As noted from these commentary pages before, I believe that we have entered into a watershed period that will determine if in about two-three years the global economic system collapses, or experiences a rebirth. We live in historical times, and for such a time as this the venerable vessel called “Global Economy” needs to rediscover its identity, because in the four decades that has been sailing the international waters without an anchor its identity has been effaced and wiped out.

The locomotive for this re-discovery has to be the U.S., because of its institutional, innovative, and flexible structure. However, it may not be able to do that without the assistance of Europe. The latter suffers from a cultural identity crisis. Europe in its mundane and dull quest for monetary integration has lost its character and its roots. Europe’s quest for absolution from its guilt at having produced the Holocaust, the Gulag, the Ukrainian terror famine, the Spanish Civil War, two World Wars and an abyss of toxic assets, has pushed her into a bifurcated position where the body (monetary integration) searches for a soul (the integrated historical roots) in the wrong places (ahistorical economic policies that may resemble efforts to model schizophrenia). If the US is dragged into that ultra-mundane quest, then the game may be lost.

While we do not expect a major economic earthquake for the next two-three years, the possibility that business will continue as normal – i.e. without establishing strong anchors which have historical relevance – undermines the foundations of stability and elevates the chances of a catastrophic collapse.

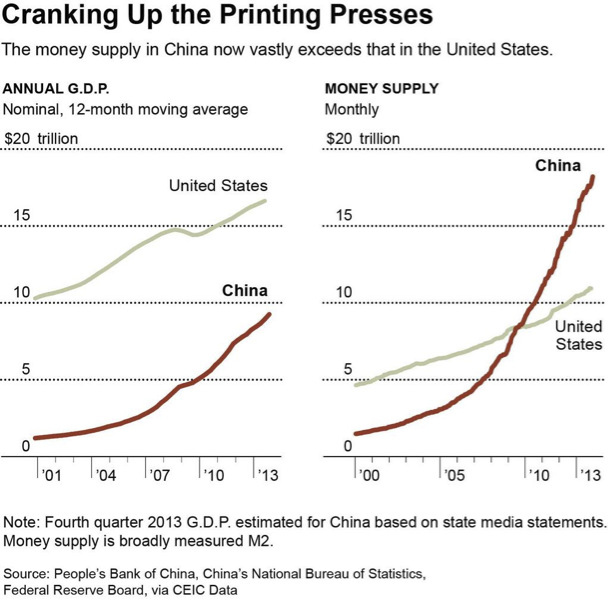

For several days in the past week, I ponder on the following graph of Chinese monetary measures.

It is obvious that the Chinese machine a.k.a. The Great Wall of Steroids, in an effort to avoid the bursting of its bubbles and thus a hard landing where GDP growth rate will drop below 2.5%, has been cranking in the money press in an unprecedented way that may force an dues ex machina solution.

Generally speaking, I believe that if the developed countries desire to help the developing ones in the long run, they need to focus on strengthening themselves and their currencies in the next two-three years, as they fortress themselves with collateral, awakening dormant assets, solving the mess of unfunded liabilities, allowing the restructuring of some debts, and rediscovering anchors that could balance out ahistorical policies. I understand that if developed countries – especially the US – focus on this, the normalization of interest rates may be much sooner than expected (I also believe that such normalization will be followed by an upward trend in precious metal prices, but will elaborate on this on another commentary).

The interest rates’ normalization will imply that capital flows to developing countries by be cut significantly (especially to countries that have low foreign reserves, big trade deficits, experience political instability, and where private debts have increased significantly in the last ten years). Therefore, countries such as Turkey, Thailand, Argentina (to name just a few) may be suffering. Therefore, I am not that optimistic – as several Wall Street analysts are – about developing markets for the foreseeable future, due to what I see as capital flows directed mainly to the US and other developed nations.

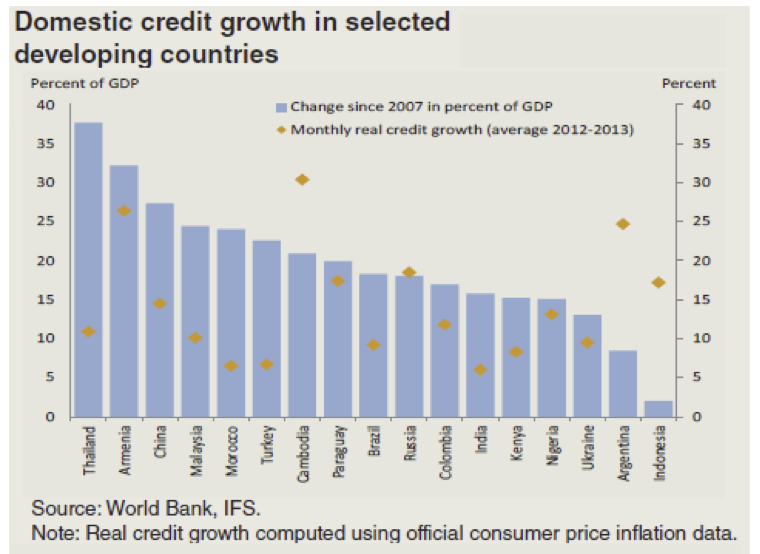

This past week, The World Bank published a report about vulnerable developing countries. The graph below shows those countries that are susceptible to crisis due to extraordinary increases in domestic credit.

