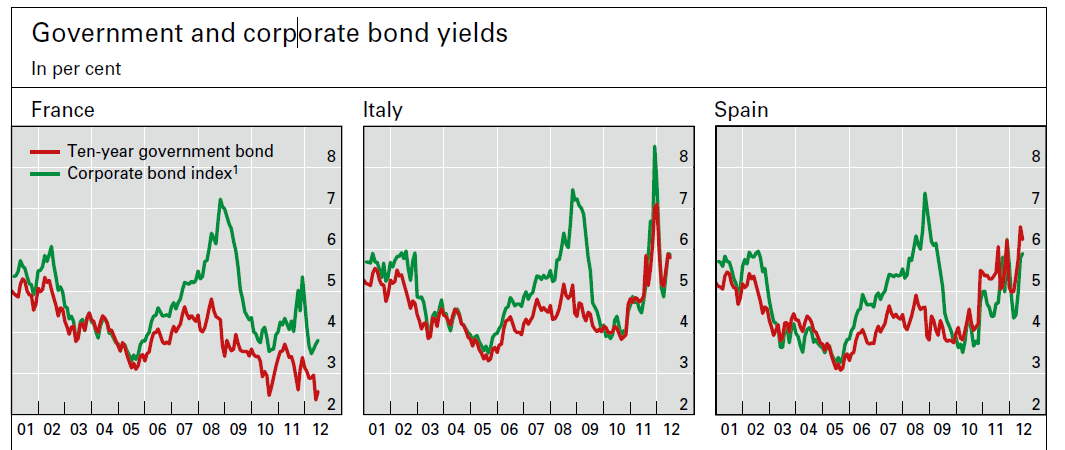

At the same time, if the QE measures taken target the yields of troubled countries, then debt refinancing for those nations will be feasible, while an exuberant spirit will prevail in the markets that the crisis is almost over. The graph below (also from the BIS) shows the yields of two such troubled nations (Spain and Italy) whose demise will bring depression in the EU, and thus such contemplated mechanism of targets. Needless to say that in case of collapse in Spain and/or Italy, France will follow thereafter, hence the yields of France’s bonds will also be indirectly targeted.

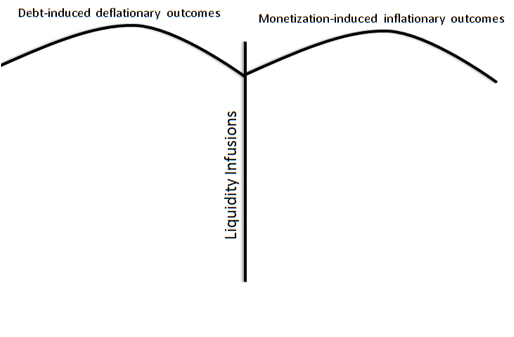

In conclusion, we believe that the crossroad in front of the central banks looks like the following tree, which we chose to call the Monetization Tree.

The liquidity alternatives show a bifurcated outcome. If monetization is chosen (probably starting with extending a banking license to the European Stability Mechanism, to be followed by measures such as Securities Market Program), along with limited SWAP lines between central banks, then market euphoria will follow. The result will be inflationary pressures down the road.

If the decision is not to monetize, then a depressing mood will prevail that could bring catastrophic chaos into the markets.

Whatever the decision is, we think it is time to repeat the chorus: Ode to assets that are no one else’s liabilities!

On Risk Premiums, Earnings Growth Potential, and Monetization Routes: Diminishing Returns and the Liquidity Tree

Author : John E. Charalambakis

Date : August 22, 2012

Over the last few weeks, we have argued that we are entering a watershed moment in economic and financial history, when significant decisions have to be made, since kicking the can down the road has its limits. The risks associated with those decisions are not negligible. We could outline some of the more important ones, namely: sovereign defaults (controlled & uncontrolled); currency earthquakes; skyrocketing unemployment; severe recession; contagion; shaky balance sheets, inflation via the monetization route; depressed asset values; political & social instability; war; just to name a few ones.

When we observe the almost euphoric markets (which we do not consider necessarily rational) our analysis says that they are underestimating those risks, and thus the risk premiums associated with securities (both equities, but especially debt/bond securities) are not properly priced. The valuation of stocks these days cannot justify growth beyond 7% (of which on average 2.5% is derived through dividends), while the negative (in most cases) real returns of bonds (i.e. when we subtract inflation) are classic cases of financial repression, neglecting the inflation and currency risks (such as the possibility of a Euro breakup). Speaking of earnings growth potential, one does not need to go very far. Just by looking at incomes growth we can understand that consumer spending around the globe (but especially in the EU) is slowing down significantly, and hence earnings potential will follow the same route. When we take into account the Chinese slowdown (which could see GDP growth rate as low as 4.5% by year’s end, a level that will signify recession for China) and the EU banks’ shaky balance sheets (where “assets” are made up of questionable paper and several non-financial companies have debts that exceed 10 times net cash flow), then we can understand that risk premiums affiliated with such sluggish growth potential are well underestimated, given the fiscal restraints that government are operating under.

The great wall of steroids a.k.a. Chinese fathom is getting ready to create a currency fatigue in Asia, similar to the one it created in the mid 1990s. We anticipate that this will put downward pressure on the Japanese Yen vs. the US dollar. At the same time, the drums of conflict in that region of the world, but most importantly in the Middle East will keep oil premium high, at least for a few more weeks.

It is our position that the central banks are developing a new measure of action that is based on two fundamental targets, namely: central banks’ “assets” as a percentage of GDP; and a bifurcated (in the sense of primary such as US and Germany vs. secondary bond markets such as those of Spain and Italy) “acceptable” yield rate on government bonds. The first target will allow them to infuse QE measures as long as the “assets” in their balance sheets do not exceed a pre-determined level e.g. 40%. The result of those QE actions would be to achieve the targeted yields on government bonds and indirectly achieve financial “stability”. (Needless to say that such “stability” is only an illusion in the medium and long term given the inflationary pressures that will develop, and the trillions in unfunded liabilities around the world). The graph below (taken from the latest report of the Bank of International Settlements, BIS) shows that there is room to grow the balance sheets of central banks until they reach the level e.g. of 40%.

At the same time, if the QE measures taken target the yields of troubled countries, then debt refinancing for those nations will be feasible, while an exuberant spirit will prevail in the markets that the crisis is almost over. The graph below (also from the BIS) shows the yields of two such troubled nations (Spain and Italy) whose demise will bring depression in the EU, and thus such contemplated mechanism of targets. Needless to say that in case of collapse in Spain and/or Italy, France will follow thereafter, hence the yields of France’s bonds will also be indirectly targeted.

In conclusion, we believe that the crossroad in front of the central banks looks like the following tree, which we chose to call the Monetization Tree.

The liquidity alternatives show a bifurcated outcome. If monetization is chosen (probably starting with extending a banking license to the European Stability Mechanism, to be followed by measures such as Securities Market Program), along with limited SWAP lines between central banks, then market euphoria will follow. The result will be inflationary pressures down the road.

If the decision is not to monetize, then a depressing mood will prevail that could bring catastrophic chaos into the markets.

Whatever the decision is, we think it is time to repeat the chorus: Ode to assets that are no one else’s liabilities!