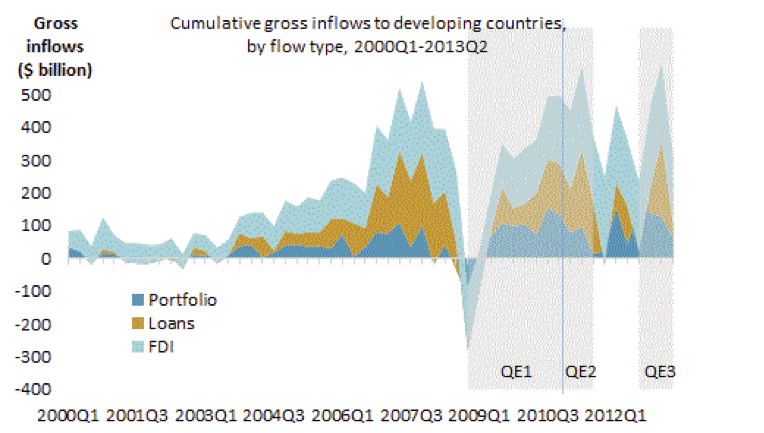

The credit overextensions portrayed above seem to be the result of quantitative easing in the developed world, as noted by the report’s authors (Jerome Lim, Sanket Mohaparta, and Marc Stocker) and as the following graph shows.

Combining a developing credit malaise – especially if it hits China – with an identity crisis could be lethal. Of course, I do not imply that all developing countries and markets will suffer. I believe that investors need to heed the fundamentals and prospects of each country and weight the idiosyncratic risks separately.

As one of my favorite jazz musicians said (Charles Mingus), his album “Tijuana Moods” was the best record he ever made. Listening to that record as I am drafting these lines, reminds me that in the midst of an identity crisis – similar to the one he was experiencing at the time of his bacchanalian trip to the rough and trouble Mexican border town – we can still produce a kaleidoscopic platform of reforms that can make the dream of sustainable growth rooted in historical anchors, a reality.

Ode to anchors!

On Malaise, Credit Flows, and Historical Roots: The Watershed Period and the Echoes of Tijuana Moods

Author : John E. Charalambakis

Date : January 18, 2014

As noted from these commentary pages before, I believe that we have entered into a watershed period that will determine if in about two-three years the global economic system collapses, or experiences a rebirth. We live in historical times, and for such a time as this the venerable vessel called “Global Economy” needs to rediscover its identity, because in the four decades that has been sailing the international waters without an anchor its identity has been effaced and wiped out.

The locomotive for this re-discovery has to be the U.S., because of its institutional, innovative, and flexible structure. However, it may not be able to do that without the assistance of Europe. The latter suffers from a cultural identity crisis. Europe in its mundane and dull quest for monetary integration has lost its character and its roots. Europe’s quest for absolution from its guilt at having produced the Holocaust, the Gulag, the Ukrainian terror famine, the Spanish Civil War, two World Wars and an abyss of toxic assets, has pushed her into a bifurcated position where the body (monetary integration) searches for a soul (the integrated historical roots) in the wrong places (ahistorical economic policies that may resemble efforts to model schizophrenia). If the US is dragged into that ultra-mundane quest, then the game may be lost.

While we do not expect a major economic earthquake for the next two-three years, the possibility that business will continue as normal – i.e. without establishing strong anchors which have historical relevance – undermines the foundations of stability and elevates the chances of a catastrophic collapse.

For several days in the past week, I ponder on the following graph of Chinese monetary measures.

It is obvious that the Chinese machine a.k.a. The Great Wall of Steroids, in an effort to avoid the bursting of its bubbles and thus a hard landing where GDP growth rate will drop below 2.5%, has been cranking in the money press in an unprecedented way that may force an dues ex machina solution.

Generally speaking, I believe that if the developed countries desire to help the developing ones in the long run, they need to focus on strengthening themselves and their currencies in the next two-three years, as they fortress themselves with collateral, awakening dormant assets, solving the mess of unfunded liabilities, allowing the restructuring of some debts, and rediscovering anchors that could balance out ahistorical policies. I understand that if developed countries – especially the US – focus on this, the normalization of interest rates may be much sooner than expected (I also believe that such normalization will be followed by an upward trend in precious metal prices, but will elaborate on this on another commentary).

The interest rates’ normalization will imply that capital flows to developing countries by be cut significantly (especially to countries that have low foreign reserves, big trade deficits, experience political instability, and where private debts have increased significantly in the last ten years). Therefore, countries such as Turkey, Thailand, Argentina (to name just a few) may be suffering. Therefore, I am not that optimistic – as several Wall Street analysts are – about developing markets for the foreseeable future, due to what I see as capital flows directed mainly to the US and other developed nations.

This past week, The World Bank published a report about vulnerable developing countries. The graph below shows those countries that are susceptible to crisis due to extraordinary increases in domestic credit.

The credit overextensions portrayed above seem to be the result of quantitative easing in the developed world, as noted by the report’s authors (Jerome Lim, Sanket Mohaparta, and Marc Stocker) and as the following graph shows.

Combining a developing credit malaise – especially if it hits China – with an identity crisis could be lethal. Of course, I do not imply that all developing countries and markets will suffer. I believe that investors need to heed the fundamentals and prospects of each country and weight the idiosyncratic risks separately.

As one of my favorite jazz musicians said (Charles Mingus), his album “Tijuana Moods” was the best record he ever made. Listening to that record as I am drafting these lines, reminds me that in the midst of an identity crisis – similar to the one he was experiencing at the time of his bacchanalian trip to the rough and trouble Mexican border town – we can still produce a kaleidoscopic platform of reforms that can make the dream of sustainable growth rooted in historical anchors, a reality.

Ode to anchors!